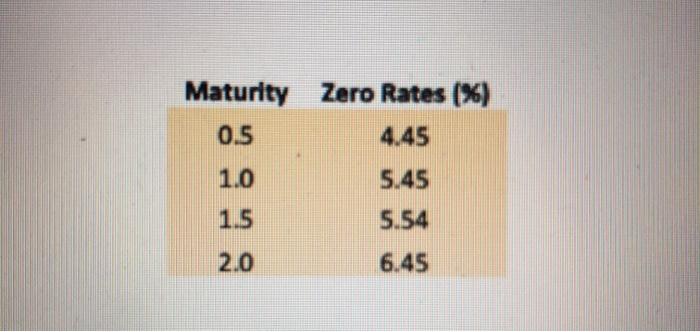

Question: please answer how to solve 6 in excel the chart and 5 arw just shown for reference. thnak you!! Maturity Zero Rates (%) 0.5 4.45

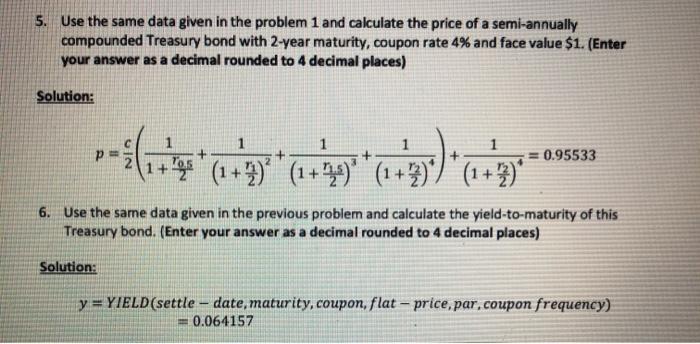

Maturity Zero Rates (%) 0.5 4.45 1.0 5.45 1.5 5.54 2.0 6.45 5. Use the same data given in the problem 1 and calculate the price of a semi-annually compounded Treasury bond with 2-year maturity, coupon rate 4% and face value $1. (Enter your answer as a decimal rounded to 4 decimal places) Solution: --(+1)*(3*(049( (1+ ) (1+3)* . (1+2))" (1 + 3)* 0+2 = 0.95533 6. Use the same data given in the previous problem and calculate the yield-to-maturity of this Treasury bond. (Enter your answer as a decimal rounded to 4 decimal places) Solution: y=YIELD(settle - date, maturity, coupon, flat - price, par,coupon frequency) 0.064157

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts