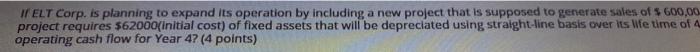

Question: please answer I ELT Corp. is planning to expand its operation by including a new project that is supposed to generate sales of $ 600,00

please answer

please answer

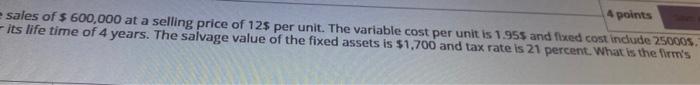

I ELT Corp. is planning to expand its operation by including a new project that is supposed to generate sales of $ 600,00 project requires 562000(Initial cost) of fixed assets that will be depreciated using straight-line basis over its We time of operating cash flow for Year 4? (4 points) 4 points e sales of $ 600,000 at a selling price of 12$ per unit. The variable cost per unit is 1955 and fixed cost include 250005 - its life time of 4 years. The salvage value of the fixed assets is $1,700 and tax rate is 21 percent. What is the firm's I ELT Corp. is planning to expand its operation by including a new project that is supposed to generate sales of $ 600,00 project requires 562000(Initial cost) of fixed assets that will be depreciated using straight-line basis over its We time of operating cash flow for Year 4? (4 points) 4 points e sales of $ 600,000 at a selling price of 12$ per unit. The variable cost per unit is 1955 and fixed cost include 250005 - its life time of 4 years. The salvage value of the fixed assets is $1,700 and tax rate is 21 percent. What is the firm's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts