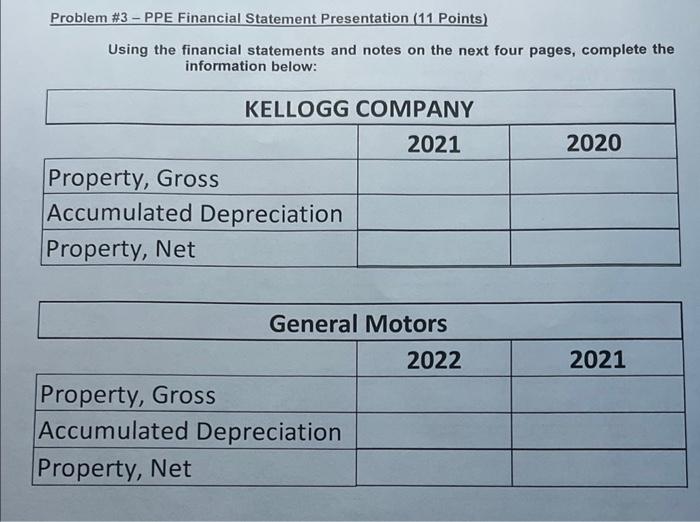

Question: please answer i will leave a good feedbacm Problem #3 - PPE Financial Statement Presentation (11 Points) Using the financial statements and notes on the

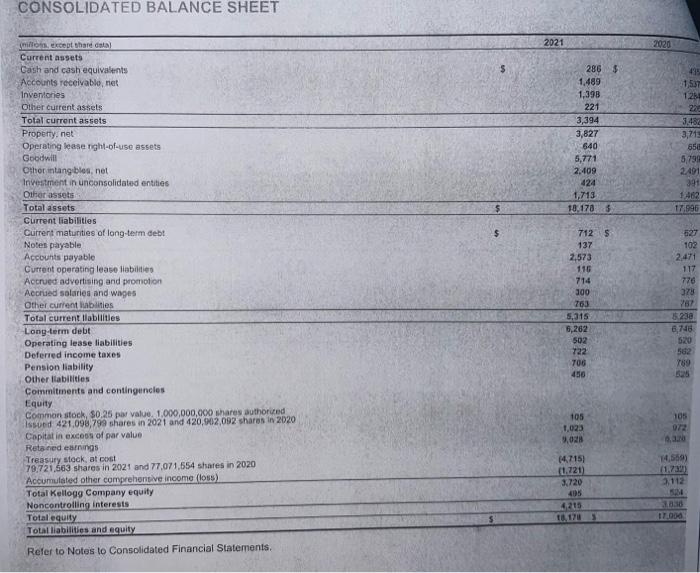

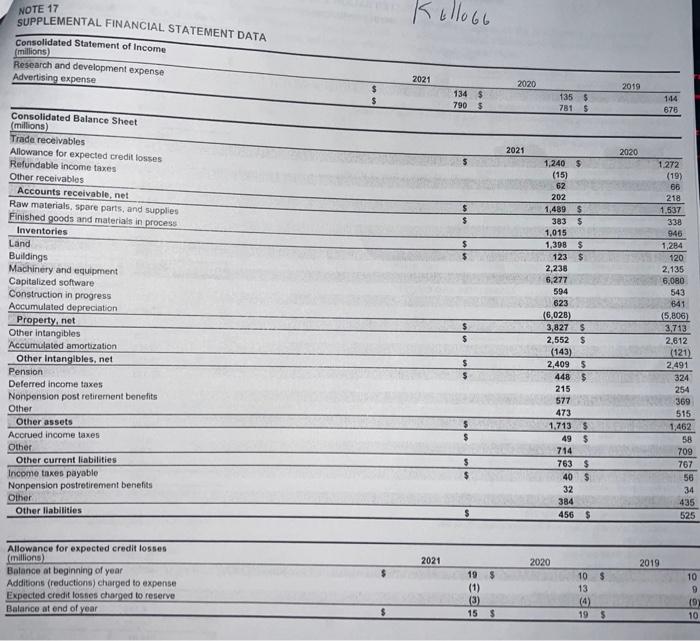

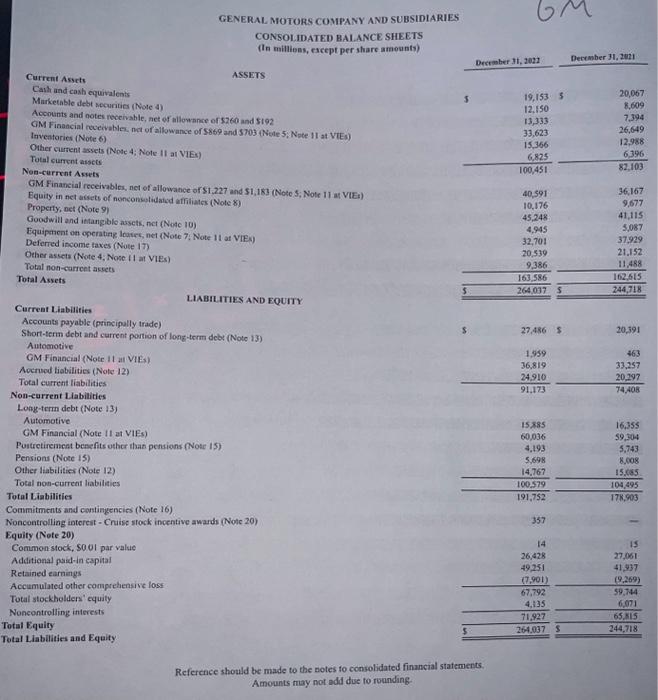

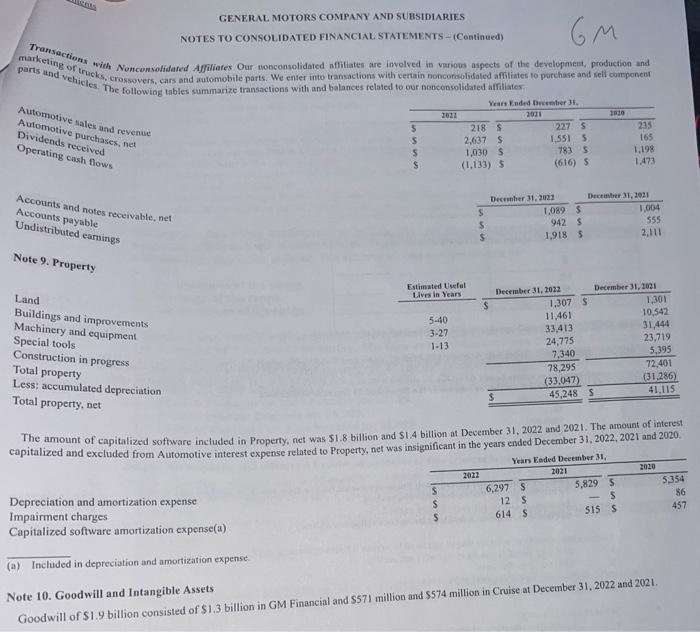

Problem \#3 - PPE Financial Statement Presentation (11 Points) Using the financial statements and notes on the next four pages, complete the information below: CONSOLIDATED BALANCE SHEET Commitments and continguneles Equity Common stock, 50,25 par value. 1,000,000,000 shares authorized Common stock, 50,25 par value, 1,000,000,000 geares authorued Issun 421,096, 799 shares in 2021 and 420,902,092 shares in 2020 Copitat in exceos of par value Retoned earnings Treasury stoek, at cost Treasury sicek, at cott 7.563 shares in 2021 and 77,071,554 shares in 2020 Accumulated other comprehentive income (loss) Total Kellogg Company equity Noncontrolling interests Total equity Total liabilities and equity Refer to Notes to Consolidated Financial Statements. NOTE 17 SUPPLEMENTAL FINANCLAL. STATEMENT DATA Consolidated Statement of Income (millions) Research and dovelopment expense Advertising expense GENERAL MOTORS COMPANY AND SUBSIDIARIES CONSOLIDATED BAL-ANCE SHEETS (In millions, escept per share amounts) Dectmber 31, 2021 December 31, 2421 Current Asscts ASSETS Canh and cash equivalents Murketable debt mecuritio (Note 4) Acoounts and notes mocivable, net of allowance of $260 and 5192 GM Financial reveivables, nct of allowance of 5869 and 5703 (Node 5, Note 11 at VIEs) Inveatories (Note 6 ) Ohher current assets (Note 4 ; Note 11 ar VIEs) Total current asccs Non-cerrnt Asrets GM Financial receivables, net of allowance or 51,227 and 51,183 (Nole 5; Note 11 at VIEt) Equity in net acsets of nonconsotidatid affilianes (Note 8) Property; oet (Note 9) Goodwill and ittangible assets, nct (Notc 10) Equipment on operating loares, net (Note 7; Note 11 at VIFv) Deferred income taxes (Note 17) Oeher assets (Note 4, Nose 11 at VIEs) Total non-carrent assets Total Assets Current Liabilities L.IABILITIS AND EQUITY Accounts payable (principully trade) Short-term debt and current portion of lone-term debe (Note 13) Autonotive GM Financial (Note II an ViEs) Aocrucd liabilities (Note 12) Total current liabilities Non-current Liabilities Long-term debt (Note 13) Automotive GM Financial (Note it at VIEs) Pontretirement benefits veher than pensions (Note 15) Pensions (Note 15) Other liabilities (Note 12) Total non-current labilities Total Liabilities Commitments and contingencies (Note 16) Noncontrolling intereit - Craise stock incentive awards (Note 20) Equity (Note 20) Common stock, 50.01 par value Adtitional psid-in espial Retained earnings Accumulated other comprehensive loss Total stockholders' equity Noncontrolling interests Total Equity Total Liabilities and Equity? marketing otion with Noncunsolidared Affiliates Our nonconsolidated nffitiates are imolved in various aspects of the developnsent, production and parts and or truck. Nonconsolidated Aljuiates Our wonconsolidated nthitiatei are imolved in varions aspecti of the developiseni, production and parts uthd vehicles. The following tables summarize transactions with and balances related to cor nobecosolidated alfiliates: Automotive sales and revenue Automotive purchases, net Dividends received Operating cush flows Accounts and notes receivable, net Accounts payable Note 9. Property Land Buildings and improvements. Machinery and equipment Special tools Construction in progress Total property Less: accumulated depreciation Total property, net The amount of eapitalized software included in Property, net was $1.8 billion and $1.4 billion at December 31, 2022 and 2021. The amount of interest The amount of capitalized software included in Property, net was $1.8 bilison-and $1.4 biltion at December 31.2022 and 2021. The amount of interest capitalized and excluded from Automotive interest expense retated to Property, net was instignificant in the years ended December 31,2022,2021 and 2020. Depreciation and amortization expense Impairment charges Capitalized software amortization cxpense(a) (a) Included in depreciotion and amortization expense. Goodwill of $1.9 billion consisted of $1.3 billion in GM Financial and $57I million and $574 million in Cruise at December 31,2022 and 2021. Note 10. Goodwill and Intangible Assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts