Question: Please answer if true or false: 1. Advertising which is intended to influence public reaction to proposed legislation normally is not a deductible business expense

Please answer if true or false:

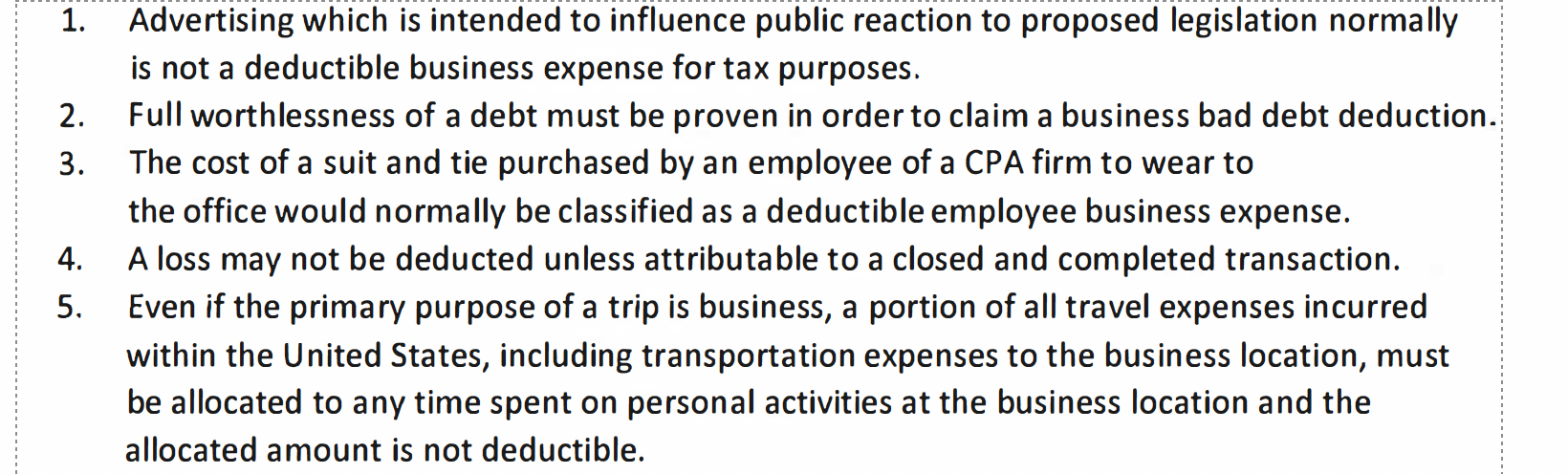

1. Advertising which is intended to influence public reaction to proposed legislation normally is not a deductible business expense for tax purposes. 2. Full worthlessness of a debt must be proven in order to claim a business bad debt deduction. 3. The cost of a suit and tie purchased by an employee of a CPA firm to wear to the office would normally be classified as a deductible employee business expense. 4. A loss may not be deducted unless attributable to a closed and completed transaction. 5. Even if the primary purpose of a trip is business, a portion of all travel expenses incurred within the United States, including transportation expenses to the business location, must be allocated to any time spent on personal activities at the business location and the allocated amount is not deductible. 1. Advertising which is intended to influence public reaction to proposed legislation normally is not a deductible business expense for tax purposes. 2. Full worthlessness of a debt must be proven in order to claim a business bad debt deduction. 3. The cost of a suit and tie purchased by an employee of a CPA firm to wear to the office would normally be classified as a deductible employee business expense. 4. A loss may not be deducted unless attributable to a closed and completed transaction. 5. Even if the primary purpose of a trip is business, a portion of all travel expenses incurred within the United States, including transportation expenses to the business location, must be allocated to any time spent on personal activities at the business location and the allocated amount is not deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts