Question: Please answer if true or false: 11. The amount of a bad debt deduction is always limited to the adjusted basis of the debt in

Please answer if true or false:

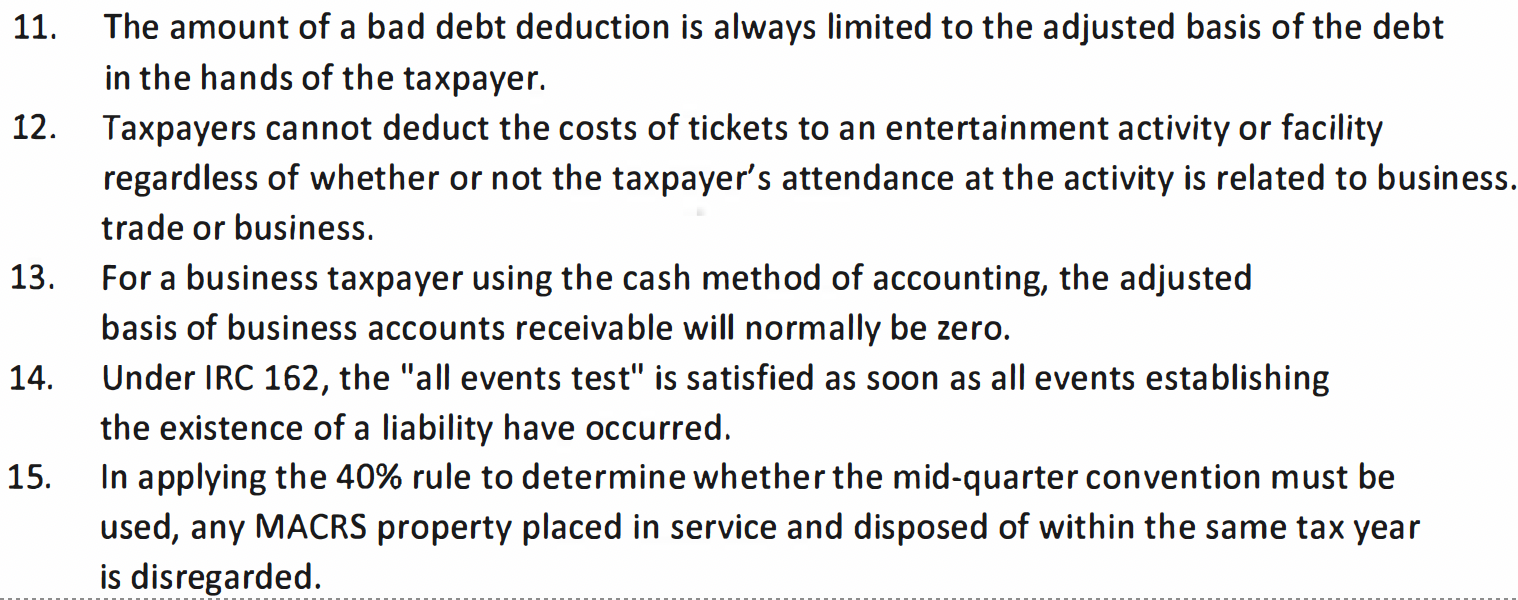

11. The amount of a bad debt deduction is always limited to the adjusted basis of the debt in the hands of the taxpayer. 12. Taxpayers cannot deduct the costs of tickets to an entertainment activity or facility regardless of whether or not the taxpayer's attendance at the activity is related to business trade or business. 13. For a business taxpayer using the cash method of accounting, the adjusted basis of business accounts receivable will normally be zero. 14. Under IRC 162, the "all events test" is satisfied as soon as all events establishing the existence of a liability have occurred. 15. In applying the 40% rule to determine whether the mid-quarter convention must be used, any MACRS property placed in service and disposed of within the same tax year is disregarded. 11. The amount of a bad debt deduction is always limited to the adjusted basis of the debt in the hands of the taxpayer. 12. Taxpayers cannot deduct the costs of tickets to an entertainment activity or facility regardless of whether or not the taxpayer's attendance at the activity is related to business trade or business. 13. For a business taxpayer using the cash method of accounting, the adjusted basis of business accounts receivable will normally be zero. 14. Under IRC 162, the "all events test" is satisfied as soon as all events establishing the existence of a liability have occurred. 15. In applying the 40% rule to determine whether the mid-quarter convention must be used, any MACRS property placed in service and disposed of within the same tax year is disregarded

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts