Question: Please answer if True or false, thank you. 7. An individual must file a federal income tax return if the individual has net earnings from

Please answer if True or false, thank you.

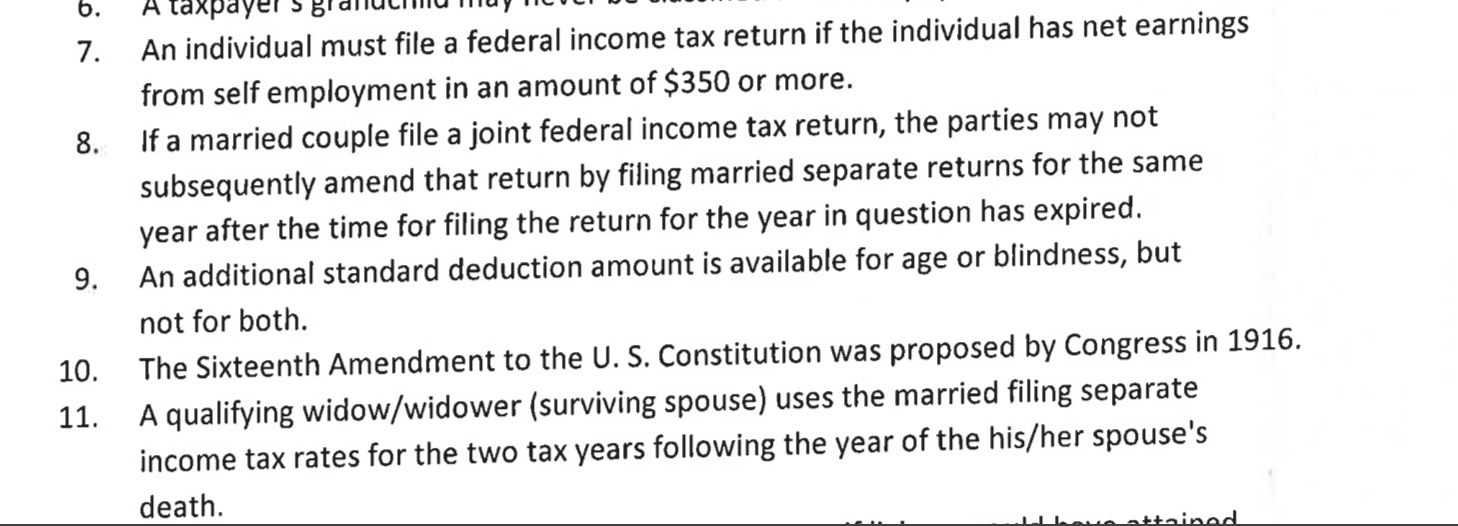

7. An individual must file a federal income tax return if the individual has net earnings from self employment in an amount of $350 or more. 8. If a married couple file a joint federal income tax return, the parties may not subsequently amend that return by filing married separate returns for the same year after the time for filing the return for the year in question has expired. 9. An additional standard deduction amount is available for age or blindness, but not for both. 10. The Sixteenth Amendment to the U. S. Constitution was proposed by Congress in 1916 11. A qualifying widow/widower (surviving spouse) uses the married filing separate income tax rates for the two tax years following the year of the his/her spouse's death

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts