Question: Please answer if you actually know how to cpmplete it ! Thank you! Required information Required information [ The following information applies to the questions

Please answer if you actually know how to cpmplete it Thank you! Required information Required information

The following information applies to the questions displayed below.

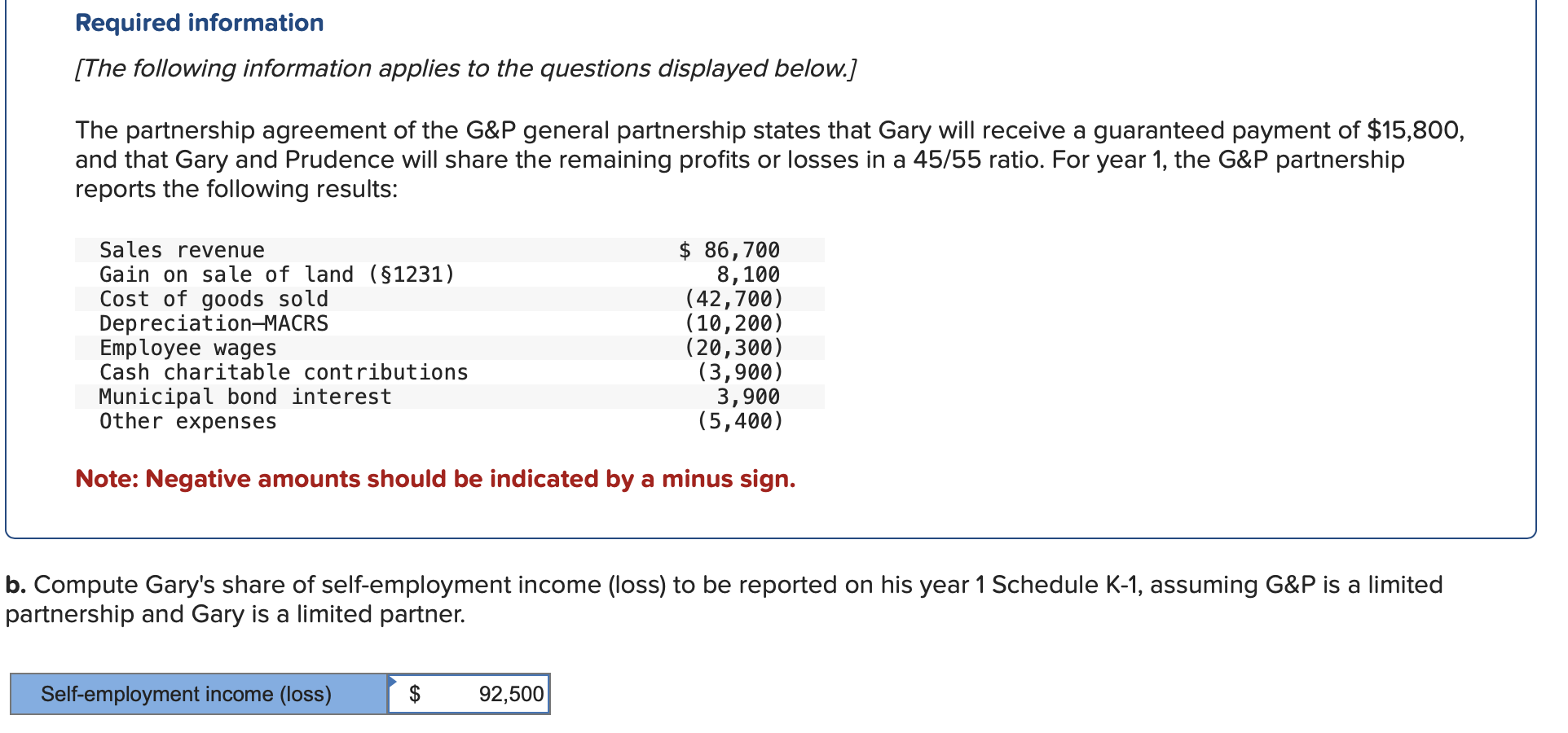

The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $

and that Gary and Prudence will share the remaining profits or losses in a ratio. For year the G&P partnership

reports the following results:

Note: Negative amounts should be indicated by a minus sign.

c What do you believe Gary's share of selfemployment income loss to be reported on his year Schedule K should be assuming

G&P is an LLC and Gary spends hours per year working there full time?

The following information applies to the questions displayed below.

The partnership agreement of the G&P general partnership states that Gary will receive a guaranteed payment of $

and that Gary and Prudence will share the remaining profits or losses in a ratio. For year the G&P partnership

reports the following results:

Note: Negative amounts should be indicated by a minus sign.

b Compute Gary's share of selfemployment income loss to be reported on his year Schedule K assuming G&P is a limited

partnership and Gary is a limited partner.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock