Question: Please answer if you are 100% sure Do give explanation ! Thank you Suppose that National Waferonics has before it a proposal for a four-year

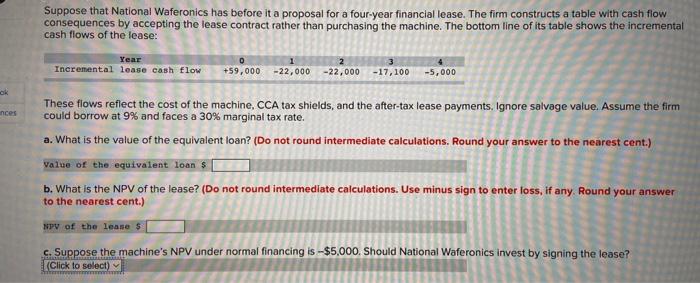

Suppose that National Waferonics has before it a proposal for a four-year financial lease. The firm constructs a table with cash flow consequences by accepting the lease contract rather than purchasing the machine. The bottom line of its table shows the incremental cash flows of the lease: These flows reflect the cost of the machine, CCA tax shields, and the after-tax lease payments. Ignore salvage value. Assume the firm could borrow at 9% and faces a 30% marginal tax rate. a. What is the value of the equivalent loan? (Do not round intermediate calculations. Round your answer to the nearest cent.) Vaive of the equivalent loan $ b. What is the NPV of the lease? (Do not round intermediate calculations. Use minus sign to enter loss, if any. Round your answer to the nearest cent.) c. Suppose the machine's NPV under normal financing is $5,000. Should National Waferonics invest by signing the lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts