Question: Please answer if you are sure about it, thanks! 5. This equation relates to the Greeks A, T and . Consult Chapter 19 of book.

Please answer if you are sure about it, thanks!

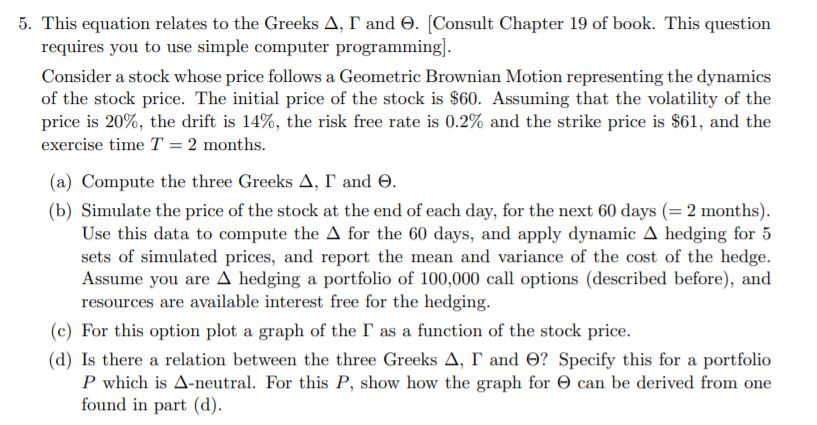

5. This equation relates to the Greeks A, T and . Consult Chapter 19 of book. This question requires you to use simple computer programming). Consider a stock whose price follows a Geometric Brownian Motion representing the dynamics of the stock price. The initial price of the stock is $60. Assuming that the volatility of the price is 20%, the drift is 14%, the risk free rate is 0.2% and the strike price is $61, and the exercise time T = 2 months. (a) Compute the three Greeks A, I and O. (b) Simulate the price of the stock at the end of each day, for the next 60 days (= 2 months). Use this data to compute the A for the 60 days, and apply dynamic A hedging for 5 sets of simulated prices, and report the mean and variance of the cost of the hedge. Assume you are A hedging a portfolio of 100,000 call options (described before), and resources are available interest free for the hedging. (c) For this option plot a graph of the I as a function of the stock price. (d) Is there a relation between the three Greeks A, I and O? Specify this for a portfolio P which is A-neutral. For this P, show how the graph for can be derived from one found in part (d). 5. This equation relates to the Greeks A, T and . Consult Chapter 19 of book. This question requires you to use simple computer programming). Consider a stock whose price follows a Geometric Brownian Motion representing the dynamics of the stock price. The initial price of the stock is $60. Assuming that the volatility of the price is 20%, the drift is 14%, the risk free rate is 0.2% and the strike price is $61, and the exercise time T = 2 months. (a) Compute the three Greeks A, I and O. (b) Simulate the price of the stock at the end of each day, for the next 60 days (= 2 months). Use this data to compute the A for the 60 days, and apply dynamic A hedging for 5 sets of simulated prices, and report the mean and variance of the cost of the hedge. Assume you are A hedging a portfolio of 100,000 call options (described before), and resources are available interest free for the hedging. (c) For this option plot a graph of the I as a function of the stock price. (d) Is there a relation between the three Greeks A, I and O? Specify this for a portfolio P which is A-neutral. For this P, show how the graph for can be derived from one found in part (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts