Question: PLEASE ANSWER, I'LL GIVE THUMBS UP Brian and Lea are considering buying treasury bills. Brian wants to buy a Canadian Treasury Bill that has an

PLEASE ANSWER, I'LL GIVE THUMBS UP

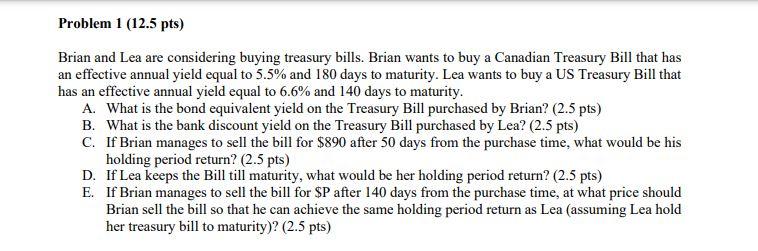

Brian and Lea are considering buying treasury bills. Brian wants to buy a Canadian Treasury Bill that has an effective annual yield equal to 5.5% and 180 days to maturity. Lea wants to buy a US Treasury Bill that has an effective annual yield equal to 6.6% and 140 days to maturity. A. What is the bond equivalent yield on the Treasury Bill purchased by Brian? ( 2.5pts) B. What is the bank discount yield on the Treasury Bill purchased by Lea? ( 2.5pts) C. If Brian manages to sell the bill for $890 after 50 days from the purchase time, what would be his holding period return? ( 2.5pts) D. If Lea keeps the Bill till maturity, what would be her holding period return? ( 2.5pts) E. If Brian manages to sell the bill for $P after 140 days from the purchase time, at what price should Brian sell the bill so that he can achieve the same holding period return as Lea (assuming Lea hold her treasury bill to maturity)? ( 2.5pts) Brian and Lea are considering buying treasury bills. Brian wants to buy a Canadian Treasury Bill that has an effective annual yield equal to 5.5% and 180 days to maturity. Lea wants to buy a US Treasury Bill that has an effective annual yield equal to 6.6% and 140 days to maturity. A. What is the bond equivalent yield on the Treasury Bill purchased by Brian? ( 2.5pts) B. What is the bank discount yield on the Treasury Bill purchased by Lea? ( 2.5pts) C. If Brian manages to sell the bill for $890 after 50 days from the purchase time, what would be his holding period return? ( 2.5pts) D. If Lea keeps the Bill till maturity, what would be her holding period return? ( 2.5pts) E. If Brian manages to sell the bill for $P after 140 days from the purchase time, at what price should Brian sell the bill so that he can achieve the same holding period return as Lea (assuming Lea hold her treasury bill to maturity)? ( 2.5pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts