Question: please answer! i'll give thumbs up!! NOTE: All options below are European option. 1. Consider the following option. Long a call option with X-price $1.19/

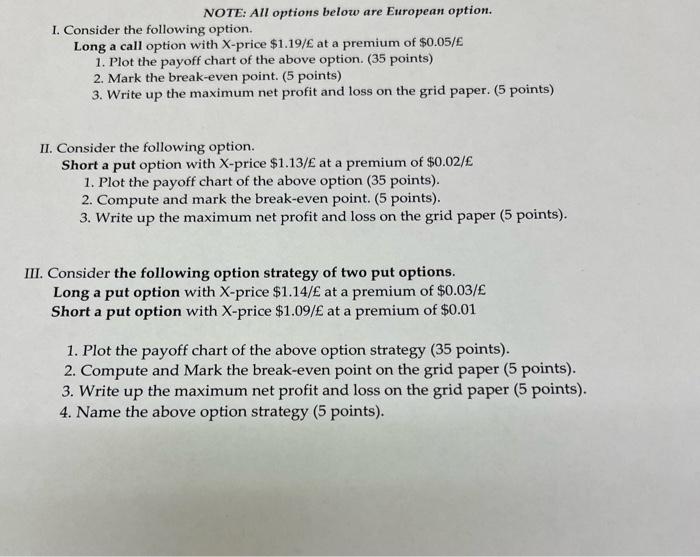

NOTE: All options below are European option. 1. Consider the following option. Long a call option with X-price $1.19/ at a premium of $0.05/ 1. Plot the payoff chart of the above option. (35 points) 2. Mark the break-even point. (5 points) 3. Write up the maximum net profit and loss on the grid paper. (5 points) II. Consider the following option. Short a put option with X-price $1.13/ at a premium of $0.02/ 1. Plot the payoff chart of the above option (35 points). 2. Compute and mark the break-even point. (5 points). 3. Write up the maximum net profit and loss on the grid paper (5 points). III. Consider the following option strategy of two put options. Long a put option with X-price $1.14/ at a premium of $0.03/ Short a put option with X-price $1.09/ at a premium of $0.01 1. Plot the payoff chart of the above option strategy (35 points). 2. Compute and Mark the break-even point on the grid paper (5 points). 3. Write up the maximum net profit and loss on the grid paper (5 points). 4. Name the above option strategy (5 points). NOTE: All options below are European option. 1. Consider the following option. Long a call option with X-price $1.19/ at a premium of $0.05/ 1. Plot the payoff chart of the above option. (35 points) 2. Mark the break-even point. (5 points) 3. Write up the maximum net profit and loss on the grid paper. (5 points) II. Consider the following option. Short a put option with X-price $1.13/ at a premium of $0.02/ 1. Plot the payoff chart of the above option (35 points). 2. Compute and mark the break-even point. (5 points). 3. Write up the maximum net profit and loss on the grid paper (5 points). III. Consider the following option strategy of two put options. Long a put option with X-price $1.14/ at a premium of $0.03/ Short a put option with X-price $1.09/ at a premium of $0.01 1. Plot the payoff chart of the above option strategy (35 points). 2. Compute and Mark the break-even point on the grid paper (5 points). 3. Write up the maximum net profit and loss on the grid paper (5 points). 4. Name the above option strategy (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts