Question: Please answer I'll-3A Identify contract components and prepare journal enuiescontractbased approach, multiple performance obligations. {LO 4 } AP Santa's Holiday Farm sells and delivers r

Please answer

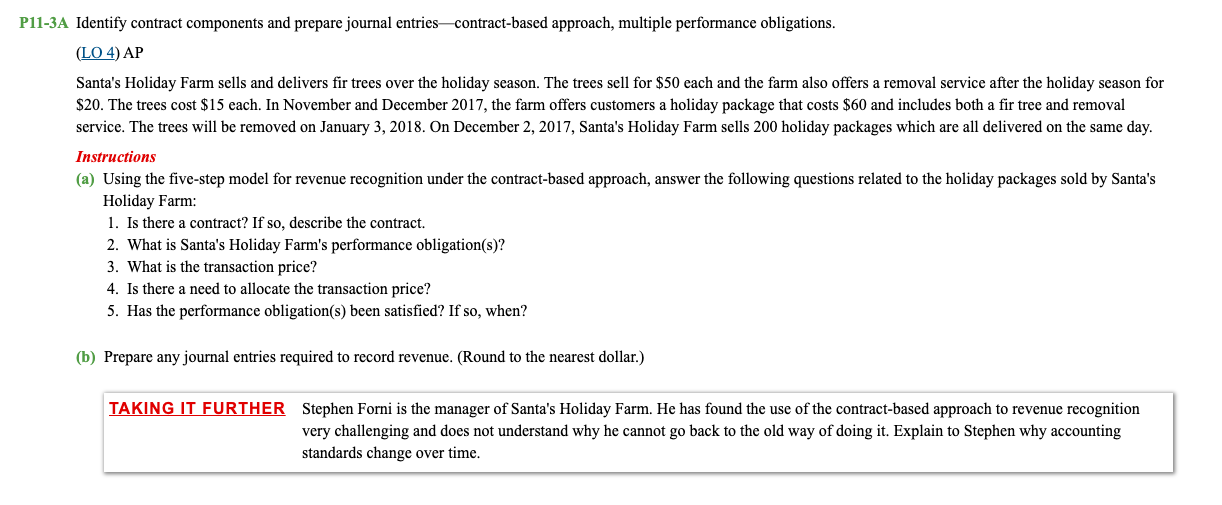

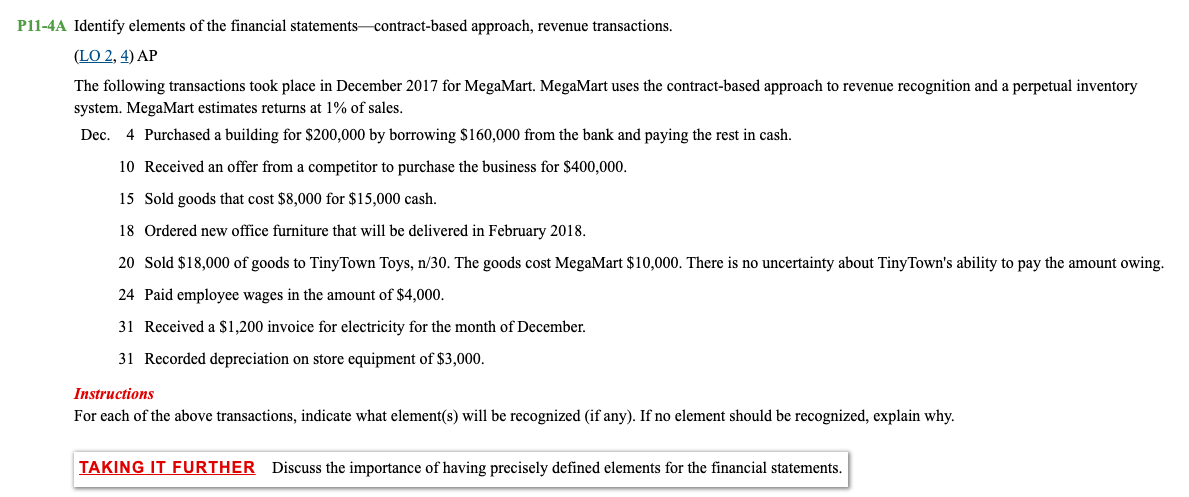

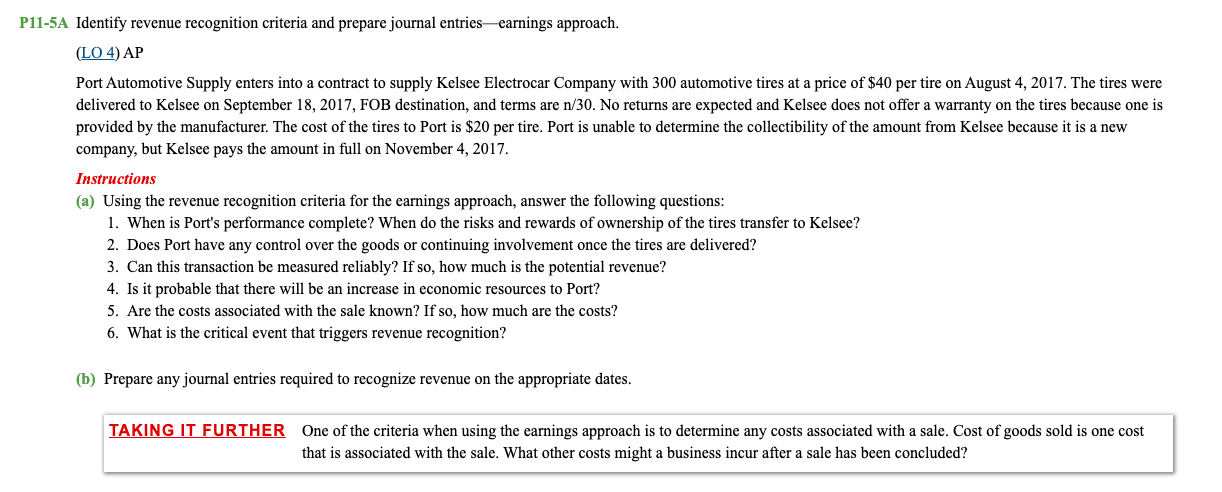

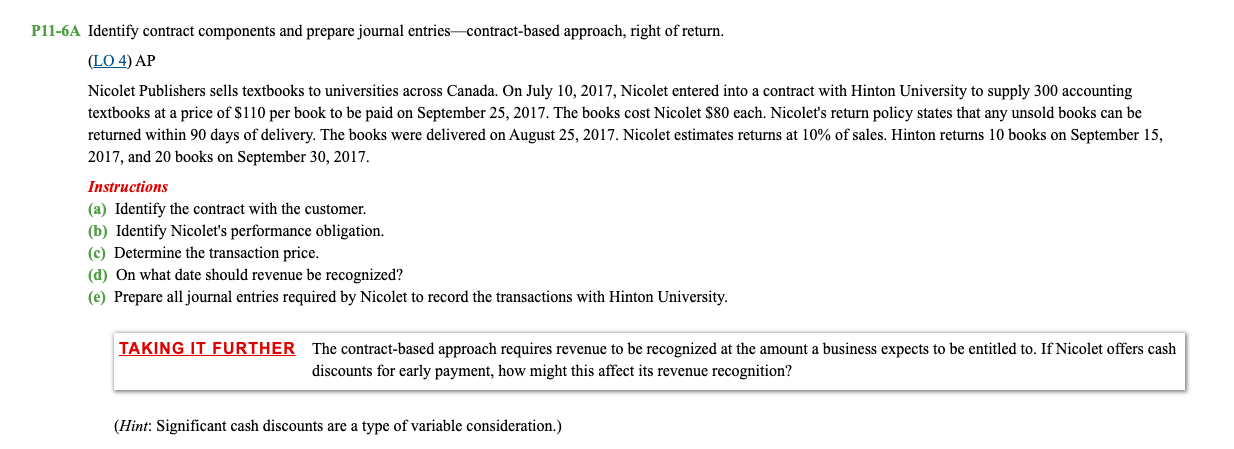

I'll-3A Identify contract components and prepare journal enuiescontractbased approach, multiple performance obligations. {LO 4 } AP Santa's Holiday Farm sells and delivers r trees over the holiday season. The trees sell for $50 each and the farm also offers a removal service after the holiday season for $20. The trees cost $15 each. In November and December 2017, the farm offers customers aholiday package that costs $60 and includes both a r tree and removal service. The trees will be removed on January 3, 2018. On December 2, 2017, Santa's Holidayr Farm sells 200 holiday packages which are all delivered on the same day. Instructions (3) Using the five-step model for revenue recognition under the contract-based approach, answer the following questions related to the holiday packages sold by Santa's Holiday Farm: 1. Is there a contract? If so, describe the contract. What is Santa's Holiday Farm's performance obligation(s)? What is the transaction price? Is there a need to allocate the transaction price? Has the performance obligation(s} been satised? If so, when? PPS-\"N (b) Prepare anyjournal entries required to record revenue. (Round to the nearest dollar.) TAKING IT FURTHER Stephen Fomi is the manager of Santa's Holiday Farm. He has found the use of the contract-based approach to revenue recognition very challenging and does not understand why he cannot go back to the old way of doing it. Explain to Stephen why accounting standards change over time. P11-4A Identify elements of the financial statements-contract-based approach, revenue transactions. (LO 2, 4) AP The following transactions took place in December 2017 for MegaMart. MegaMart uses the contract-based approach to revenue recognition and a perpetual inventory system. MegaMart estimates returns at 1% of sales. Dec. 4 Purchased a building for $200,000 by borrowing $160,000 from the bank and paying the rest in cash. 10 Received an offer from a competitor to purchase the business for $400,000. 15 Sold goods that cost $8,000 for $15,000 cash. 18 Ordered new office furniture that will be delivered in February 2018. 20 Sold $18,000 of goods to TinyTown Toys, n/30. The goods cost MegaMart $10,000. There is no uncertainty about Tiny Town's ability to pay the amount owing. 24 Paid employee wages in the amount of $4,000. 31 Received a $1,200 invoice for electricity for the month of December. 31 Recorded depreciation on store equipment of $3,000. Instructions For each of the above transactions, indicate what element(s) will be recognized (if any). If no element should be recognized, explain why. TAKING IT FURTHER Discuss the importance of having precisely defined elements for the financial statements.I'll-5A Identify revenue recognition criteria and prepare journal entriesearnings approach. {LO'HAP Port Automotive Supply enters into a contract to supply Kelsee Electrocar Company with 300 automotive tires at a price of $40 pertire on August 4, 2017. The tires were deliveredto Kelsee on September 18, 201?, FOB destination, and terms are nf3t). No returns are expected and Kelsee does not offer awarranty on the tires because one is provided by the manufacturer. The cost of the tires to Port is $20 per tire. Port is unable to determine the collectibility of the amount from Kelsee because it is a new company, but Kelsee pays the amount in full on November 4, 2017. Instructions {3) Using the revenue recognition criteria for the eamjngs approach, answer the following questions: 1. P'P'PE-\"E'J When is Port's performance complete? When do the risks and rewards of ownership of the tires transfer to Kelsee? Does Port have any control over the goods or continuing involvement once the tires are delivered? Can this transaction be measured reliably? It'so, how much is the potential revenue? Is it probable that there will be an increase in economic resources to Port? Are the costs associated with the sale known? If so, how much are the costs? What is the critical event that triggers revenue recognition? (b) Prepare anyjoumal entries required to recognize revenue on the appropriate dates. TAKING IT FURTHER One ofthe criteria when using the earnings approach is to determine any costs associated with a sale. Cost of goods sold is one cost that is associated with the sale. What other costs might a business incur aer a sale has been concluded? P11-6A Identify contract components and prepare journal entries-contract-based approach, right of return. (LO 4) AP Nicolet Publishers sells textbooks to universities across Canada. On July 10, 2017, Nicolet entered into a contract with Hinton University to supply 300 accounting textbooks at a price of $110 per book to be paid on September 25, 2017. The books cost Nicolet $80 each. Nicolet's return policy states that any unsold books can be returned within 90 days of delivery. The books were delivered on August 25, 2017. Nicolet estimates returns at 10% of sales. Hinton returns 10 books on September 15, 2017, and 20 books on September 30, 2017. Instructions (a) Identify the contract with the customer. (b) Identify Nicolet's performance obligation. (c) Determine the transaction price. (d) On what date should revenue be recognized? (e) Prepare all journal entries required by Nicolet to record the transactions with Hinton University. TAKING IT FURTHER The contract-based approach requires revenue to be recognized at the amount a business expects to be entitled to. If Nicolet offers cash discounts for early payment, how might this affect its revenue recognition? (Hint: Significant cash discounts are a type of variable consideration.)