Question: PLEASE ANSWER IN ANSWER FORMAT HAVE BEEN STUCK ON PROBLEM FOR A WHILE. WILL GIVE THUMBS UP AND GOOD RATING TO ANSWER IN CORRECT FORMAT.

PLEASE ANSWER IN ANSWER FORMAT

HAVE BEEN STUCK ON PROBLEM FOR A WHILE. WILL GIVE THUMBS UP AND GOOD RATING TO ANSWER IN CORRECT FORMAT. THANKS!!

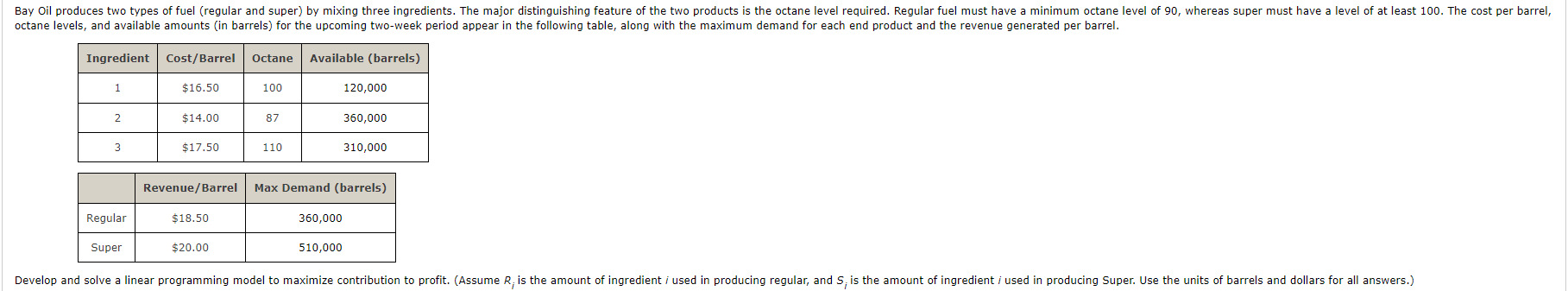

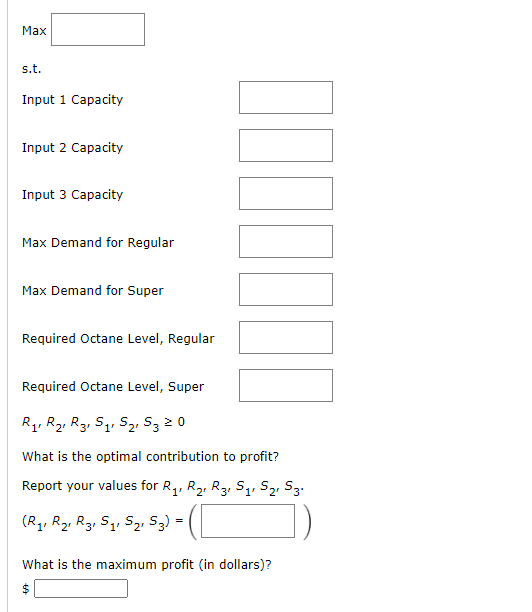

Bay Oil produces two types of fuel (regular and super) by mixing three ingredients. The major distinguishing feature of the two products is the octane level required. Regular fuel must have a minimum octane level of 90, whereas super must have a level of at least 100. The cost per barrel, octane levels, and available amounts (in barrels) for the upcoming two-week period appear in the following table, along with the maximum demand for each end product and the revenue generated per barrel. Ingredient Cost/Barrel Octane Available (barrels) 1 $16.50 100 120,000 2 $14.00 87 360,000 3 $17.50 110 310,000 Revenue/Barrel Max Demand (barrels) Regular $18.50 360,000 Super $20.00 510,000 Develop and solve a linear programming model to maximize contribution to profit. (Assume R, is the amount of ingredient i used in producing regular, and S, is the amount of ingredient i used in producing Super. Use the units of barrels and dollars for all answers.) Max s.t. Input 1 Capacity Input 2 Capacity Input 3 Capacity IIIIII Max Demand for Regular Max Demand for Super Required Octane Level, Regular Required Octane Level, Super Rir R2, R3, 51, 52, 5320 1 ' What is the optimal contribution to profit? Report your values for R1, R2, R3, 51, 52, 53, ' (R1, R2, R3, 51, 52, 53) = ([ ' What is the maximum profit (in dollars)Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts