Question: Please answer in at least 2 paragraphs 4. Using the material in Beyond Hedging, please explain why the London Metals Exchange (LME) developed the North

Please answer in at least 2 paragraphs

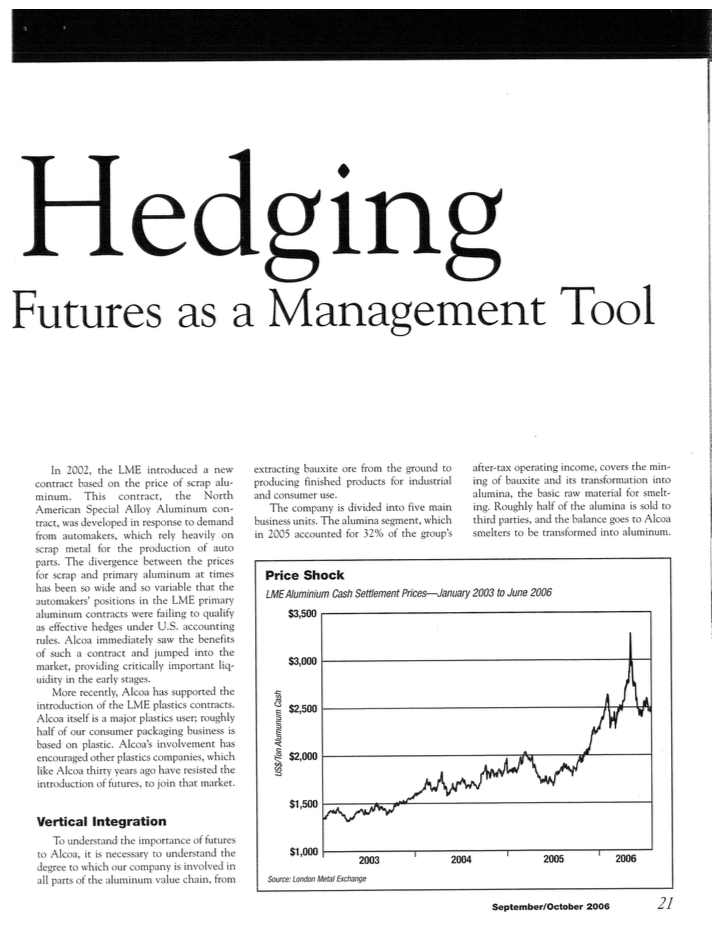

4. Using the material in "Beyond Hedging," please explain why the London Metals Exchange (LME) developed the North American Special Alloy (Scrap) Aluminum contract. In the same article, the author discusses how the development of the LME Aluminum futures contracts changed the way Alcoa sells aluminum to its customers. Outline some of the significant changes that has occurred as Alcoa adjusted to these contracts. Absorbing Shocks Beyond How Alcoa Relies on By Kevin Anton There is a saying in corporate circles: you you measure. Alcoa is the largest aluminum company in the world. Its global operations run all the For Alcoa, the existence of a futures market in aluminum allows the company to man- age its various business units in a more way from bauxite mines in Australia to effective way. Each part of the value chain can be analyzed separately, and the pricing of components as they move up the value chain can be set independently, by refer- ence to LME prices, rather than by an internal pricing scheme set by company managers. This creates price discipline within the company and allows the man- agement to determine the profitability of each segment of the business. smelters in North America and on into fab- rication, manufacturing and consumer packaging. Alcoa is also a heavy user of the aluminum futures markets, not only to hedge its price risks but also as an impor- tant reference point for pricing decisions throughout the organization. In the follow- ing article, a senior Alcoa executive explains the many ways in which the com- pany relies on the London Metal Exchange's aluminum futures market for hedge for our own operations but also as price discovery and risk management. Initially Alcoa was a reluctant user of the futures market. In fact, thirty years ago, when the LME first introduced an alu- minum contract, the company viewed it as a threat to its pricing power. It was rumored that Krome George, Alcoa's chairman at that time, threatened to dismiss anyone who entered into an LME-based contract. How times have changed. Alcoa now relies on LME prices in the marketing of vir- tually all of its commodity grade aluminum and a substantial portion of its consumer products. Alcoa also uses LME futures to price risk, not only as a part of the services that we provide to our worldwide customer base. 20 Hedging Futures as a Management Tool extracting bauxite ore from the ground to producing finished products for industrial and consumer use. The company is divided into five main business units. The alumina segment, which in 2005 accounted for 32% of the group's after-tax operating income, covers the min- ing of bauxite and its transformation into alumina, the basic raw material for smelt- ing. Roughly half of the alumina is sold to third parties, and the balance goes to Alcoa smelters to be transformed into aluminum. In 2002, the LME introduced a new contract based on the price of scrap alu- minum. This contract, the North American Special Alloy Aluminum con- tract, was developed in response to demand from automakers, which rely heavily on scrap metal for the production of auto parts. The divergence between the prices for scrap and primary aluminum at times has been so wide and so variable that the automakers' positions in the LME primary aluminum contracts were failing to qualify as effective hedges under U.S. accounting rules. Alcoa immediately saw the benefits of such a contract and jumped into the market, providing critically important liq- uidity in the early stages. Price Shock LME Aluminium Cash Settlement Prices-January 2003 to June 2006 $3,500 $3,000 $2,500 More recently, Alcoa has supported the introduction of the LME plastics contracts. Alcoa itself is a major plastics user; roughly half of our consumer packaging business is based on plastic. Alcoa's involvement has encouraged other plastics companies, which like Alcoa thirty years ago have resisted the introduction of futures, to join that market. $2,000 were mate $1,500 Vertical Integration $1,000 To understand the importance of futures to Alcoa, it is necessary to understand the degree to which our company is involved i all parts of the aluminum value chain, from 2004 Source: London Metal Exchange USS/Ton Alumunum Cash 2003 2005 September/October 2006 2006 21 Absorbing Shocks ness separately. This allows us to make bet- ter decisions on pricing and capital alloca- tion, prevent one side of the company from subsidizing another, and decide in which parts of the business to invest. Second, on the external side, we can incorporate a reference to LME prices in its products. Before the introduction of alu- minum futures, producers sold aluminum sheet at a set price. Today substantially all of Alcoa's aluminum products are sold on an aluminum-plus-conversion price. Risk Management The fact that the prices for so many of Alcoa's products are referenced to the LME means that, in effect, customers are paying a floating price. This puts the onus on the customers to think about how they are going to hedge an unexpected movement in price. Some customers have the size and At Alcoa, the value of call options granted to customers is calculated very carefully, so that before our salespeople go out they know what that option is going to cost. sophistication to go directly to the broker- age community to convert this exposure to a fixed price, but for those customers who do not want to set up a hedge program, Alcoa can provide coverage. We do not market risk management as a separate busi- ness, but it is part of the overall value proposition that we offer to our customers. For example, suppose an aerospace com- pany decides to launch a new airplane plat- form and it wants to have assured costs for the next five years. We may not want to offer a fixed price for such a long period. The existence of the exchange, where there are financial intermediaries willing to take long or short positions, provides the neces- sary liquidity to allow the aerospace cus- tomer to get the fixed price it wants for that five-year period, and Alcoa to hedge the risk on that long-term commitment. For most purposes, the LME market is sufficiently deep to meet this need. The alu- minum contract goes out 63 months, and over-the-counter derivatives are available This is handled by the company's primary metals segment, which in 2005 accounted for 38% of after-tax operating income. Roughly half of this unit's production goes to third party clients, and the remainder goes into Alcoa facilities for further process- ing downstream. The company also buys significant amounts of aluminum scrap plus other forms of primary aluminum for down- stream businesses. The downstream businesses, which accounted for the remaining 30% of after- tax operating income, is divided into four groups. The flat-rolled products segment produces and sells aluminum plate, sheet and foil. The extruded and end products segment produces alloy extrusions, architec- tural extrusions and vinyl siding. The engi- neered solutions segment manufactures various castings, forgings, and fasteners as well as wheels and other products used in the aerospace, automotive, commercial transportation and power generation mar- kets. Lastly, the packaging and consumer segment includes the Reynolds wrap and other packaging products, about half of which are based on aluminum and half on plastics. The existence of a liquid futures market at the LME creates a very transparent price discovery method for an intermediate prod- uct-commodity grade aluminum. In effect, we rely on the LME to disaggregate the value chain. One part of the value chain runs from bauxite to aluminum, and the sec- ond part from aluminum to aircraft parts, auto frames and beverage cans. From a practical point of view, the transparency of LME prices has two effects. First, on the internal side, it is a key source of discipline. All the transfer pricing as alu- minum is passed from one part of the group to another is done at full market price. So our managers have the ability to break out measurement points along the value chain and measure the contribution of each busi- 22 Futures Industry for up to 15 years. Alcoa generally can find enough liquidity to conduct its business inside the exchange's 63-month window. It is worth noting that a recent shift in the behavior of commodity investors has improved the amount of liquidity available in the back months. The so-called index- ers-institutional investors and swap deal- ers that take positions in commodity indices have been coming into the alu- minum market in a big way for approxi- mately the last two years. For most of this time, they concentrated their positions in the near months, but starting in the second quarter of this year, they have been moving to the back months to avoid the negative return caused by the fact that the aluminum futures market is in contango. This trend has provided more liquidity to companies like Alcoa that are looking to take large positions to hedge long-term risk. Options vs. Futures Futures are not the only way to hedge futures and structures such as aluminum price risk. Options on aluminum collars also have an important role in a hedge program, especially when there is a fixed pricing commitment on an unknown amount of volume. In deciding what instruments to use, the first step is to make sure that the sales and marketing strategy is aligned with the raw material acquisition strategy. If, for exam- ple, a company in the aluminum window business has sold all of its windows for next year, then it really should use futures to lock in its aluminum cost for the year to protect its profit margin. Otherwise the sales strat- egy has created a big short position that can blow a hole in the balance sheet. Conversely, a company should avoid locking up all of its aluminum needs at a fixed price if it has a variable pricing strat- egy. Suppose an auto parts company wins a contract to provide all the wheels for a par- ticular type of car at a fixed price for the life of that model. There is no way in advance to know how much aluminum that company will need to buy to meet that commitment. The contract could last four to six years, and the number of cars produced under that con- tract could range from 100,000 units a year to 200,000 units a year. By extending a price guarantee on a variable number of units, that company effectively has granted a call option to the customer. This is where options can come into a and Shanghai offices have teams that are to operate in these markets, but only if they hedge program. Options can provide cover- actively encouraging customers in Brazil have the necessary infrastructure and con- age for the risk when a company has com- and China to manage aluminum price risk. trols and sophistication mitted to a fixed price on a variable Just to give an example of how global The importance of having a proper con amount of production. Options are not this industry is, Alcoa recently announced a trol structure extends to the market itself. cheap, however, and many customers are joint venture that will produce aluminum The LME still has open outcry, which in reluctant to use options to cover this risk brazing sheet in a city near Shanghai. This Alcoa's view adds to market integrity. In because they do not like paying for the investment, our third flat-rolled products addition, Alcoa appreciates the oversight volatility. At Alcoa, the value of call facility in China, will give Alcoa the ability provided by the Financial Services options granted to customers is calculated to supply aluminum brazing sheet to auto Authority and the oversight infrastructure very carefully, so that before our salespeople motive and other customers serving the that the LME has established. Without that go out they know what that option is going Asian market oversight, Alcoa would not participate in to cost. We often see that other market par The Asia-Pacific region accounted for that market. ticipants do not have the discipline to put 12% of our overall sales last year, and we As markets continue to globalise, com a value on the options they have granted to expect that percentage to rise as countries modity price movements will become even their customers. like China and India move up the GDP per more difficult to anticipate, and it seems capital scale and consume more aluminum. almost inevitable that more large users like Other Benefits In fact, McKinsey projects that by the year Alcoa will turn to the futures markets to The existence of a futures market also 2020, the amount of aluminum consumed mitigate that risk. In economic sectors helps reduce the cost of financing by allow in Asia will have more than doubled, far where futures are not well established, or ing companies to take the price risk out of outstripping the rate of growth in Europe where they do not exist at all, there contin the credit decision. Banks are willing to finance inventory, so a borrower can do longer term structured financing with an LME component, or a shorter term inven. We do not market risk management as a tory financing and consignment supported by the contango structure at the front end separate business, but it is part of the overall production forward, can also help producers value proposition that we offer to our customers. finance construction of new facilities at a lower cost, as they now have a known rev. enue stream The existence of a deep and liquid futures market also provides a springboard and North America. McKinsey also projects ues to be resistance to change, but our expe- for centralized market intelligence analysis that aluminum consumption in Asia will rience has shown that the price discovery and dissemination. Alcoa runs its risk man account for more than half of total world and risk management benefits of futures agement function as a centralized office consumption by 2020, versus 42% in 2005. markets are a powerful aide to effective cor- based in Knoxville, Tenn. This office accu- This growth clearly will create greater expo- porate management. That said, many large mulates all commercial risk from all the sure to aluminum price risk, and greater users of aluminum and other traded com- Alcoa business units around the world so interest in hedging that risk. modities need to enhance their understand- that we know at any given time what our ing of risk management. We welcome more aluminum price risk is. The Knoxville office Control Structure participation in these markets, but we also also runs our trading activities at the LME. An important element of a good hedge believe that it is important that new Alcoa is not a member of the exchange; all ing program is the control structure. entrants establish all the necessary controls of our trades are executed through brokers, Alcoa's program has direct involvement to use these products properly. Most of what Alcoa trades are either listed from the chief financial officer and the on the LME or look-a-like contracts avail- chairman to make sure that the hedge strat Kevin Anton is the president of Alcoa Materials able in the over-the-counter products. egy is aligned with the company's goals. Management. He is responsible for materials man- The central office is supported with This means having the accounting infra- agement for all of Alcoa's upstream commercial oper- satellite offices in So Paulo, Perth, structure to make sure only authorized ations; this includes primary aluminum and alumina Shanghai and Geneva, so the company has trades take place and the management sales, primary and scrap aluminum physical and 24-hour coverage of the global aluminum infrastructure to ensure a clear line of con- financial trading, electricity trading and transporta- market. These offices are not only analyzing trol from the chairman through the finance tion. He is also the vice chairman of the Aluminum the risks for Alcoa's own operations, they organization through the metals organiza- Association are also collecting information on the risks tion down to the traders. Alcoa has encour- that the company is absorbing in its market- aged and will encourage other companies ing activities. So for example, the So Paulo September/October 2006 23

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts