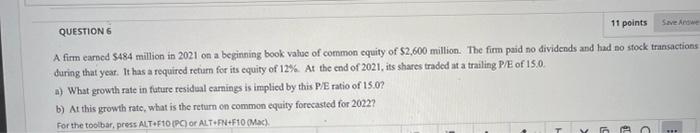

Question: please answer in detail 11 points Save Awe QUESTIONS A firm earned $484 million in 2021 on a beginning book value of common equity of

11 points Save Awe QUESTIONS A firm earned $484 million in 2021 on a beginning book value of common equity of $2,600 million. The firm paid no dividends and had no sfock transactions during that year. It has a required return for its equity of 12%. At the end of 2021, its shares traded at a trailing P/E of 15.0. a) What growth rate in future residual carnings is implied by this P/E ratio of 15.0? b) At this growth ratc, what is the return on common equity forecasted for 2022? For the toolbar, press ALT F10 (PC) O ALTFN+F10 Mac) 11 points Save Awe QUESTIONS A firm earned $484 million in 2021 on a beginning book value of common equity of $2,600 million. The firm paid no dividends and had no sfock transactions during that year. It has a required return for its equity of 12%. At the end of 2021, its shares traded at a trailing P/E of 15.0. a) What growth rate in future residual carnings is implied by this P/E ratio of 15.0? b) At this growth ratc, what is the return on common equity forecasted for 2022? For the toolbar, press ALT F10 (PC) O ALTFN+F10 Mac)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts