Question: PLEASE ANSWER IN DETAILS AND CORRECTLY. YOU WILL GET UPVOTES. THANKS QUESTION 5 Below is a two-period price tree of ABC Stock. A European call

PLEASE ANSWER IN DETAILS AND CORRECTLY. YOU WILL GET UPVOTES. THANKS

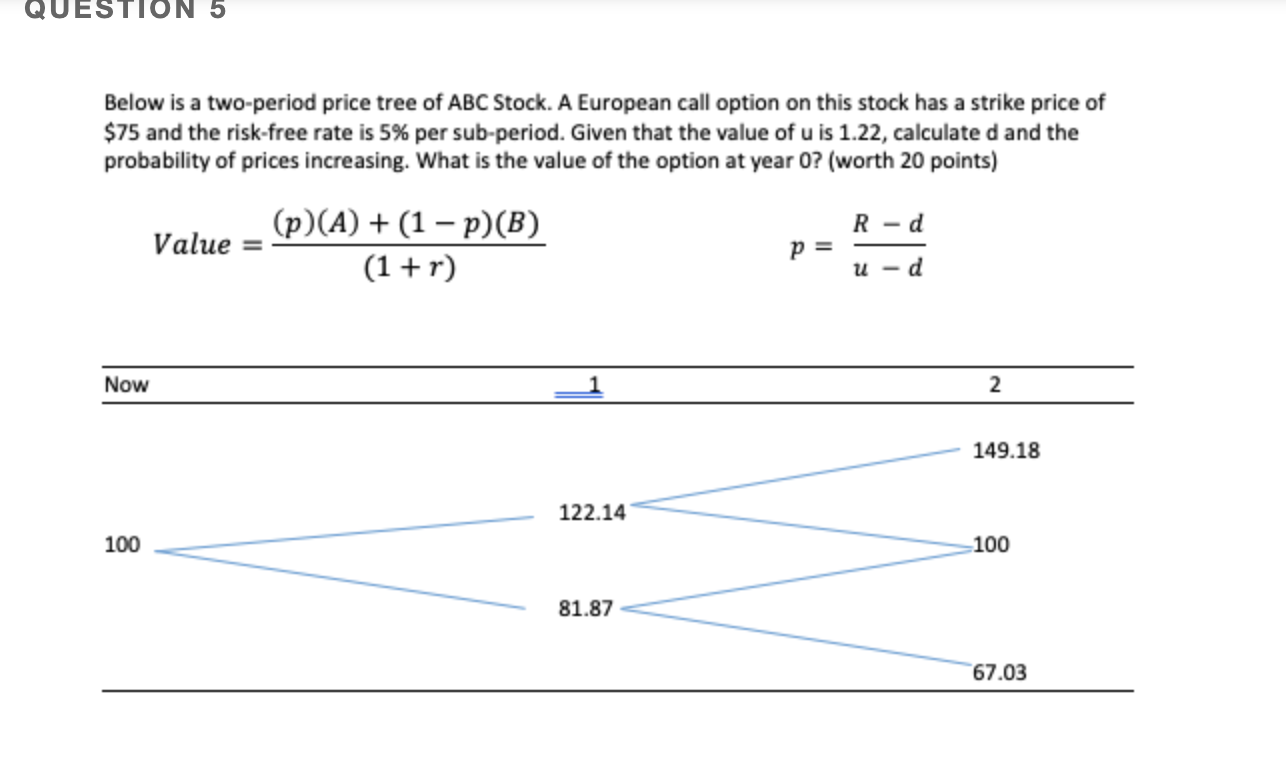

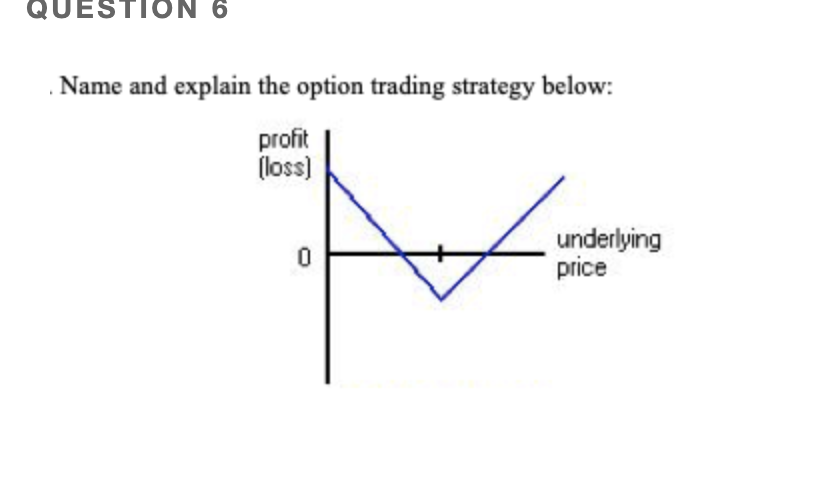

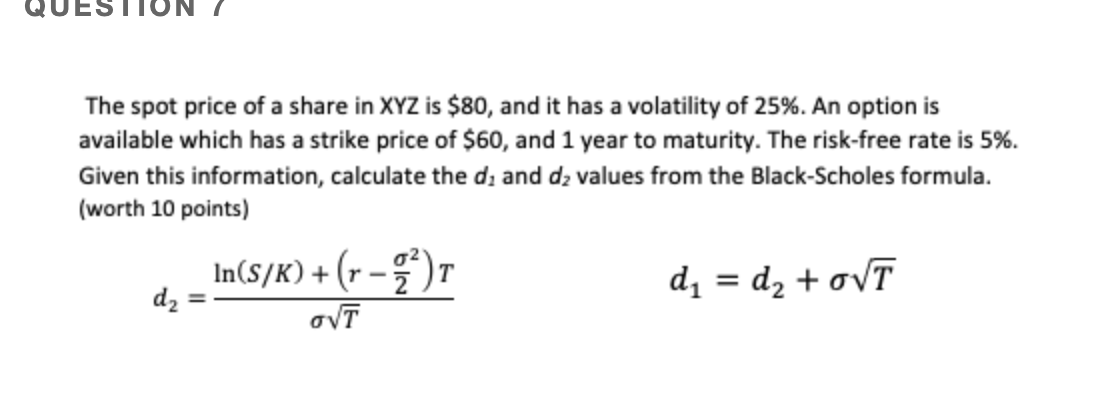

QUESTION 5 Below is a two-period price tree of ABC Stock. A European call option on this stock has a strike price of $75 and the risk-free rate is 5% per sub-period. Given that the value of u is 1.22, calculate d and the probability of prices increasing. What is the value of the option at year 0? (worth 20 points) Value (p)(A) + (1 - p)(B) (1+r) R-d p = u-d Now 2 149.18 122.14 100 100 81.87 67.03 QUESTION 6 Name and explain the option trading strategy below: profit (loss) 0 + underlying price The spot price of a share in XYZ is $80, and it has a volatility of 25%. An option is available which has a strike price of $60, and 1 year to maturity. The risk-free rate is 5%. Given this information, calculate the d, and dz values from the Black-Scholes formula. (worth 10 points) In(s/K) +(v-2) di = d2 +oT dz ovt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts