Question: please answer in excel 2. The Square Bagel is an all equity firm. It has 10 million outstanding share currently prices at $10 per share.

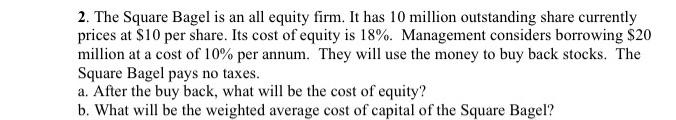

2. The Square Bagel is an all equity firm. It has 10 million outstanding share currently prices at $10 per share. Its cost of equity is 18%. Management considers borrowing $20 million at a cost of 10% per annum. They will use the money to buy back stocks. The Square Bagel pays no taxes. a. After the buy back, what will be the cost of equity? b. What will be the weighted average cost of capital of the Square Bagel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts