Question: PLEASE ANSWER IN EXCEL AND SHOW CALCULATION/FORMULA. THANK YOU 3 4) You have the option to invest in the following four projects: Project 0 1

PLEASE ANSWER IN EXCEL AND SHOW CALCULATION/FORMULA. THANK YOU

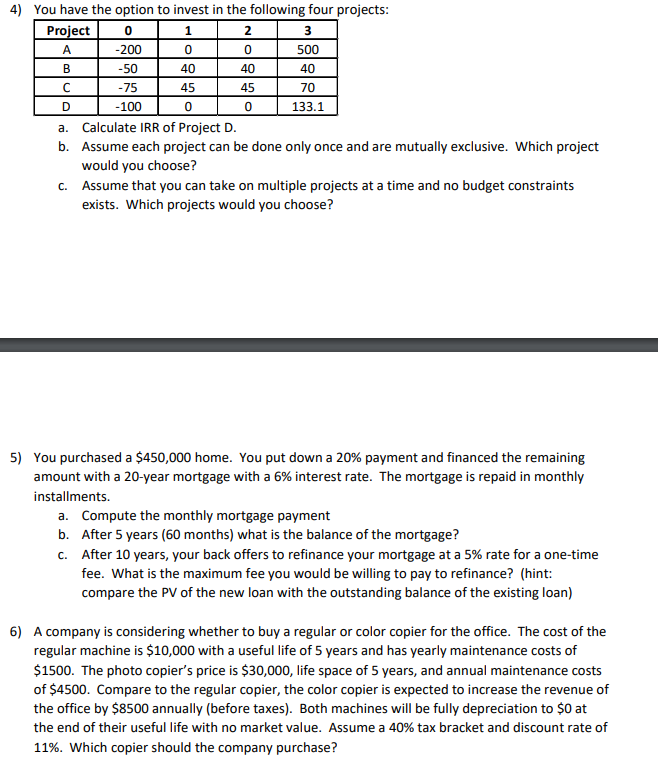

3 4) You have the option to invest in the following four projects: Project 0 1 2 -200 0 0 500 B -50 40 40 40 C -75 45 45 70 D -100 0 0 133.1 a. Calculate IRR of Project D. b. Assume each project can be done only once and are mutually exclusive. Which project would you choose? C. Assume that you can take on multiple projects at a time and no budget constraints exists. Which projects would you choose? 5) You purchased a $450,000 home. You put down a 20% payment and financed the remaining amount with a 20-year mortgage with a 6% interest rate. The mortgage is repaid in monthly installments. a. Compute the monthly mortgage payment b. After 5 years (60 months) what is the balance of the mortgage? C. After 10 years, your back offers to refinance your mortgage at a 5% rate for a one-time fee. What is the maximum fee you would be willing to pay to refinance? (hint: compare the PV of the new loan with the outstanding balance of the existing loan) 6) A company is considering whether to buy a regular or color copier for the office. The cost of the regular machine is $10,000 with a useful life of 5 years and has yearly maintenance costs of $1500. The photo copier's price is $30,000, life space of 5 years, and annual maintenance costs of $4500. Compare to the regular copier, the color copier is expected to increase the revenue of the office by $8500 annually (before taxes). Both machines will be fully depreciation to $0 at the end of their useful life with no market value. Assume a 40% tax bracket and discount rate of 11%. Which copier should the company purchase? 3 4) You have the option to invest in the following four projects: Project 0 1 2 -200 0 0 500 B -50 40 40 40 C -75 45 45 70 D -100 0 0 133.1 a. Calculate IRR of Project D. b. Assume each project can be done only once and are mutually exclusive. Which project would you choose? C. Assume that you can take on multiple projects at a time and no budget constraints exists. Which projects would you choose? 5) You purchased a $450,000 home. You put down a 20% payment and financed the remaining amount with a 20-year mortgage with a 6% interest rate. The mortgage is repaid in monthly installments. a. Compute the monthly mortgage payment b. After 5 years (60 months) what is the balance of the mortgage? C. After 10 years, your back offers to refinance your mortgage at a 5% rate for a one-time fee. What is the maximum fee you would be willing to pay to refinance? (hint: compare the PV of the new loan with the outstanding balance of the existing loan) 6) A company is considering whether to buy a regular or color copier for the office. The cost of the regular machine is $10,000 with a useful life of 5 years and has yearly maintenance costs of $1500. The photo copier's price is $30,000, life space of 5 years, and annual maintenance costs of $4500. Compare to the regular copier, the color copier is expected to increase the revenue of the office by $8500 annually (before taxes). Both machines will be fully depreciation to $0 at the end of their useful life with no market value. Assume a 40% tax bracket and discount rate of 11%. Which copier should the company purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts