Question: PLEASE ANSWER IN EXCEL AND SHOW FORMULAS, THANK YOU! Debt Bonds outstanding Settlement date Maturity date Annual coupon rate Coupons per year Bond price %

PLEASE ANSWER IN EXCEL AND SHOW FORMULAS, THANK YOU!

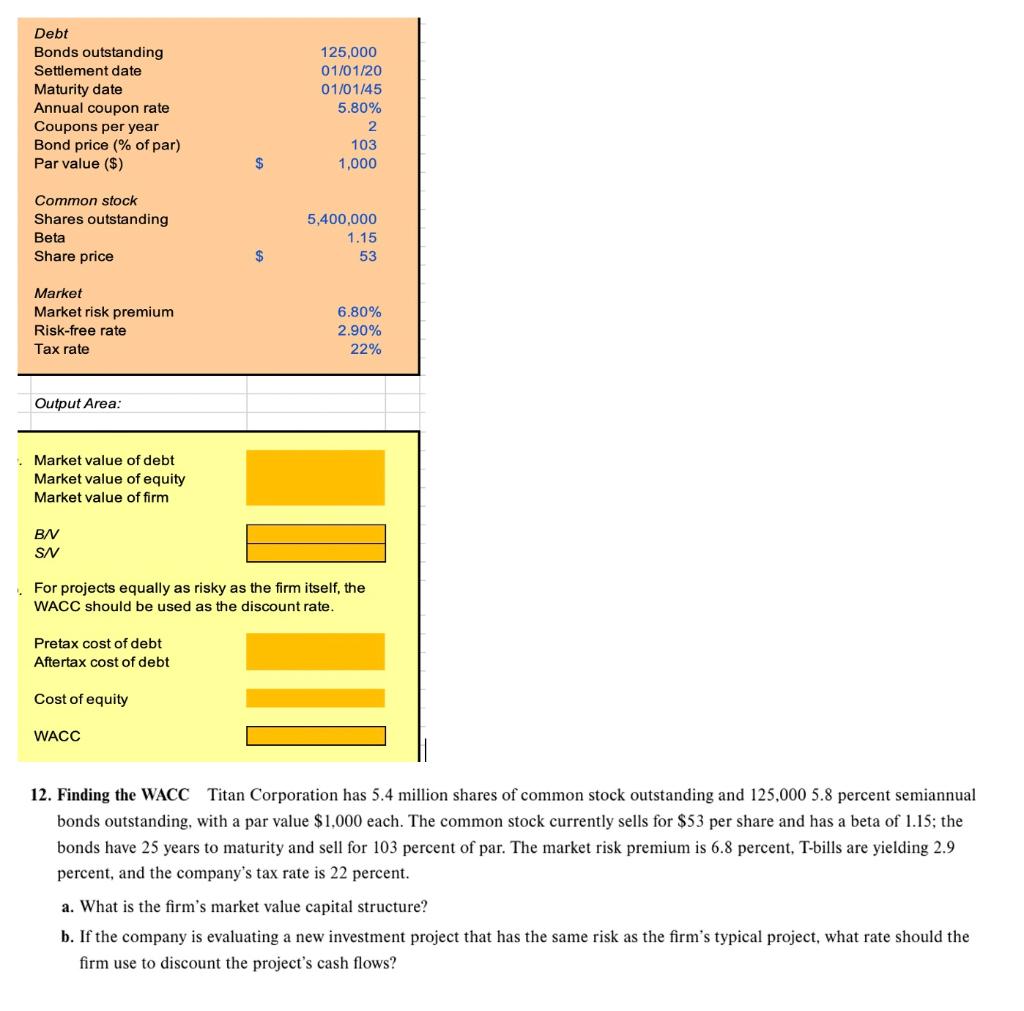

Debt Bonds outstanding Settlement date Maturity date Annual coupon rate Coupons per year Bond price % of par) Par value ($) 125,000 01/01/20 01/01/45 5.80% 2 103 1,000 $ Common stock Shares outstanding Beta Share price 5,400,000 1.15 53 $ Market Market risk premium Risk-free rate Tax rate 6.80% 2.90% 22% Output Area: Market value of debt Market value of equity Market value of firm BN SW For projects equally as risky as the firm itself, the WACC should be used as the discount rate. Pretax cost of debt Aftertax cost of debt Cost of equity WACC 12. Finding the WACC Titan Corporation has 5.4 million shares of common stock outstanding and 125,000 5.8 percent semiannual bonds outstanding, with a par value $1,000 each. The common stock currently sells for $53 per share and has a beta of 1.15; the bonds have 25 years to maturity and sell for 103 percent of par. The market risk premium is 6.8 percent, T-bills are yielding 2.9 percent, and the company's tax rate is 22 percent. a. What is the firm's market value capital structure? b. If the company is evaluating a new investment project that has the same risk as the firm's typical project, what rate should the firm use to discount the project's cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts