Question: please answer in Excel and show work. Ken made the following transfers during the current year. Determine Ken's taxable gifts for the current year. Transferred

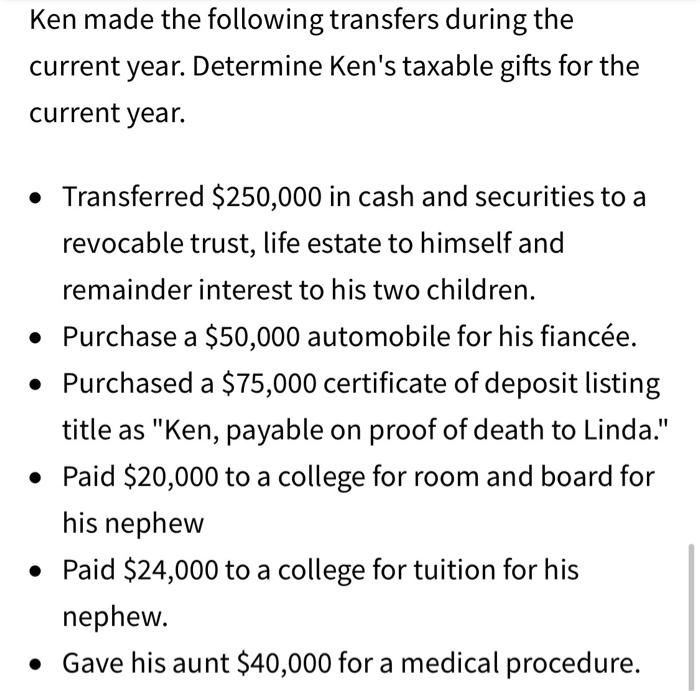

Ken made the following transfers during the current year. Determine Ken's taxable gifts for the current year. Transferred $250,000 in cash and securities to a revocable trust, life estate to himself and remainder interest to his two children. Purchase a $50,000 automobile for his fiance. Purchased a $75,000 certificate of deposit listing title as "Ken, payable on proof of death to Linda." Paid $20,000 to a college for room and board for his nephew Paid $24,000 to a college for tuition for his nephew. Gave his aunt $40,000 for a medical procedure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts