Question: please answer in excel and use formula text to show formulas. 2) Given the following information about a company's financial results, value the Company's stock

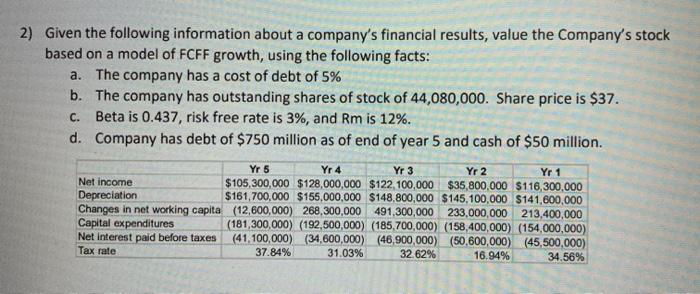

2) Given the following information about a company's financial results, value the Company's stock based on a model of FCFF growth, using the following facts: a. The company has a cost of debt of 5% b. The company has outstanding shares of stock of 44,080,000. Share price is $37. Beta is 0.437, risk free rate is 3%, and Rm is 12%. d. Company has debt of $750 million as of end of year 5 and cash of $50 million. C. Yr 5 Yr 4 Yr 3 Yr 2 Yr 1 Net income $105,300,000 $128,000,000 $122, 100,000 $35,800,000 $116,300,000 Depreciation $161,700,000 $155,000,000 $148.800,000 $145,100,000 $141,600,000 Changes in net working capita (12,600,000) 268,300,000 491,300,000 233,000,000 213,400,000 Capital expenditures (181,300,000) (192,500,000) (185,700,000) (158,400,000) (154,000,000) Net interest paid before taxes (41,100,000) (34,600,000) (46,900,000) (50,600,000) (45,500,000) Tax rate 37.84% 31.03% 32.62% 16.94% 34.56% 2) Given the following information about a company's financial results, value the Company's stock based on a model of FCFF growth, using the following facts: a. The company has a cost of debt of 5% b. The company has outstanding shares of stock of 44,080,000. Share price is $37. Beta is 0.437, risk free rate is 3%, and Rm is 12%. d. Company has debt of $750 million as of end of year 5 and cash of $50 million. C. Yr 5 Yr 4 Yr 3 Yr 2 Yr 1 Net income $105,300,000 $128,000,000 $122, 100,000 $35,800,000 $116,300,000 Depreciation $161,700,000 $155,000,000 $148.800,000 $145,100,000 $141,600,000 Changes in net working capita (12,600,000) 268,300,000 491,300,000 233,000,000 213,400,000 Capital expenditures (181,300,000) (192,500,000) (185,700,000) (158,400,000) (154,000,000) Net interest paid before taxes (41,100,000) (34,600,000) (46,900,000) (50,600,000) (45,500,000) Tax rate 37.84% 31.03% 32.62% 16.94% 34.56%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts