Question: PLEASE ANSWER IN EXCEL FORM WITH EXACT CELL FORMULAS USED TO SOLVE EACH OF THE YELLOW BOXES. long-term corporate bonds and T-bills are normally distributed

PLEASE ANSWER IN EXCEL FORM WITH EXACT CELL FORMULAS USED TO SOLVE EACH OF THE YELLOW BOXES.

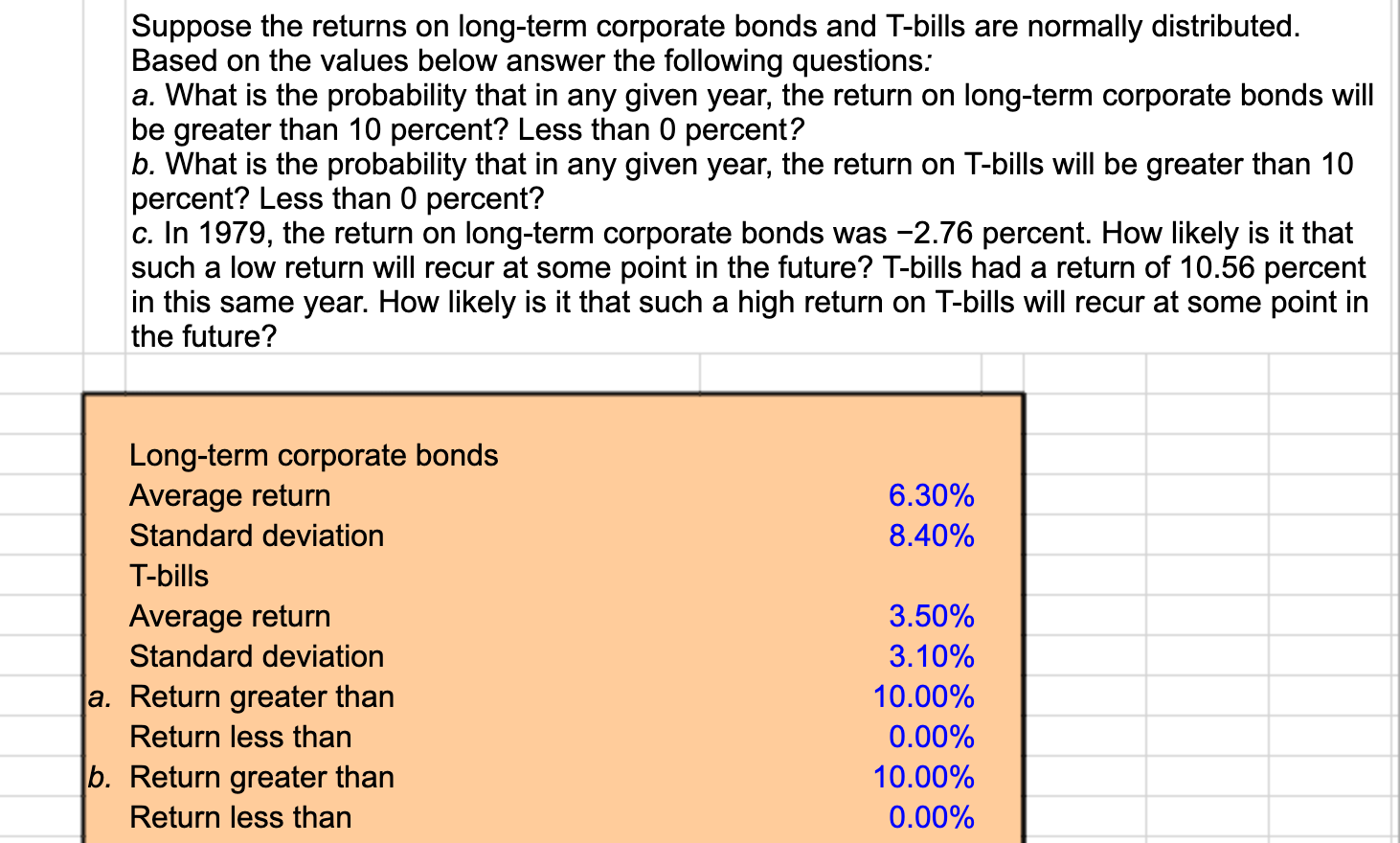

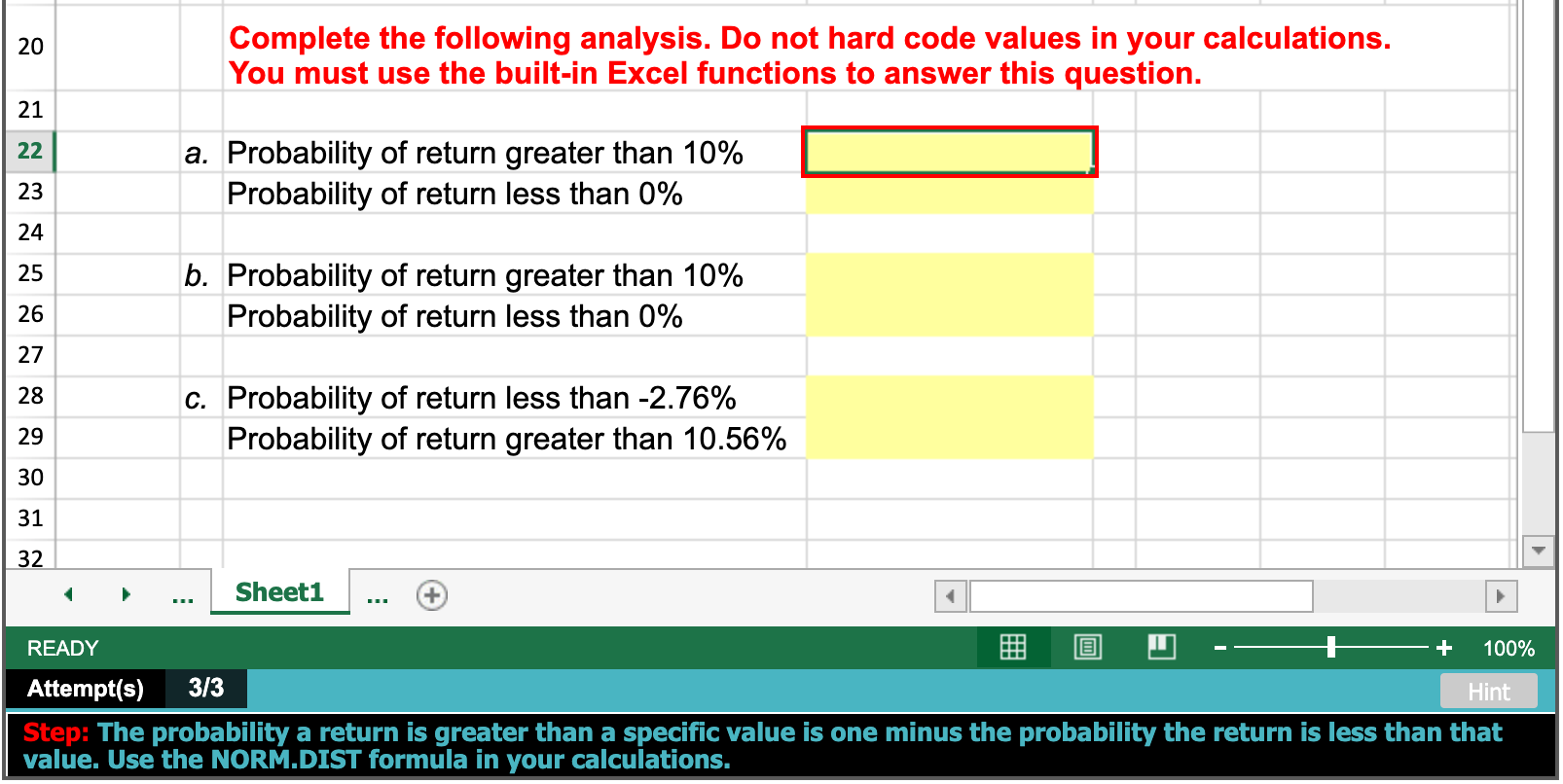

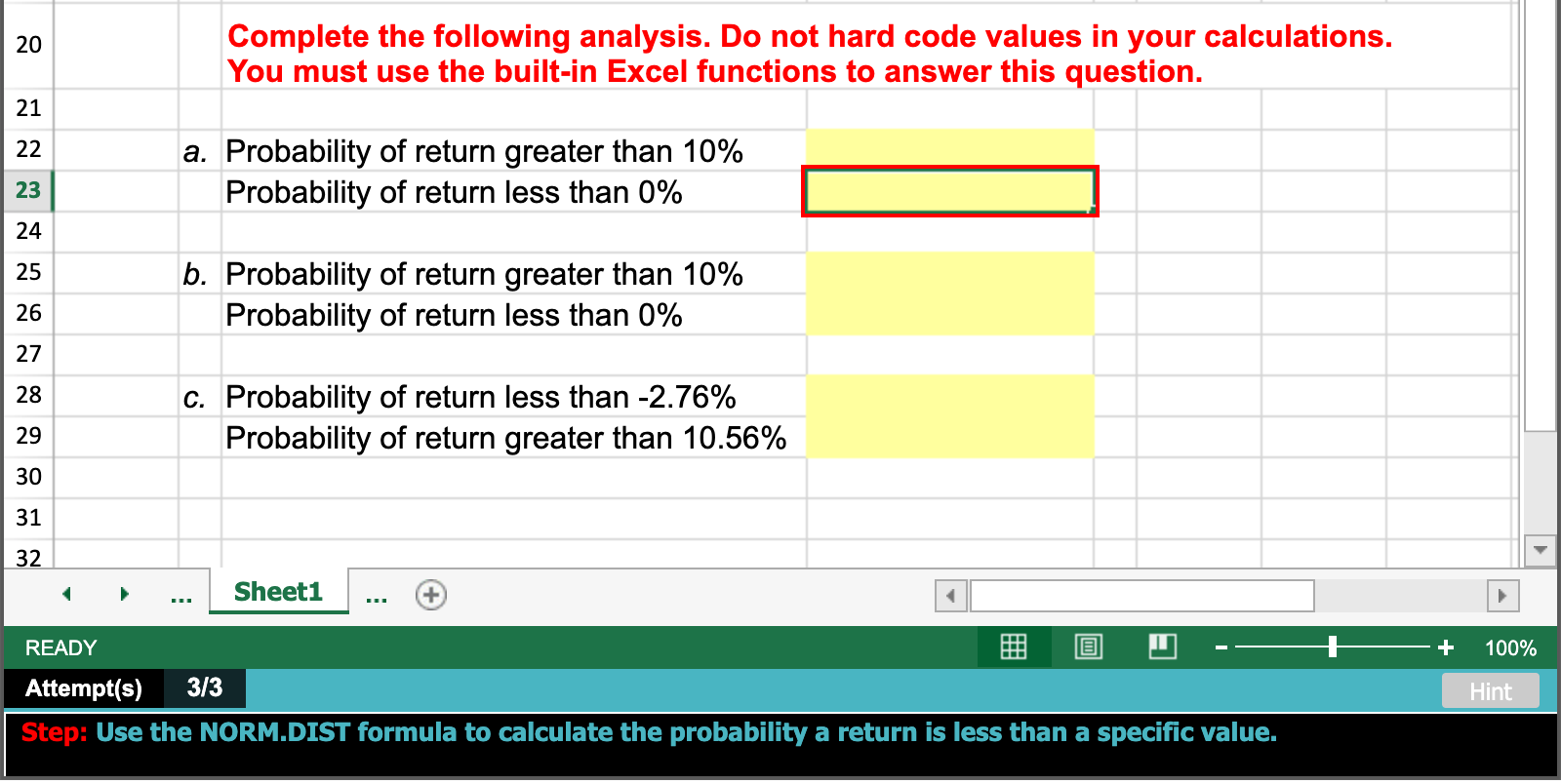

long-term corporate bonds and T-bills are normally distributed Suppose the returns on Based on the values below answer the following questions: a. What is the probability that in any given year, the return on long-term corporate bonds will be greater than 10 percent? Less than 0 percent? b. What is the probability that in any given year, the return on T-bills will be greater than 10 percent? Less than 0 percent? c. In 1979, the return on long-term corporate bonds was -2.76 percent. How likely is it that such a low return will recur at some point in the future? T-bills had a return of 10.56 percent in this same year. How likely is it that such a high return on T-bills will recur at some point in the future? Long-term corporate bonds Average return 6.30% 8.40% Standard deviation T-bills 3.50% Average return Standard deviation 3.10% a. Return greater than 10.00% Return less than 0.00% |b. Return greater than 10.00% Return less than 0.00% Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel functions to answer this question. 20 21 Probability of return greater than 10% Probability of return less than 0% 22 a. 23 24 b. Probability of return greater than 10% Probability of return less than 0% 25 26 27 c. Probability of return less than -2.76% Probability of return greater than 10.56% 28 29 30 31 32 Sheet1 READY + 100% Attempt(s) 3/3 Hint Step: The probability a return is greater than a specific value is one minus the probability the return is less than that value. Use the NORM.DIST formula in your calculations. Complete the following analysis. Do not hard code values in your calculations. You must use the built-in Excel functions to answer this question. 20 21 a. Probability of return greater than 10% Probability of return less than 0% 22 23 24 b. Probability of return greater than 10% Probability of return less than 0% 25 26 27 c. Probability of return less than -2.76% Probability of return greater than 10.56% 28 29 30 31 32 Sheet1 READY + 100% 3/3 Attempt(s) Hint Step: Use the NORM.DIST formula to calculate the probability a return is less than a specific value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts