Question: please answer in excel format 3. Your parents have an investment portfolio of $900,000, and they wish to take out cash flows of $9,000 per

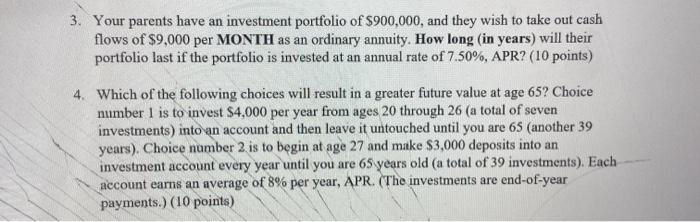

3. Your parents have an investment portfolio of $900,000, and they wish to take out cash flows of $9,000 per MONTH as an ordinary annuity. How long (in years) will their portfolio last if the portfolio is invested at an annual rate of 7.50%, APR? (10 points) 4. Which of the following choices will result in a greater future value at age 65? Choice number 1 is to invest $4,000 per year from ages 20 through 26 (a total of seven investments) into an account and then leave it untouched until you are 65 (another 39 years). Choice number 2 is to begin at age 27 and make $3,000 deposits into an investment account every year until you are 65 years old a total of 39 investments). Each account earns an average of 8% per year, APR. (The investments are end-of-year payments.) (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts