Question: PLEASE ANSWER IN EXCEL FORMAT WITH FORMULAS INCLUDED *Use the following spreadsheet format. Total Average Sales % Net Sales S/S Ratio BOM EOM Avg Stock

PLEASE ANSWER IN EXCEL FORMAT WITH FORMULAS INCLUDED

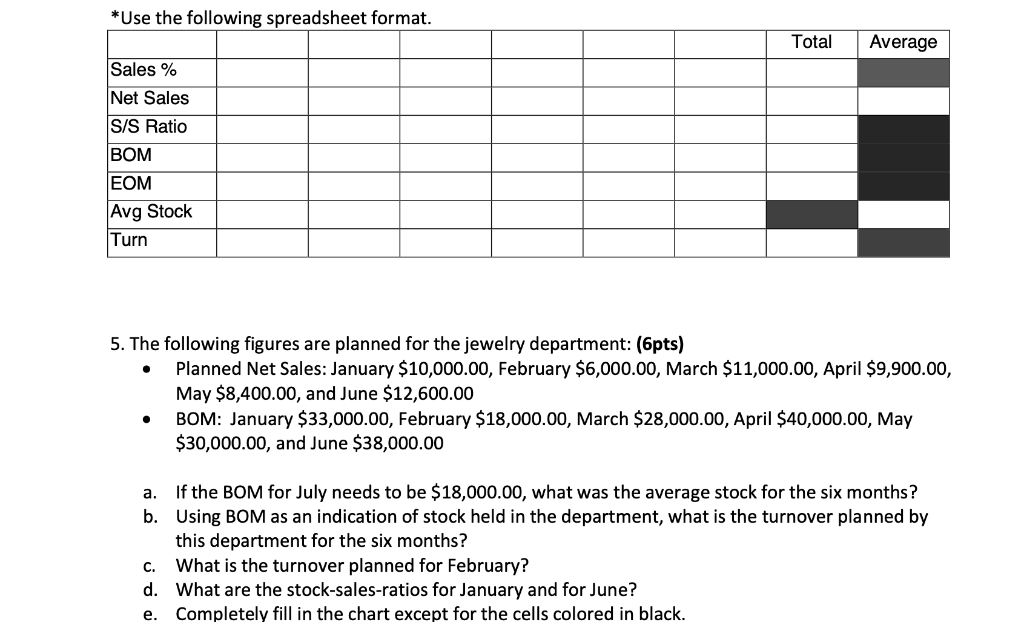

*Use the following spreadsheet format. Total Average Sales % Net Sales S/S Ratio BOM EOM Avg Stock Turn . 5. The following figures are planned for the jewelry department: (6pts) Planned Net Sales: January $10,000.00, February $6,000.00, March $11,000.00, April $9,900.00, May $8,400.00, and June $12,600.00 BOM: January $33,000.00, February $18,000.00, March $28,000.00, April $40,000.00, May $30,000.00, and June $38,000.00 a. If the BOM for July needs to be $18,000.00, what was the average stock for the six months? b. Using BOM as an indication of stock held in the department, what is the turnover planned by this department for the six months? What is the turnover planned for February? d. What are the stock-sales-ratios for January and for June? Completely fill in the chart except for the cells colored in black. c. e. *Use the following spreadsheet format. Total Average Sales % Net Sales S/S Ratio BOM EOM Avg Stock Turn . 5. The following figures are planned for the jewelry department: (6pts) Planned Net Sales: January $10,000.00, February $6,000.00, March $11,000.00, April $9,900.00, May $8,400.00, and June $12,600.00 BOM: January $33,000.00, February $18,000.00, March $28,000.00, April $40,000.00, May $30,000.00, and June $38,000.00 a. If the BOM for July needs to be $18,000.00, what was the average stock for the six months? b. Using BOM as an indication of stock held in the department, what is the turnover planned by this department for the six months? What is the turnover planned for February? d. What are the stock-sales-ratios for January and for June? Completely fill in the chart except for the cells colored in black. c. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts