Question: Please answer in Excel format with proper labels and detailed formulas for a great rating. Thank you! The Francesca Finance Corporation has issued a bond

Please answer in Excel format with proper labels and detailed formulas for a great rating. Thank you!

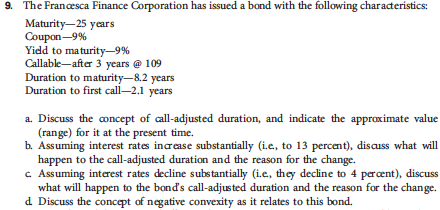

The Francesca Finance Corporation has issued a bond with the following characteristics: Maturity-25 years Coupon-9% Yield to maturity-9% Callable-after 3 years @ 109 Duration to maturity-8.2 years Duration to first call-2.1 years Discuss the concept of call-adjusted duration, and indicate the approximate value (range) for it at the present time. Assuming interest rates increase substantially (i.e., to 13 percent), discuss what will happen to the call-adjusted duration and the reason for the change. Assuming interest rates decline substantially (i.e., the)- decline to 4 percent), discuss what will happen to the bond's call-adjusted duration and the reason for the change. Discuss the concept of negative convexity as it relates to this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts