Question: Please answer in Excel format Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Question 4 (2 marks) The same machine, with

Please answer in Excel format

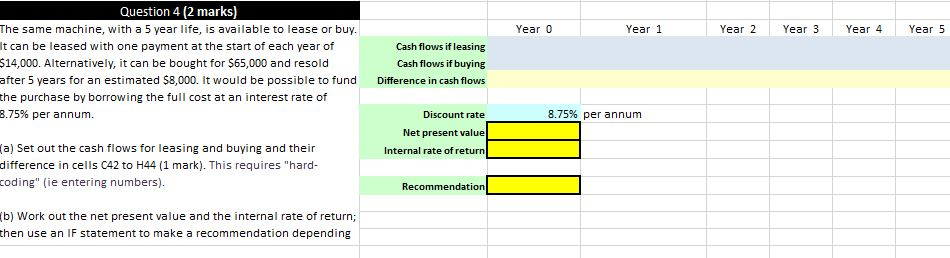

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Question 4 (2 marks) The same machine, with a 5 year life, is available to lease or buy. It can be leased with one payment at the start of each year of $14,000. Alternatively, it can be bought for $65,000 and resold after 5 years for an estimated $8,000. It would be possible to fund the purchase by borrowing the full cost at an interest rate of 8.75% per annum. Cash flows if leasing Cash flows if buying Difference in cash flows 8.75% per annum Discount rate Net present value Internal rate of return (a) Set out the cash flows for leasing and buying and their difference in cells C42 to H44 (1 mark). This requires "hard- coding" (ie entering numbers). Recommendation b) Work out the net present value and the internal rate of return; then use an IF statement to make a recommendation depending

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts