Question: **PLEASE ANSWER IN EXCEL & SHOW FORMULA'S** Kagera Company has made a portfolio of these three securities: Cost Treasury bond $100,000 Kasai Corporation $80,000 Limpopo

**PLEASE ANSWER IN EXCEL & SHOW FORMULA'S**

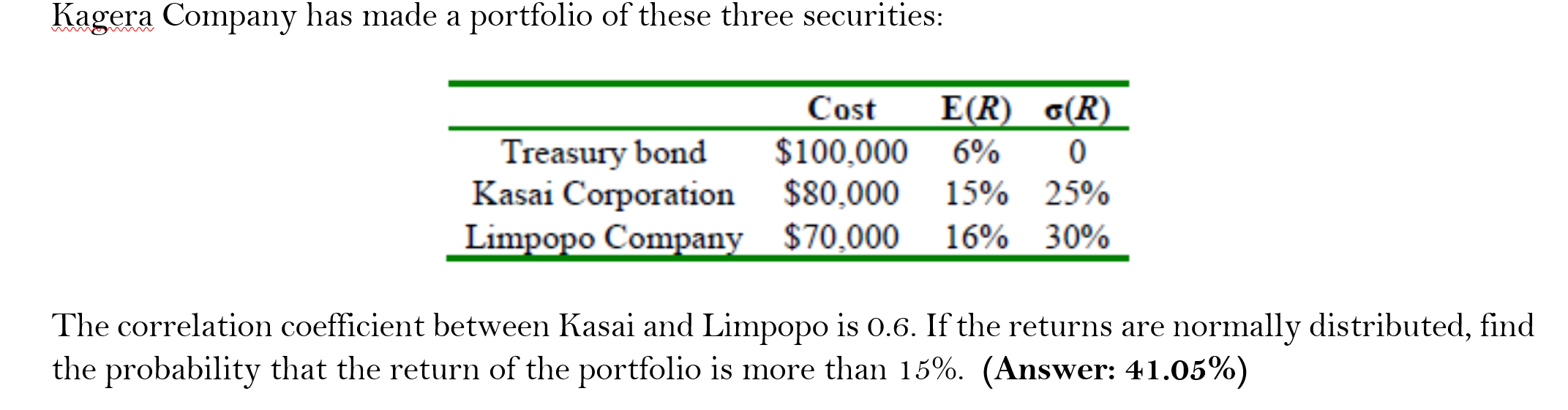

Kagera Company has made a portfolio of these three securities: Cost Treasury bond $100,000 Kasai Corporation $80,000 Limpopo Company $70,000 E(R) (R) 6% 0 15% 25% 16% 30% The correlation coefficient between Kasai and Limpopo is 0.6. If the returns are normally distributed, find the probability that the return of the portfolio is more than 15%. (Answer: 41.05%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts