Question: Please answer in Excel showing work. Tanner Partnership reported income before guaranteed payments of $100,000. Sam owns an 80% profits interest and works 1,500 hours

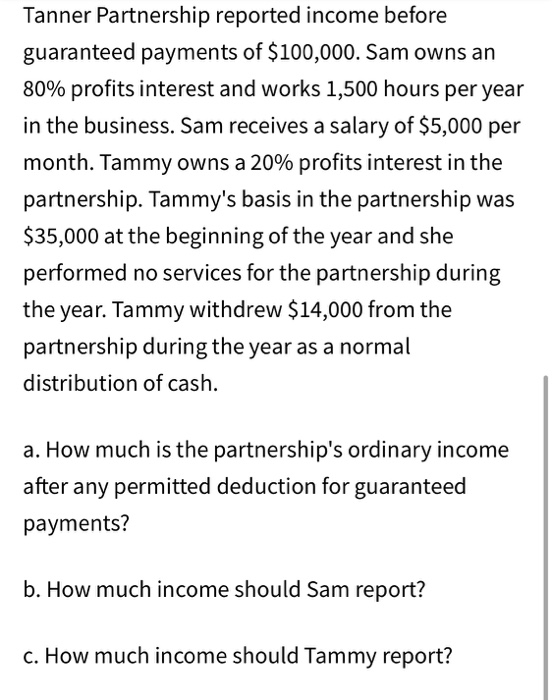

Tanner Partnership reported income before guaranteed payments of $100,000. Sam owns an 80% profits interest and works 1,500 hours per year in the business. Sam receives a salary of $5,000 per month. Tammy owns a 20% profits interest in the partnership. Tammy's basis in the partnership was $35,000 at the beginning of the year and she performed no services for the partnership during the year. Tammy withdrew $14,000 from the partnership during the year as a normal distribution of cash. a. How much is the partnership's ordinary income after any permitted deduction for guaranteed payments? b. How much income should Sam report? c. How much income should Tammy report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts