Question: please answer in excel V-Formula Example: Example involves the development of a new restaurant property. The land, building, and equipment investment required to construct the

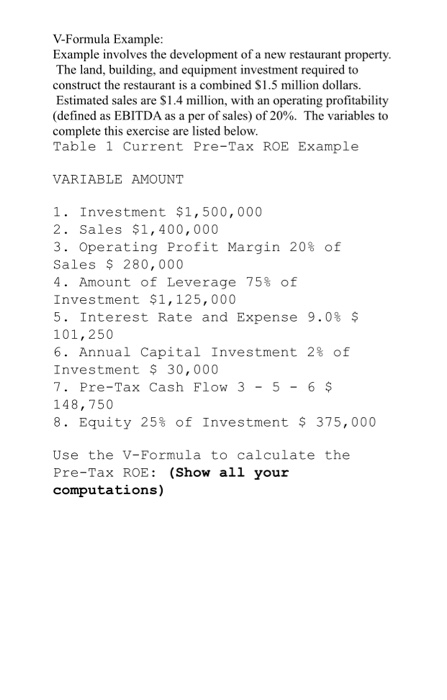

V-Formula Example: Example involves the development of a new restaurant property. The land, building, and equipment investment required to construct the restaurant is a combined $1.5 million dollars. Estimated sales are $1.4 million, with an operating profitability (defined as EBITDA as a per of sales) of 20%. The variables to complete this exercise are listed below. Table 1 Current Pre-Tax ROE Example VARIABLE AMOUNT 1. Investment $1,500,000 2. Sales $1,400,000 3. Operating Profit Margin 20% of Sales $ 280,000 4. Amount of Leverage 75% of Investment $1,125,000 5. Interest Rate and Expense 9.0% $ 101,250 6. Annual Capital Investment 2% of Investment $ 30,000 7. Pre-Tax Cash Flow 3 - 5 - 6 $ 148,750 8. Equity 25% of Investment $ 375,000 Use the V-Formula to calculate the Pre-Tax ROE: (Show all your computations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts