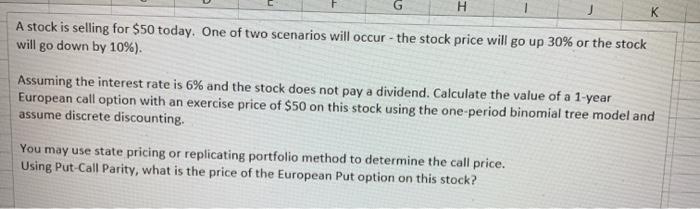

Question: please answer in excel with formula text G H J A stock is selling for $50 today. One of two scenarios will occur - the

G H J A stock is selling for $50 today. One of two scenarios will occur - the stock price will go up 30% or the stock will go down by 10%). Assuming the interest rate is 6% and the stock does not pay a dividend. Calculate the value of a 1-year European call option with an exercise price of $50 on this stock using the one-period binomial tree model and assume discrete discounting. You may use state pricing or replicating portfolio method to determine the call price. Using Put-Call Parity, what is the price of the European Put option on this stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts