Question: please answer in excel with formulas. 18-4. The Greentree Financial Management Group manages funds for institutional clients. A fund has placed $100,000,000 with the Group.

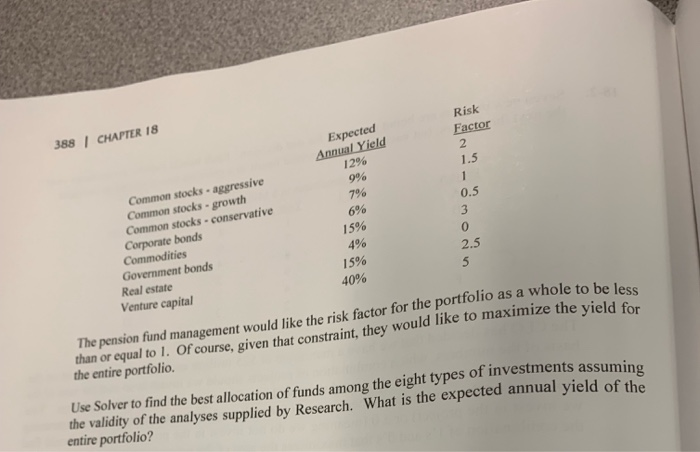

18-4. The Greentree Financial Management Group manages funds for institutional clients. A fund has placed $100,000,000 with the Group. The Research Department at the Group identifies eight types of investments and rates them as follows. Risk Factor 388 | CHAPTER 18 Expected Annual Yield 12% 1.5 9% 7% 6% 15% 4% Common stocks . aggressive Common stocks - growth Common stocks - conservative Corporate bonds Commodities 15% Government bonds 40% Real estate Venture capital The pension fund management would like the risk factor for the portfolio as a whole to be than or equal to I. Of course, given that constraint, they would like to maximize the yield f. the entire portfolio as a whole to be less Use Solver to find the best allocation of funds among the eight types of investments assuming the validity of the analyses supplied by Research. What is the expected annual yield of the entire portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts