Question: please answer in excell or using financial calculator but please show mw how introduce the values on the calculator 3. RAK, Inc., currently has an

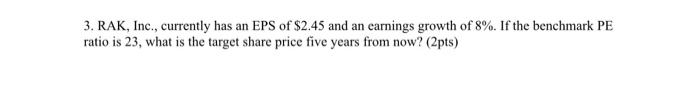

3. RAK, Inc., currently has an EPS of $2.45 and an earnings growth of 8%. If the benchmark PE ratio is 23, what is the target share price five years from now? (2pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts