Question: please answer in full detail explain all steps Today is your 25th birthday (Again). You're planning to work and save money for the next 5

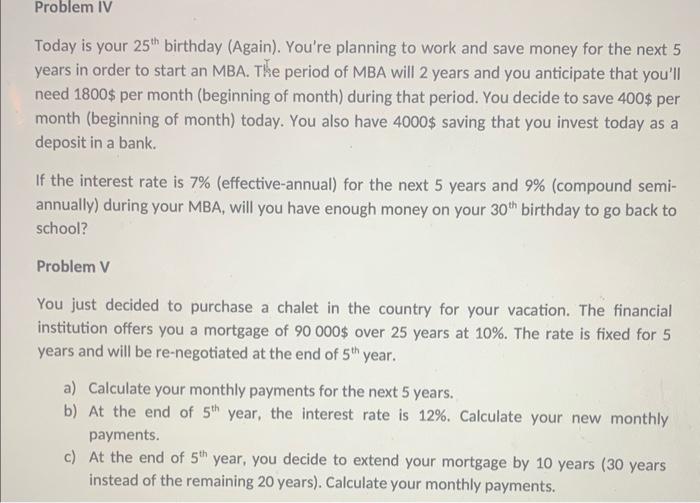

Today is your 25th birthday (Again). You're planning to work and save money for the next 5 years in order to start an MBA. The period of MBA will 2 years and you anticipate that you'll need 1800$ per month (beginning of month) during that period. You decide to save 400$ per month (beginning of month) today. You also have 4000$ saving that you invest today as a deposit in a bank. If the interest rate is 7% (effective-annual) for the next 5 years and 9% (compound semiannually) during your MBA, will you have enough money on your 30th birthday to go back to school? Problem V You just decided to purchase a chalet in the country for your vacation. The financial institution offers you a mortgage of 90000$ over 25 years at 10%. The rate is fixed for 5 years and will be re-negotiated at the end of 5th year. a) Calculate your monthly payments for the next 5 years. b) At the end of 5th year, the interest rate is 12%. Calculate your new monthly payments. c) At the end of 5th year, you decide to extend your mortgage by 10 years ( 30 years instead of the remaining 20 years). Calculate your monthly payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts