Question: Please Answer In Good Form (preparing for data analytics) answer Questions A-F what is required is shown in picture below 3. The adjacent balance sheets

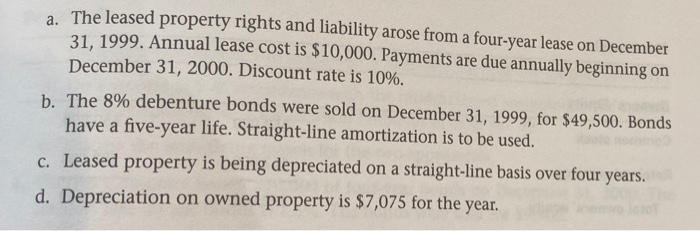

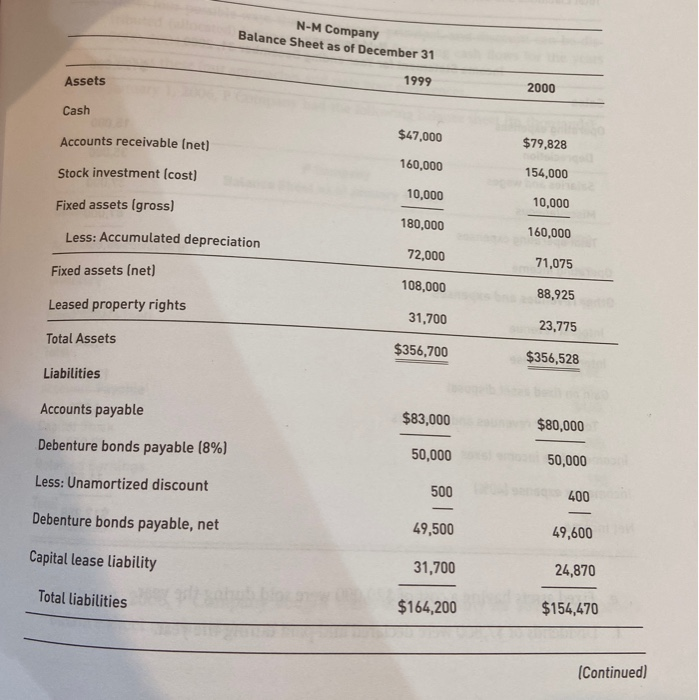

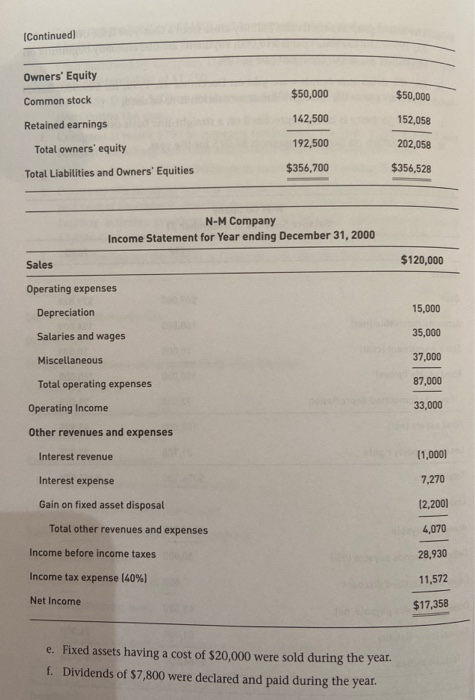

3. The adjacent balance sheets represent the beginning and end-of-year for 2000 for the N-M Company and the income statement for 2000. Other information: The leased property rights and liability arose from a four-year lease on December 31. 1999. Annual lease cost is $10,000. Payments are due annually beginning on December 31, 2000. Discount rate is 10%. b. The 8% debenture bonds were sold on December 31, 1999, for $49,500. Bonds have a five-year life. Straight-line amortization is to be used. c. Leased property is being depreciated on a straight-line basis over four years. d. Depreciation on owned property is $7,075 for the year. N-M Company Balance Sheet as of December 31 Assets 1999 2000 Cash Accounts receivable (net) $47.000 $79,828 160,000 Stock investment (cost) 154,000 10,000 Fixed assets (gross) 10,000 180,000 Less: Accumulated depreciation 160,000 72,000 71,075 Fixed assets (net) 108,000 88,925 Leased property rights 31,700 23,775 Total Assets $356,700 $356,528 Liabilities Accounts payable $83,000 $80,000 Debenture bonds payable (8%) 50,000 50,000 Less: Unamortized discount 500 400 Debenture bonds payable, net 49,500 49,600 Capital lease liability 31,700 24,870 Total liabilities $164,200 $154,470 (Continued) Continued) Owners' Equity Common stock $50,000 $50,000 142,500 Retained earnings 152,058 192,500 Total owners' equity 202,058 $356,700 Total Liabilities and Owners' Equities $356,528 N-M Company Income Statement for Year ending December 31, 2000 $120,000 Sales Operating expenses Depreciation Salaries and wages 15,000 35,000 37,000 Miscellaneous Total operating expenses 87,000 Operating Income 33,000 Other revenues and expenses Interest revenue 11,0001 Interest expense 7,270 Gain on fixed asset disposal (2.2001 Total other revenues and expenses 4,070 Income before income taxes 28,930 11,572 Income tax expense (40%) Net Income $17,358 e. Fixed assets having a cost of $20,000 were sold during the year. f. Dividends of $7,800 were declared and paid during the year. Required: a. Do a conventional SCF in accord with SFAS No. 95. (Use the indirect method.) b. Do a second SCF in accordance with the modifications suggested in the section of the chapter titled "Classification Problems of SFAS No. 95." c. Discuss the underlying reason for the two approaches

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts