Question: Please answer in proper format with all working clearly Note : Every entry should have narration please Requirement 3. Prepare Navy Seals Surplus' income statement

Please answer in proper format with all working clearly Note : Every entry should have narration please

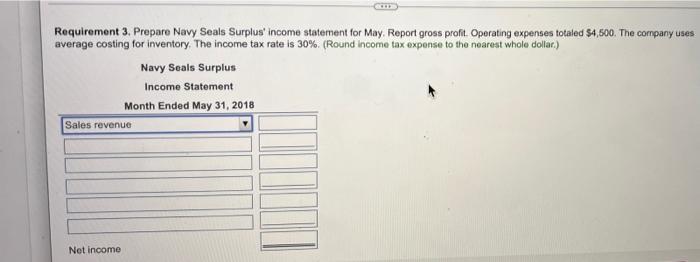

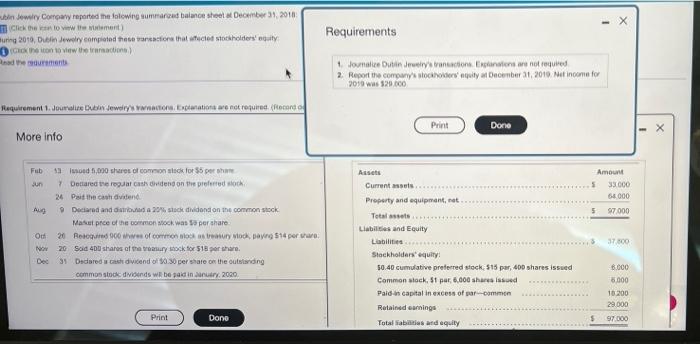

Requirement 3. Prepare Navy Seals Surplus' income statement for May, Report gross profit. Operating expenses totaled $4,500. The company uses average costing for inventory, The income tax rate is 30%. (Round Income tax expense to the nearest whole dollar.) Navy Seals Surplus Income Statement Month Ended May 31, 2018 Sales revenue Net incomeJoin Jewelry Company reported the lalewing summaneed balance sheet at December 39, 2010 - X (Click the rap to v w i'm minismont ) Requirements luring 2010, Dublin Jewelry complaind things transactions that stacies stockholders equity lead to muuremonte 1. Journaltre Dubin Jessing's transactions. Explanatory are not requved 2. Report the company's alocalhowdon' nqsity al December 21, 2019 Mit income for 2010 was $28.FC0 Requirement 1. Jour dire Dubin dowdry's winactions. Explanationa Do not required (toman of Print Done X More Info Fab 9 13 Isgood 6,030 shares of common slack for 15 per pham Ausell Amount Donarea the regular cash dividend on the pinferred stock, Current assets.......... 35000 24 Paid the cash dvalend Property and equipment, matpoppingoffthe 45 000 Decagon and oninto a 25% wisch dividona on ina common sock. 87/000 Makei price of the common stock was be per share. Liabilities and Equity 20 Sad 409 shares of the treasury cock for $18 por charm. Stockholders equity! Dec 31 Dadared i Guhid widend of $0.30 per share oo the outstanding 50.40 cumulative preferred stock, Sis per, ADD shares issued common aloo: dividends wh be paki in January 2050 Common stock, $1 par, 8.900 shares issued 6.000 Paid in capital in excess of par - common 10300 Rotained earnings 29.000 Print Dono Total Sabilities Fre equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts