Question: Please answer in same format. 7. On January 3, Spartan Corporation purchased 1,900 shares of the company's S1 par value common stock as treasury stock,

Please answer in same format.

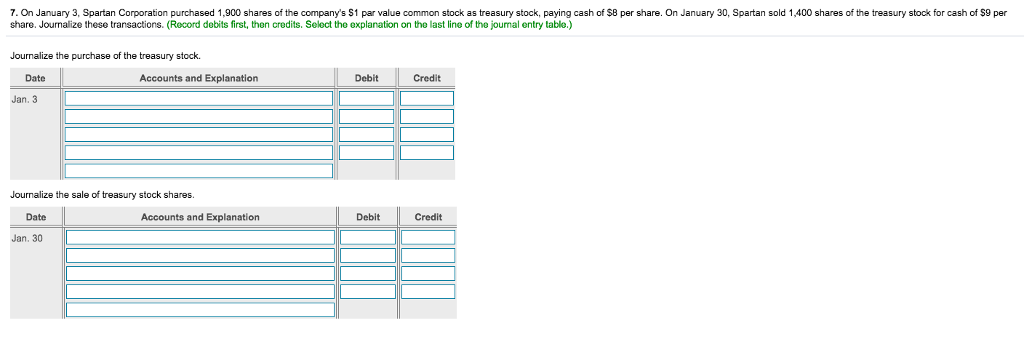

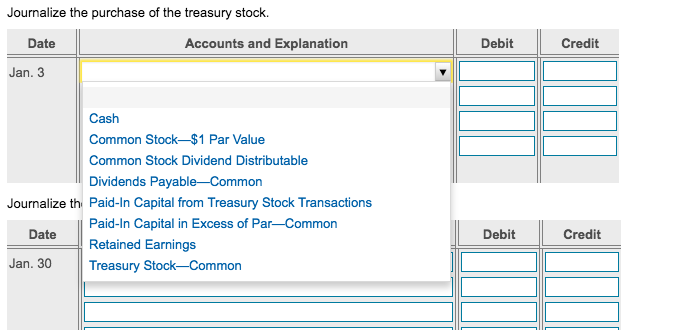

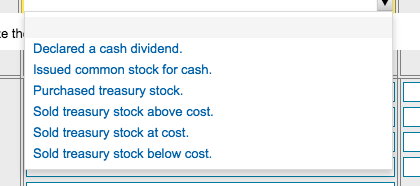

7. On January 3, Spartan Corporation purchased 1,900 shares of the company's S1 par value common stock as treasury stock, paying cash of $8 per share. On January 30, Spartan sold 1,400 shares of the treasury stock for cash of S9 per share. Journalize these transactions. (Record debits first, then credits. Select the explanation on the last line of the joumal entry tablo.) Journalize the purchase of the treasury stock. Date Accounts and Explanation Debit Credit Jan. 3 Journalize the sale of treasury stock shares. Date Accounts and Explanation Debit Credit Jan. 30 Journalize the purchase of the treasury stock. Date Accounts and Explanation Debit Credit Jan. 3 Cash Common Stock-$1 Par Value Common Stock Dividend Distributable Dividends Payable-Common Journalize th Paid-In Capital from Treasury Stock Transactions Paid-In Capital in Excess of Par Common Retained Earnings Date Debit Credit Jan. 30 Treasury Stock-Common e th Declared a cash dividend. Issued common stock for cash Purchased treasury stock Sold treasury stock above cost Sold treasury stock at cost. Sold treasury stock below cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts