Question: Please answer in same format. The company use aidS6 Oo sale On August the state. 0, Hanley om any recorded sales of merchandise inventory on

Please answer in same format.

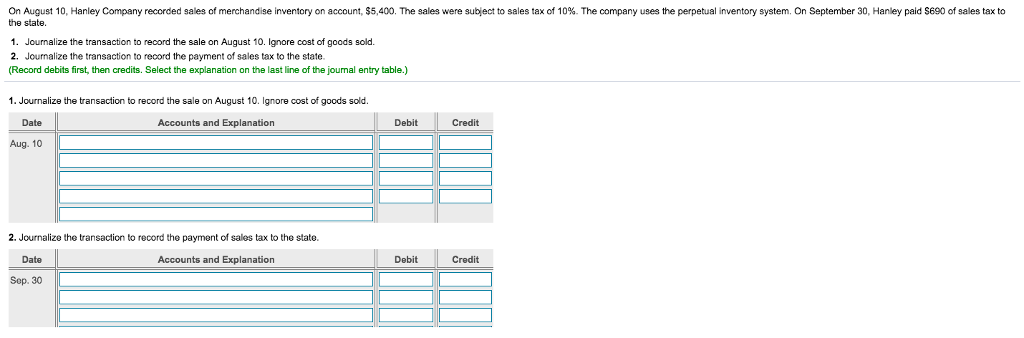

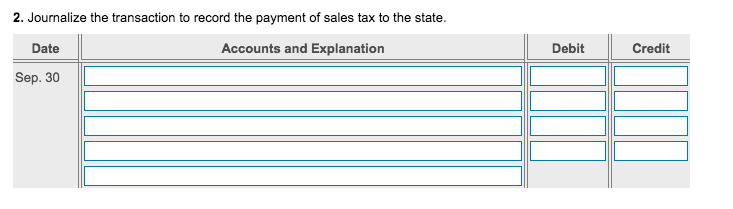

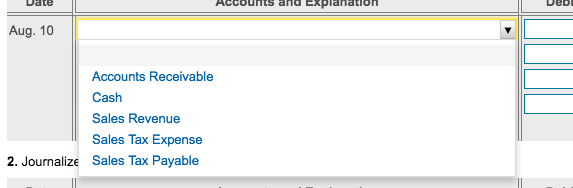

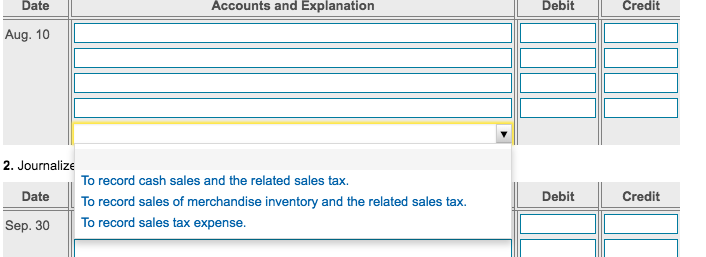

The company use aidS6 Oo sale On August the state. 0, Hanley om any recorded sales of merchandise inventory on account, 54 e sa s ere su e to saes ax o 0 the perpetua inventory system n eptember 0 Hane to 1. Journalize the transaction to record the sale on August 10. Ignore cost of goods sold. 2. Journalize the transaction to record the payment of sales tax to the state. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) 1. Journalize the transaction to record the sale on August 10. Ignore cost of goods sold Date Accounts and Explanation Debit Credit Aug. 10 2. Journalize the transaction to record the payment of sales tax to the state. Date Accounts and Explanation Debit Credit Sep. 30 Date Accounts and Explanation Aug. 10 Accounts Receivable Cash Sales Revenue Sales Tax Expense 2. Journalize Sales Tax Payable Date Accounts and Explanation Debit Credit Aug. 10 2. Journalize To record cash sales and the related sales tax. Date To record sales of merchandise inventory and the related sales tax. Sep. 30 To record sales tax expense. Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts