Question: please answer in same format will thumbs up The comparative statements of Cullumber Company are presented here, Liabilities and Stockholders' Equity All sales were on

please answer in same format will thumbs up

please answer in same format will thumbs up

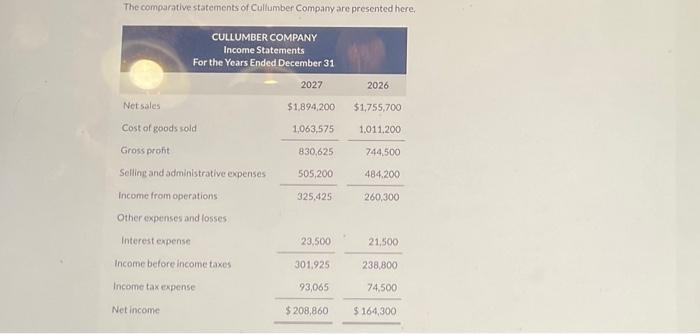

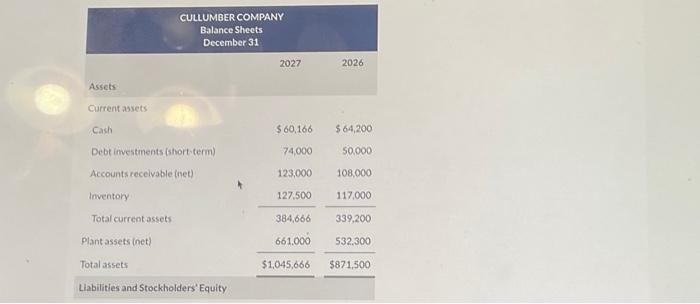

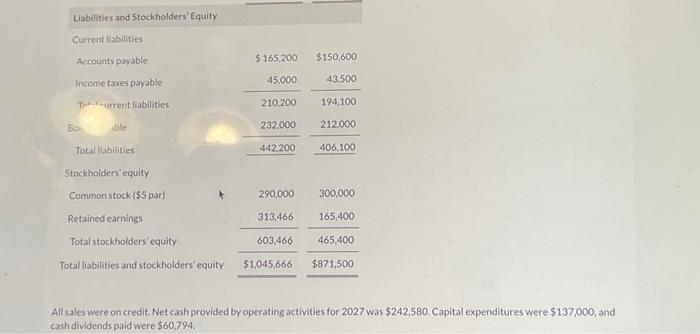

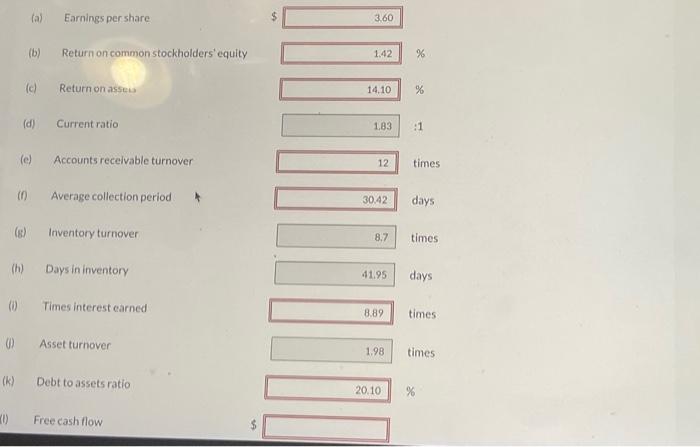

The comparative statements of Cullumber Company are presented here, Liabilities and Stockholders' Equity All sales were on credit. Net cash provided by operating activities for 2027 was $242,580. Capital expenditures were $137,000, and cash dividends paid were $60,794. (a) Earnings per share (b) Return on common stockholders' equity (c) Return on asseas (d) Current ratio (c) Accounts receivable turnover 12 times (f) Average collection period 30.42 days (8) Inventory turnover (h) Days in inventory (i) Times interest earned 8.89 times (i) Asset turnover \begin{tabular}{|r|r|} \hline 8.89 & times \\ \hline 1.98 & times \\ \hline \end{tabular} (k) Debt to assets ratio Free cash flow The comparative statements of Cullumber Company are presented here, Liabilities and Stockholders' Equity All sales were on credit. Net cash provided by operating activities for 2027 was $242,580. Capital expenditures were $137,000, and cash dividends paid were $60,794. (a) Earnings per share (b) Return on common stockholders' equity (c) Return on asseas (d) Current ratio (c) Accounts receivable turnover 12 times (f) Average collection period 30.42 days (8) Inventory turnover (h) Days in inventory (i) Times interest earned 8.89 times (i) Asset turnover \begin{tabular}{|r|r|} \hline 8.89 & times \\ \hline 1.98 & times \\ \hline \end{tabular} (k) Debt to assets ratio Free cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts