Question: PLEASE ANSWER IN TAX FORMS Decision Making Tax Forms Problem Daniel B . Butler and his spouse Freida C . Butler file a joint return.

PLEASE ANSWER IN TAX FORMS

Decision Making

Tax Forms Problem

Daniel B Butler and his spouse Freida C Butler file a joint return. The Butlers live at Oak Street in Corbin, KY Dans Social Security number is and Freidas is Dan was born on January and Freida was born on August

During Dan and Freida furnished over half of the total support of each of the following individuals, all of whom still live at home:

Gina, their daughter, age a fulltime student, who married on December has no income of her own and did not file a joint return with her husband, Casey, who earned $ during Ginas Social Security number is

Willie, their son, age graduated high school in May He is taking a leap year and will not begin college until He had gross income of $ in Willies Social Security number is

Ben, their oldest son, age is a fulltime graduate student with gross income of $ Bens Social Security number is

Dan was employed as a manager by WJJJ Inc. employer identification number Franklin Street, Corbin, KY and Freida was employed as a salesperson for Corbin Realty, Inc. employer identification number Central Street, Corbin, KY Selected information from the W forms provided by the employers is presented below. Dan and Freida use the cash method.

Line Description Dan Freida

Wages, tips, other compensation $ $

Federal income tax withheld

State income tax withheld

Freida sold a house on December and will be paid a commission of $not included in the $ reported on the W on the January closing date.

Other income as reported on forms for consisted of the following:

Dividends on CSX stock qualified $

Interest on savings at Second Bank

Interest on City of Corbin bonds

Interest on First Bank CD

The $ from First Bank was an original issue discount. Dan and Freida collected

$ on the First Bank CD that matured on September The CD was

purchased on October for $ and the yield to maturity was Dan

participated on a game show and won a cash prize of $

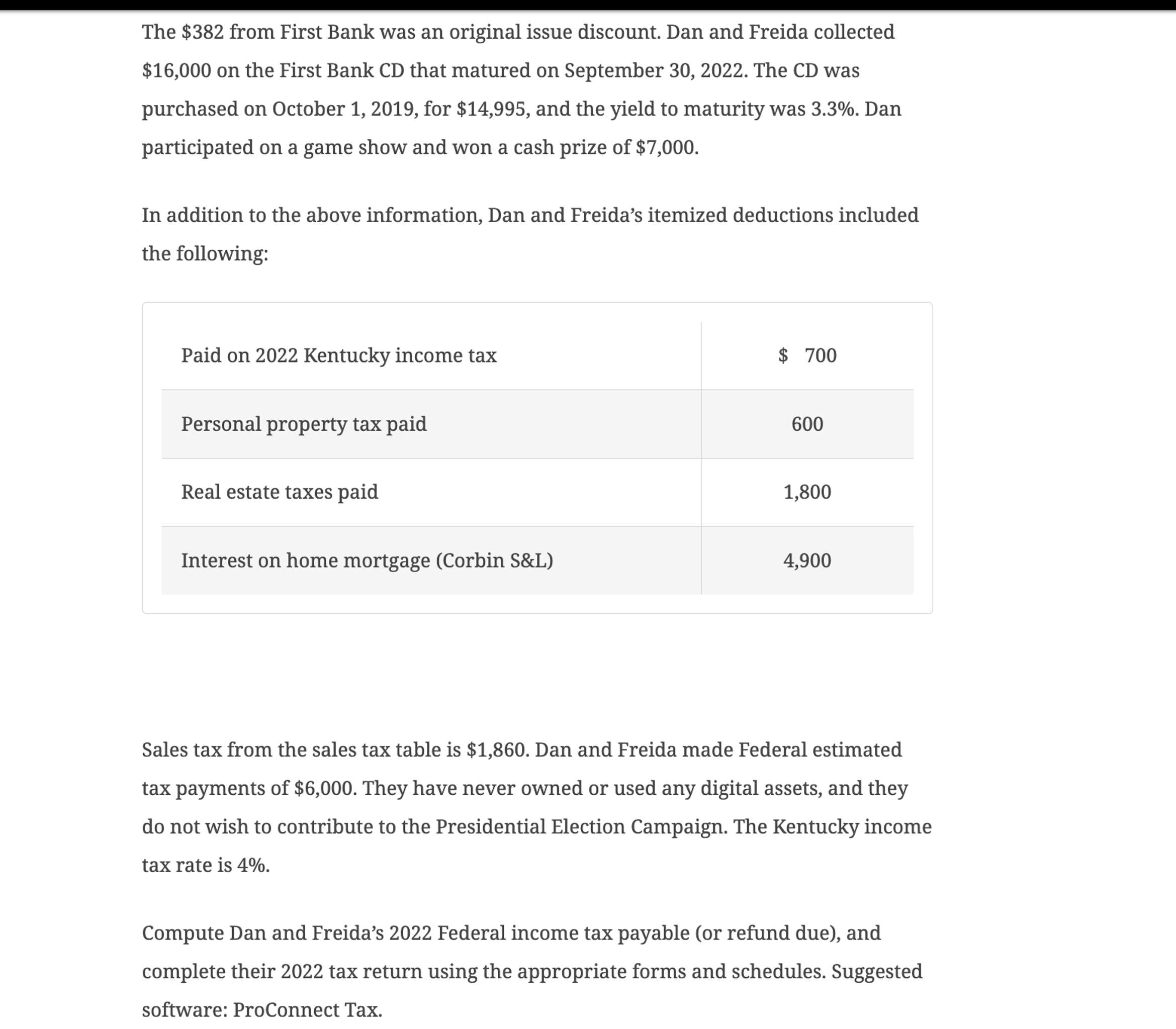

In addition to the above information, Dan and Freida's itemized deductions included

the following:

Sales tax from the sales tax table is $ Dan and Freida made Federal estimated

tax payments of $ They have never owned or used any digital assets, and they

do not wish to contribute to the Presidential Election Campaign. The Kentucky income

tax rate is

Compute Dan and Freida's Federal income tax payable or refund due and

complete their tax return using the appropriate forms and schedules. Suggested

software: ProConnect Tax.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock