Question: please answer in text so i am enabled to copy and paste > Question 22 5 pts A bond with face value $1,000 has 9

please answer in text so i am enabled to copy and paste

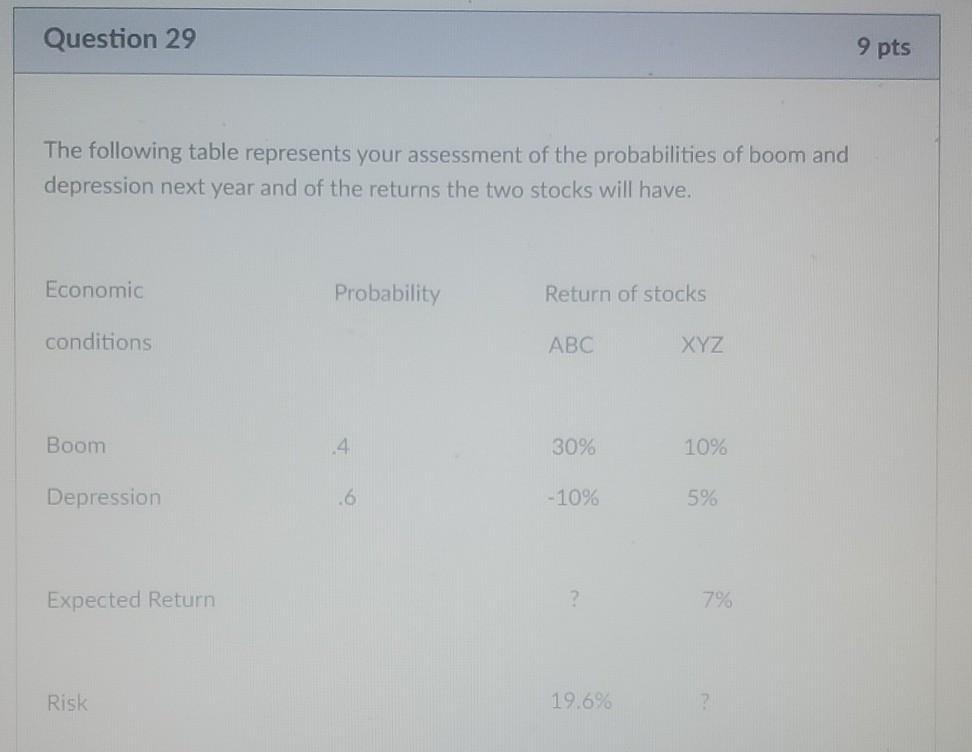

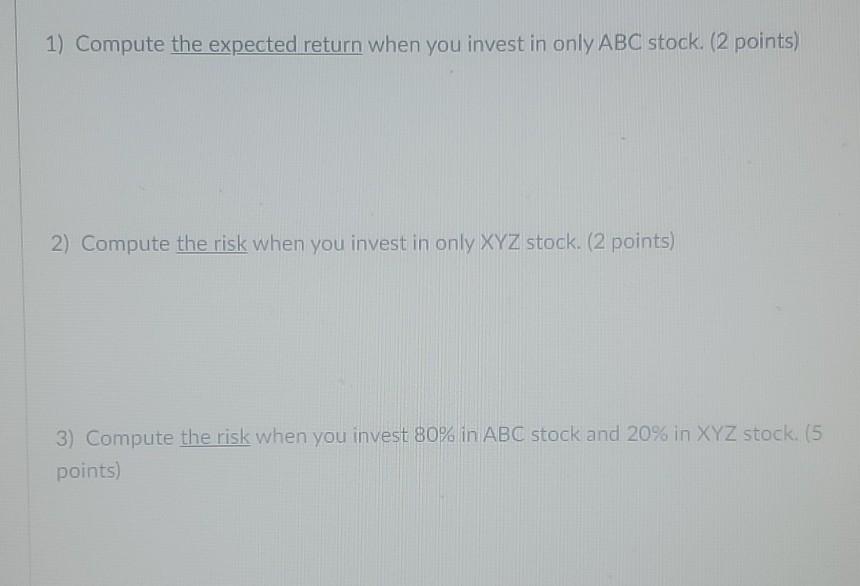

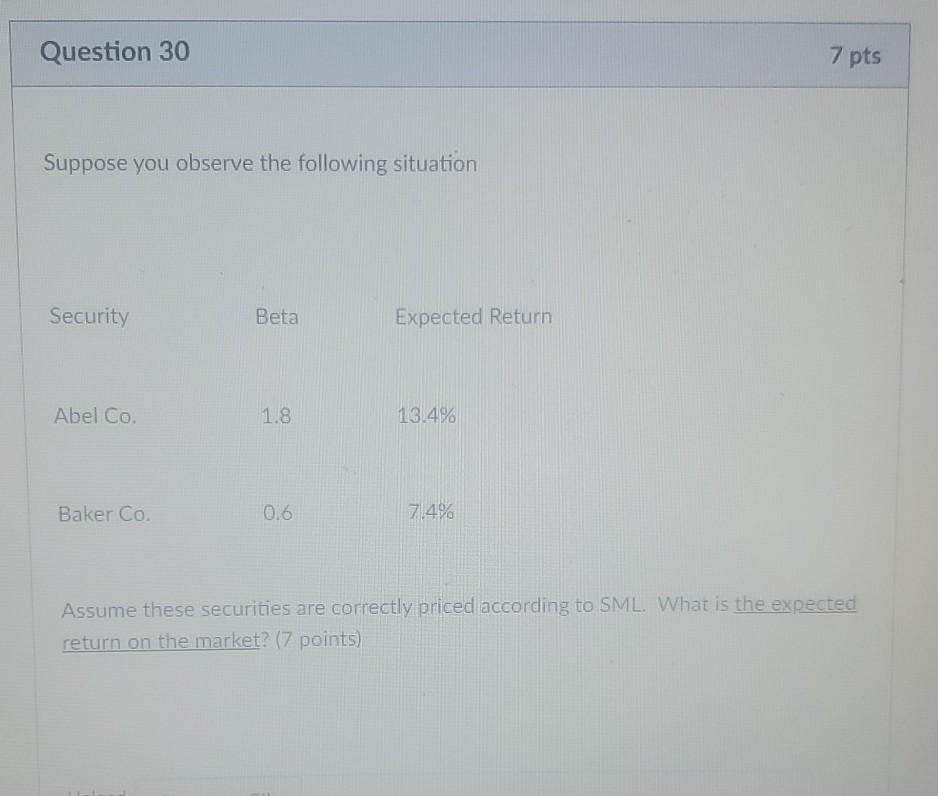

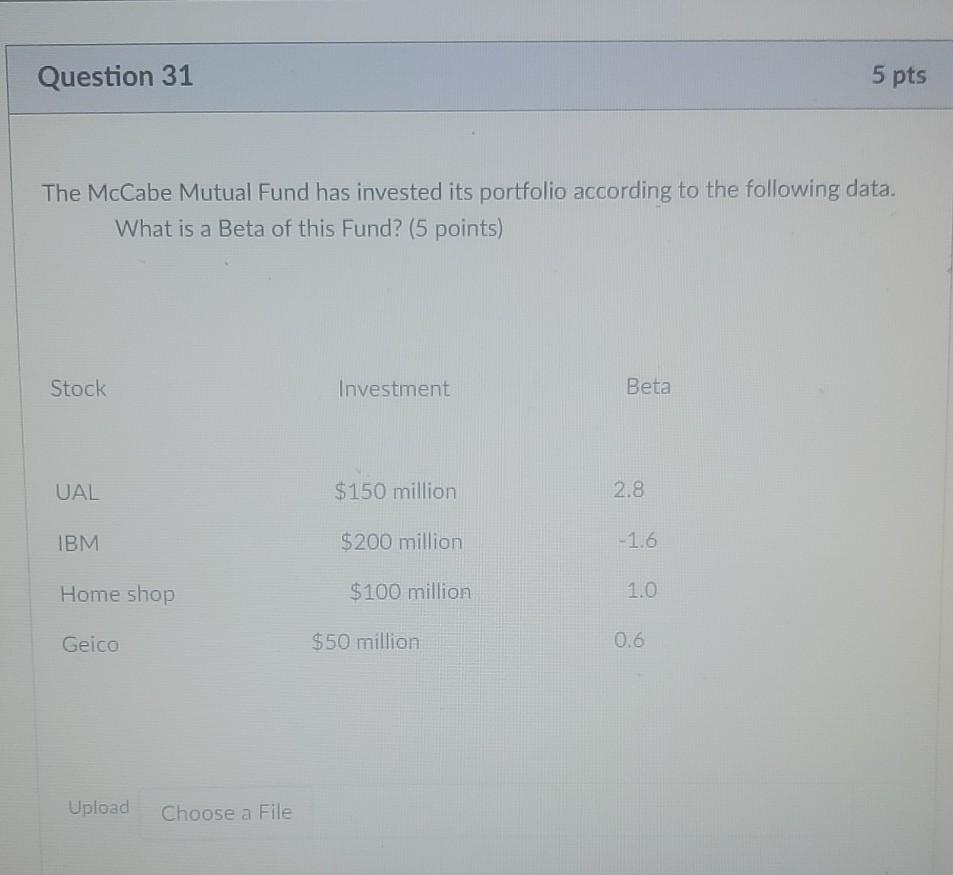

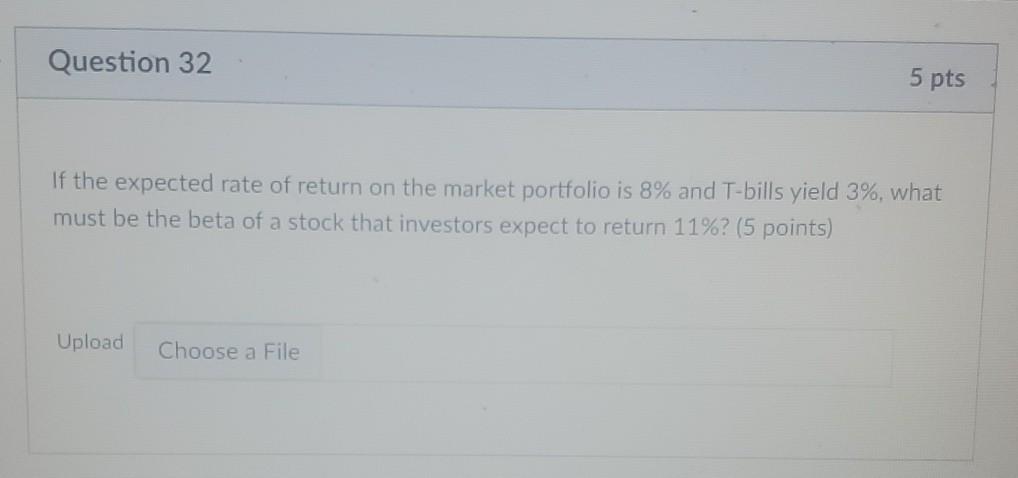

> Question 22 5 pts A bond with face value $1,000 has 9 years until maturity, a coupon rate of 6 percent, paid annually and a yield to maturity of 12 percent. What is its current yield? (5 points) Upload Choose a File Question 23 5 pts Bonds issued by the Etling Corporation have a price of $1075.36 and a coupon rate of 9 percent which is paid annually. The bonds will mature in 12 years and the face value is $1,000. What is the yield to maturity? (5 points) Upload Choose a File Question 24 5 pts Stability Corporation's dividend is expected to be $3.40 next year. Its current stock price is $68 per share. The company is a constant growth firm. If investors require a return of 11 percent on this stock, what do they think Stability's growth rate will be? (5 points) Question 25 5 pts Plug and Play Inc. is in a declining industry at a rate of 12 percent per year indefinitely. If the discount rate is 10 percent and a $2.20 per share dividend are just paid, what price do you forecast for the stock next year? (5 points) Upload Choose a File Question 26 5 pts Mercosur Inc. will pay a year-end dividend of $3.20 per share. Investors expect the dividend to grow at a rate of 6% indefinitely. If the stock currently sells for $32 per share, what is the expected rate of return on the stock? (5 points) Upload Choose a File Question 27 5 pts You buy an 12% coupon, 10-yeay bond for $940. A year later the bond price is $1,300. What is your rate of return over the year? (5 points) Upload Choose a File Question 28 7 pts Mercosur Food Company's sales is $4,800,000 and asset turnover ratio is 2. If its debt-equity ratio is 4.0, its interest payment and taxes are each $12,000, and EBIT is $114,000. what is its ROE? (7 points) Upload Choose a File Question 29 9 pts The following table represents your assessment of the probabilities of boom and depression next year and of the returns the two stocks will have. Economic Probability Return of stocks conditions ABC XYZ Boom 4 30% 10% Depression .6 -10% 5% Expected Return 7% Risk 19.6% 1) Compute the expected return when you invest in only ABC stock. (2 points) 2) Compute the risk when you invest in only XYZ stock. (2 points) 3) Compute the risk when you invest 80% in ABC stock and 20% in XYZ stock. 15 points) Question 30 7 pts Suppose you observe the following situation Security Beta Expected Return Abel Co. 1.8 13.4% Baker Co. 0.6 7.4% Assume these securities are correctly priced according to SML What is the expected return on the market? (7 points) Question 31 5 pts The McCabe Mutual Fund has invested its portfolio according to the following data. What is a Beta of this Fund? (5 points) Stock Investment Beta UAL $150 million 2.8 IBM $200 million -1.6 Home shop $100 million 1.0 Geico $50 million Upload Choose a File Question 32 5 pts If the expected rate of return on the market portfolio is 8% and T-bills yield 3%, what must be the beta of a stock that investors expect to return 11%? (5 points) Upload Choose a File Question 33 6 pts Investors expect the risk-free rate this year to be 4 percent. A stock with a beta of 1.6 has an expected rate of return of 12 percent. If the risk-free rate this year turns out to be 6 percent, what will be the rate of return on this stock? (6 points) Upload Choose a File Question 34 6 pts If the risk-free rate is 5% and the expected rate of return on the market portfolio is 11%, is a security with a beta of 1.8 and an expected return of 17% overpriced or underpriced? (6 points) Upload Choose a File

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts