Question: please answer in text. thanks! 1. Duration: There is a 7 year maturity bond that makes semiannual coupon payments and has a coupon rate of

please answer in text. thanks!

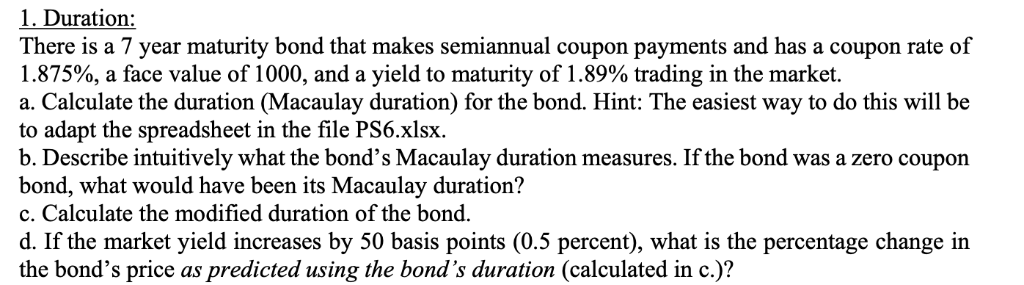

1. Duration: There is a 7 year maturity bond that makes semiannual coupon payments and has a coupon rate of 1.875%, a face value of 1000, and a yield to maturity of 1.89% trading in the market. a. Calculate the duration (Macaulay duration) for the bond. Hint: The easiest way to do this will be to adapt the spreadsheet in the file PS6.xlsx. b. Describe intuitively what the bond's Macaulay duration measures. If the bond was a zero coupon bond, what would have been its Macaulay duration? c. Calculate the modified duration of the bond. d. If the market yield increases by 50 basis points (0.5 percent), what is the percentage change in the bond's price as predicted using the bond's duration (calculated in c.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts