Question: PLEASE ANSWER IN THE NEXT 35 MINS OR DONT BOTHER ANSWERING You are thinking of making an investment in a new factory. The factory will

PLEASE ANSWER IN THE NEXT 35 MINS OR DONT BOTHER ANSWERING

PLEASE ANSWER IN THE NEXT 35 MINS OR DONT BOTHER ANSWERING

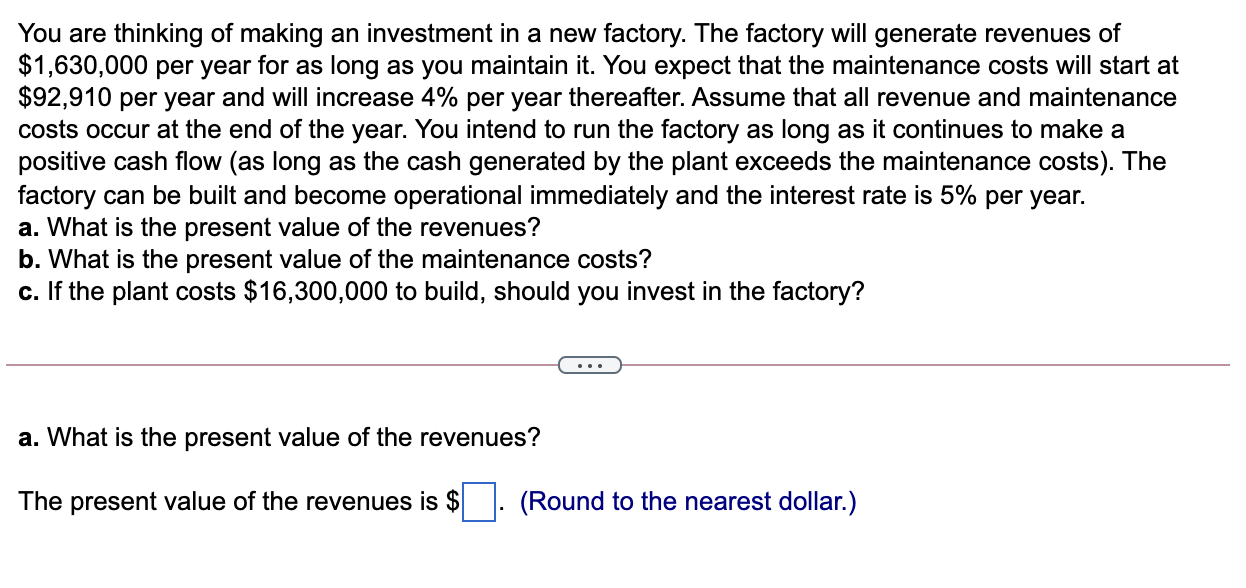

You are thinking of making an investment in a new factory. The factory will generate revenues of $1,630,000 per year for as long as you maintain it. You expect that the maintenance costs will start at $92,910 per year and will increase 4% per year thereafter. Assume that all revenue and maintenance costs occur at the end of the year. You intend to run the factory as long as it continues to make a positive cash flow (as long as the cash generated by the plant exceeds the maintenance costs). The factory can be built and become operational immediately and the interest rate is 5% per year. a. What is the present value of the revenues? b. What is the present value of the maintenance costs? c. If the plant costs $16,300,000 to build, should you invest in the factory? a. What is the present value of the revenues? The present value of the revenues is $. (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts