Question: Please answer in the same format as the second picture D3 fx 1 Question Discoverit! Company will pay $1 dividend payment and growth rate will

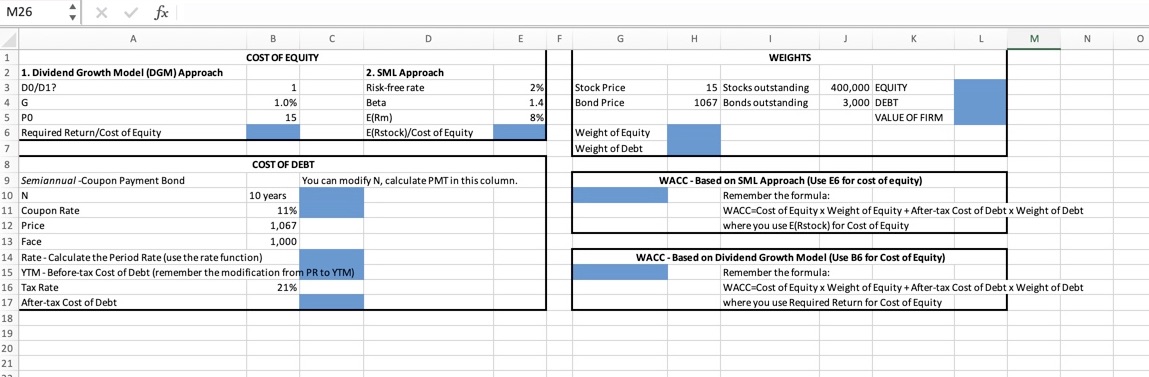

Please answer in the same format as the second picture

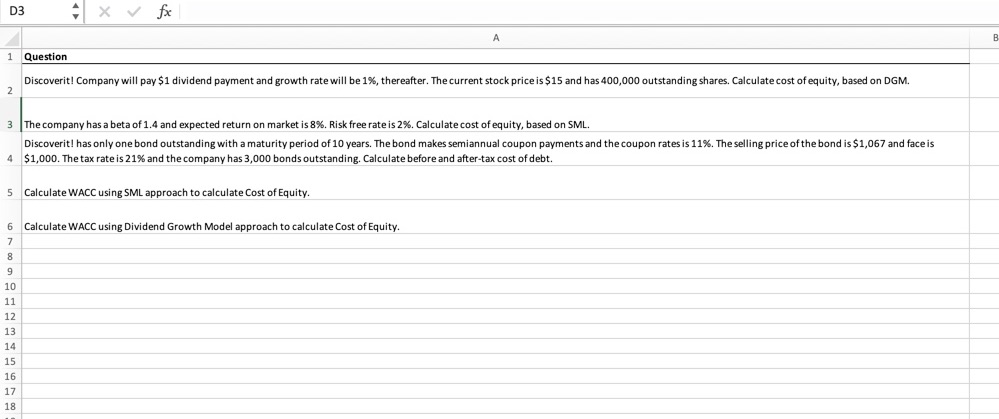

D3 fx 1 Question Discoverit! Company will pay $1 dividend payment and growth rate will be 1%, thereafter. The current stock price is $15 and has 400,000 outstanding shares. Calculate cost of equity, based on DGM. 3 The company has a beta of 1.4 and expected return on market is 8%. Risk free rate is 2%. Calculate cost of equity, based on SML. Discoverit! has only one bond outstanding with a maturity period of 10 years. The bond makes semiannual coupon payments and the coupon rates is 11%. The selling price of the bond is $1,067 and face is 4$1,000. The tax rate is 21% and the company has 3,000 bonds outstanding. Calculate before and after-tax cost of debt. 5 Calculate WACC using SML approach to calculate Cost of Equity. 6 Calculate WACC using Dividend Growth Model approach to calculate Cost of Equity. 7 8 9 10 11 12 13 14 15 16 17 18 D3 fx 1 Question Discoverit! Company will pay $1 dividend payment and growth rate will be 1%, thereafter. The current stock price is $15 and has 400,000 outstanding shares. Calculate cost of equity, based on DGM. 3 The company has a beta of 1.4 and expected return on market is 8%. Risk free rate is 2%. Calculate cost of equity, based on SML. Discoverit! has only one bond outstanding with a maturity period of 10 years. The bond makes semiannual coupon payments and the coupon rates is 11%. The selling price of the bond is $1,067 and face is 4$1,000. The tax rate is 21% and the company has 3,000 bonds outstanding. Calculate before and after-tax cost of debt. 5 Calculate WACC using SML approach to calculate Cost of Equity. 6 Calculate WACC using Dividend Growth Model approach to calculate Cost of Equity. 7 8 9 10 11 12 13 14 15 16 17 18

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts