Question: Please answer in type written please. Q. No. 1- Pat Middleton owns a non-depreciable capital asset that originally cost $20,000 and is now worth $80,000.

Please answer in type written please.

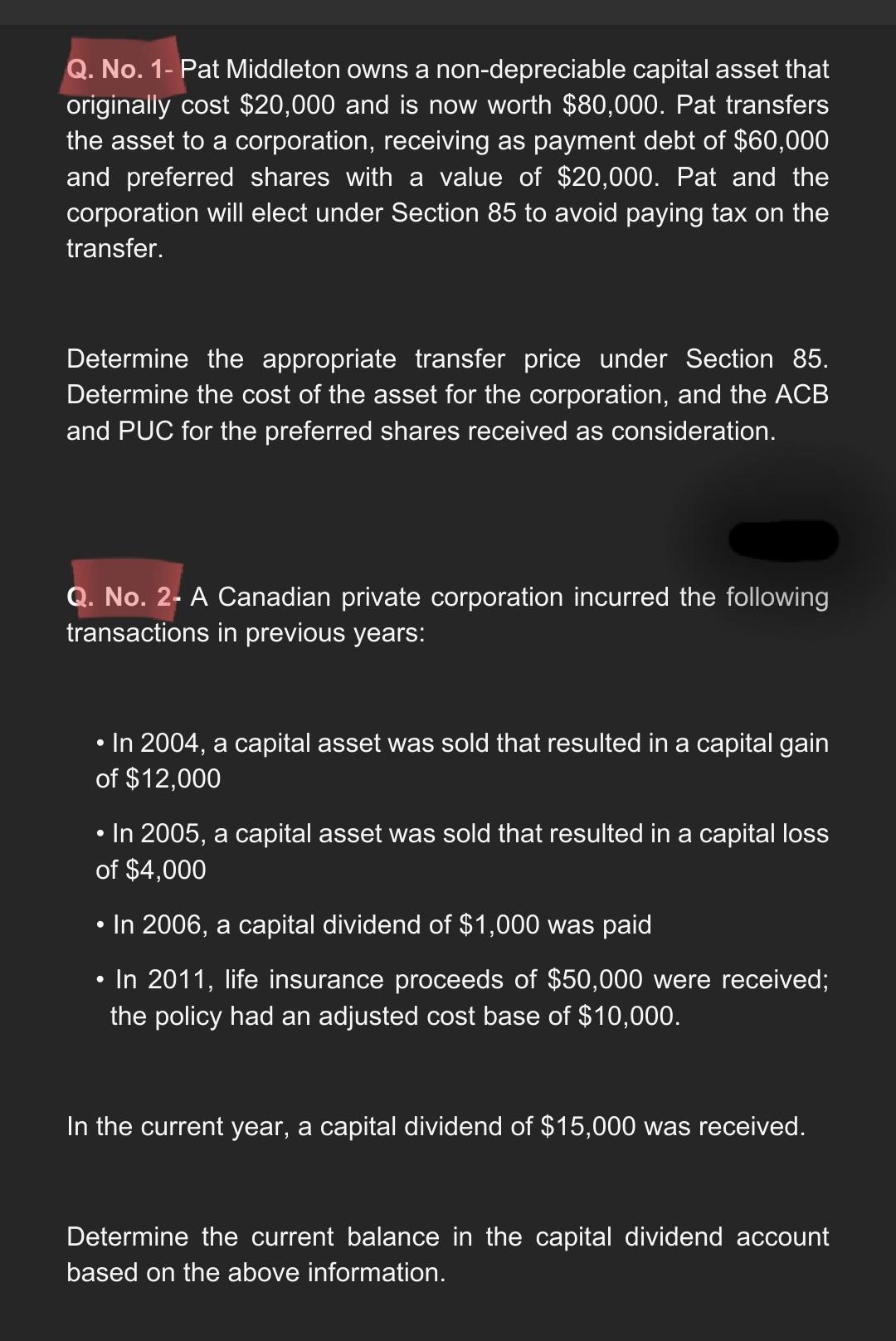

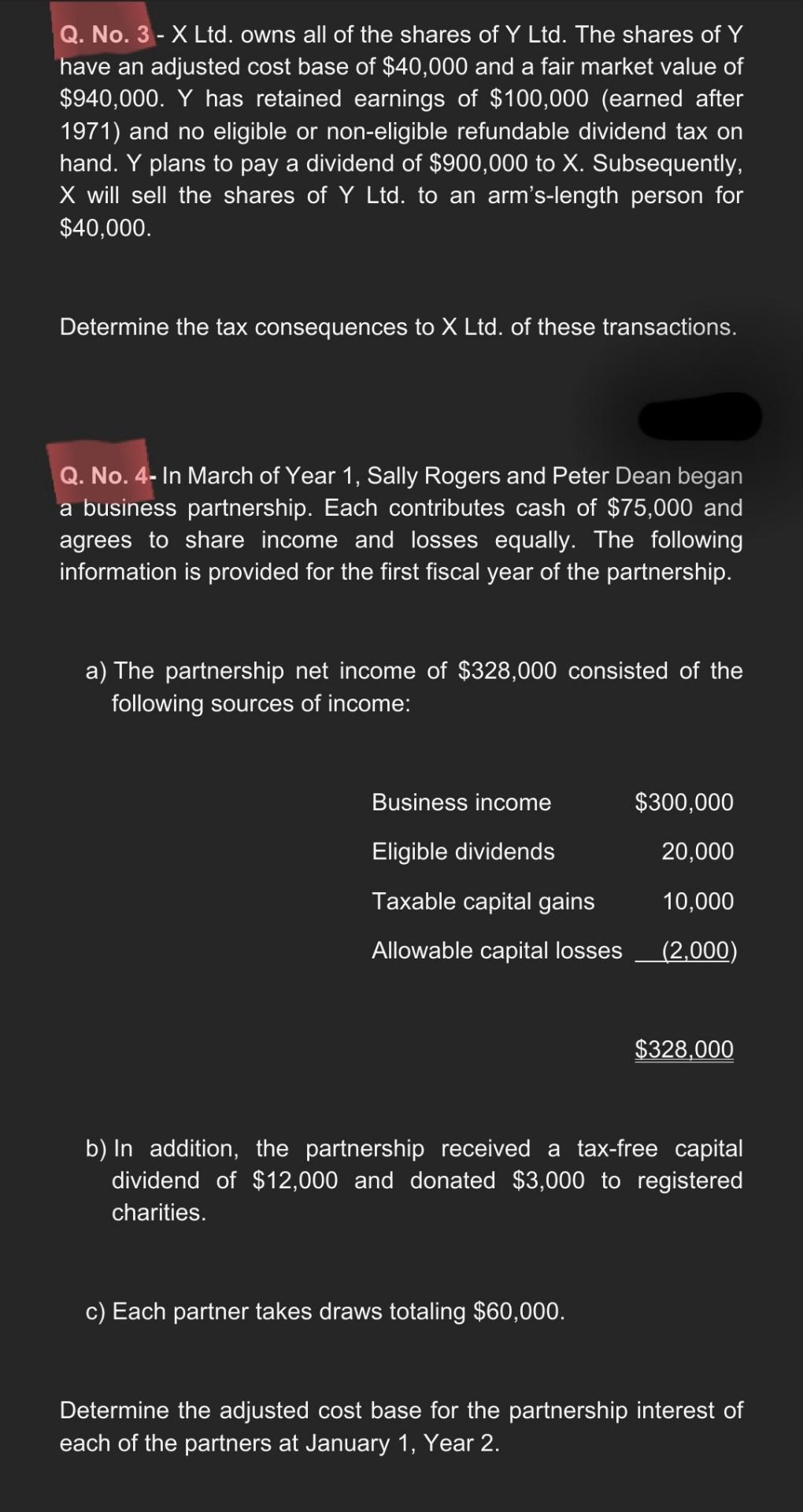

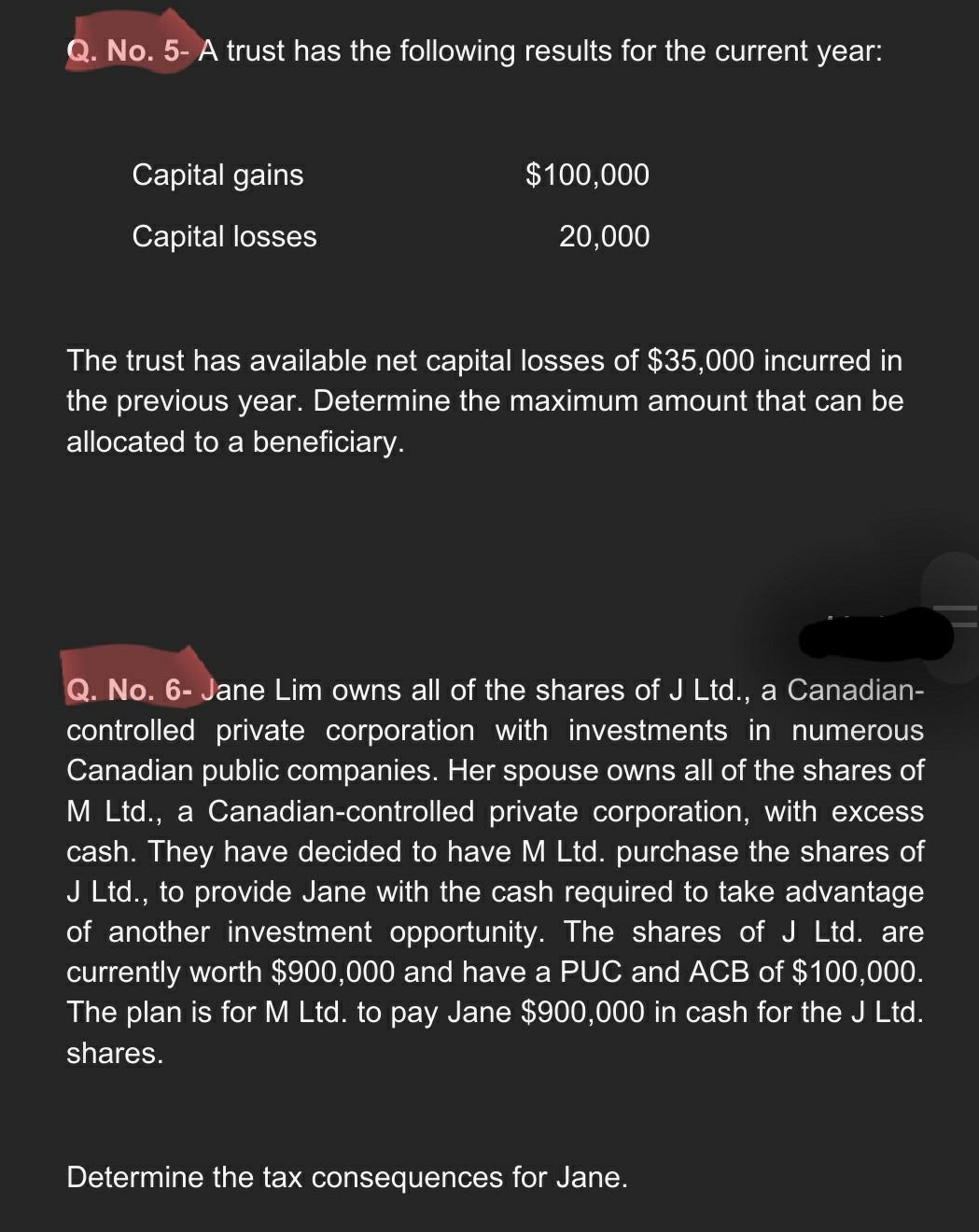

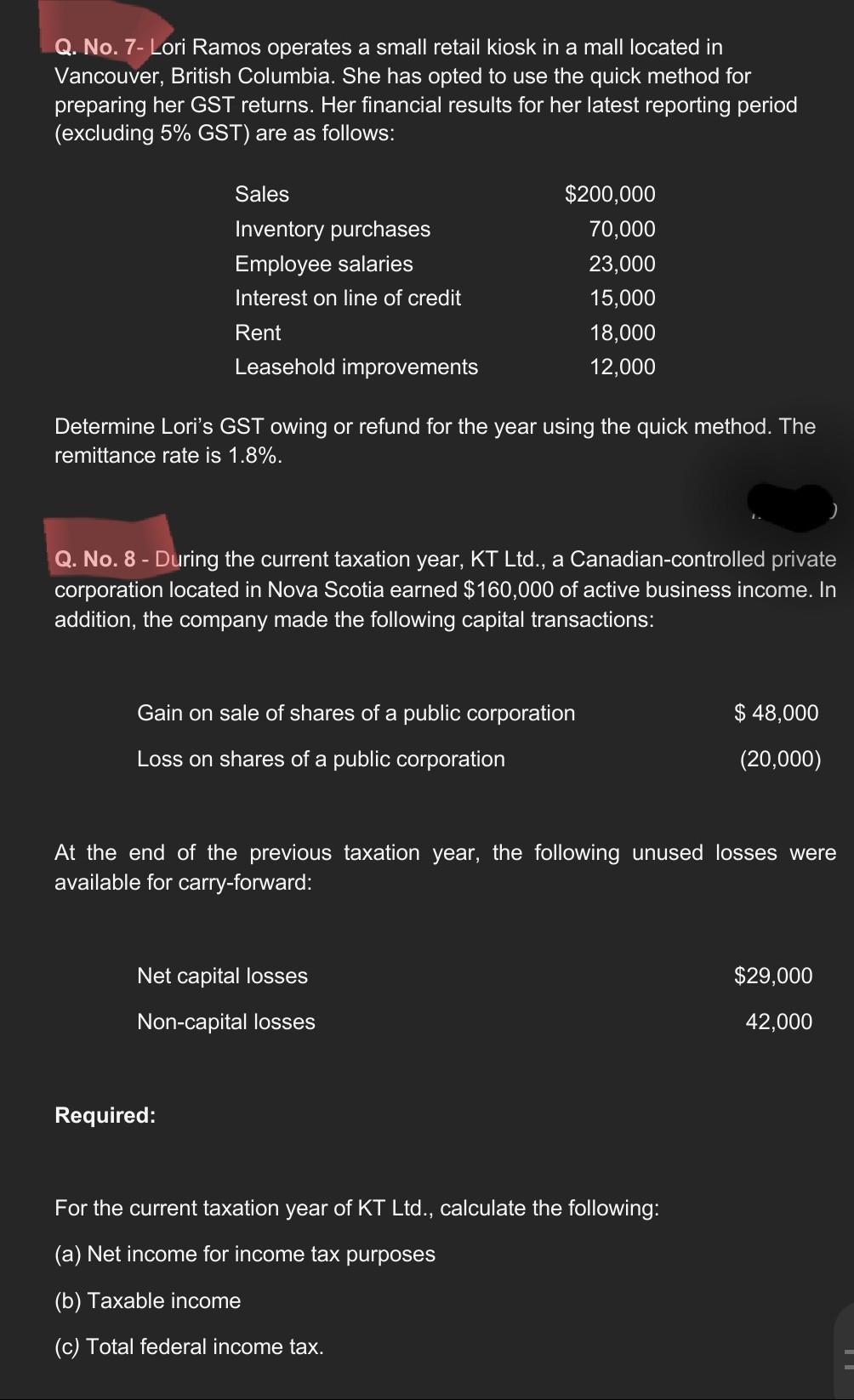

Q. No. 1- Pat Middleton owns a non-depreciable capital asset that originally cost $20,000 and is now worth $80,000. Pat transfers the asset to a corporation, receiving as payment debt of $60,000 and preferred shares with a value of $20,000. Pat and the corporation will elect under Section 85 to avoid paying tax on the transfer. Determine the appropriate transfer price under Section 85. Determine the cost of the asset for the corporation, and the ACB and PUC for the preferred shares received as consideration. Q. No. 2- A Canadian private corporation incurred the following transactions in previous years: In 2004, a capital asset was sold that resulted in a capital gain of $12,000 In 2005, a capital asset was sold that resulted in a capital loss of $4,000 . In 2006, a capital dividend of $1,000 was paid In 2011, life insurance proceeds of $50,000 were received; the policy had an adjusted cost base of $10,000. In the current year, a capital dividend of $15,000 was received. Determine the current balance in the capital dividend account based on the above information. Q. No. 3 - X Ltd. owns all of the shares of Y Ltd. The shares of Y have an adjusted cost base of $40,000 and a fair market value of $940,000. Y has retained earnings of $100,000 (earned after 1971) and no eligible or non-eligible refundable dividend tax on hand. Y plans to pay a dividend of $900,000 to X. Subsequently, X will sell the shares of Y Ltd. to an arm's-length person for $40,000. Determine the tax consequences to X Ltd. of these transactions. Q. No. 4- In March of Year 1, Sally Rogers and Peter Dean began a business partnership. Each contributes cash of $75,000 and agrees to share income and losses equally. The following information is provided for the first fiscal year of the partnership. a) The partnership net income of $328,000 consisted of the following sources of income: Business income $300,000 Eligible dividends 20,000 Taxable capital gains 10,000 Allowable capital losses (2,000) $328,000 b) In addition, the partnership received a tax-free capital dividend of $12,000 and donated $3,000 to registered charities. c) Each partner takes draws totaling $60,000. Determine the adjusted cost base for the partnership interest of each of the partners at January 1, Year 2. Q. No. 5- A trust has the following results for the current year: Capital gains $100,000 Capital losses 20,000 The trust has available net capital losses of $35,000 incurred in the previous year. Determine the maximum amount that can be allocated to a beneficiary. 1 Q. No. 6-Jane Lim owns all of the shares of J Ltd., a Canadian- controlled private corporation with investments in numerous Canadian public companies. Her spouse owns all of the shares of M Ltd., a Canadian-controlled private corporation, with excess cash. They have decided to have M Ltd. purchase the shares of J Ltd., to provide Jane with the cash required to take advantage of another investment opportunity. The shares of J Ltd. are currently worth $900,000 and have a PUC and ACB of $100,000. The plan is for M Ltd. to pay Jane $900,000 in cash for the J Ltd. shares. Determine the tax consequences for Jane. Q. No. 7- Lori Ramos operates a small retail kiosk in a mall located in Vancouver, British Columbia. She has opted to use the quick method for preparing her GST returns. Her financial results for her latest reporting period (excluding 5% GST) are as follows: Sales Inventory purchases Employee salaries Interest on line of credit Rent Leasehold improvements $200,000 70,000 23,000 15,000 18,000 12,000 Determine Lori's GST owing or refund for the year using the quick method. The remittance rate is 1.8%. Q. No. 8 - During the current taxation year, KT Ltd., a Canadian-controlled private corporation located in Nova Scotia earned $160,000 of active business income. In addition, the company made the following capital transactions: Gain on sale of shares of a public corporation $ 48,000 Loss on shares of a public corporation (20,000) At the end of the previous taxation year, the following unused losses were available for carry-forward: Net capital losses $29,000 Non-capital losses 42,000 Required: For the current taxation year of KT Ltd., calculate the following: (a) Net income for income tax purposes (b) Taxable income (c) Total federal income tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts