Question: please answer it 6 Please note that Present Value Tables are attached at the end of this exam for your reference. Question 1 (25 marks)

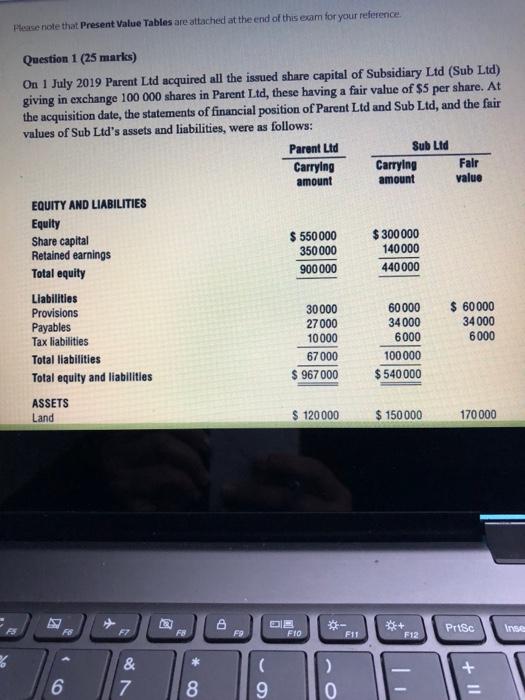

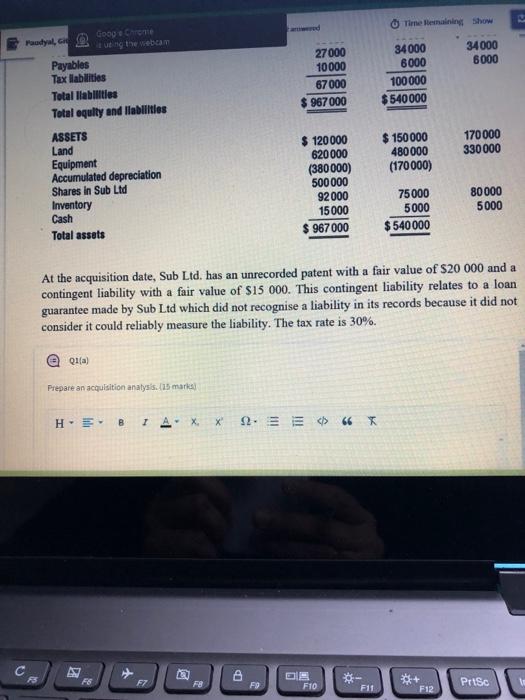

6 Please note that Present Value Tables are attached at the end of this exam for your reference. Question 1 (25 marks) On 1 July 2019 Parent Ltd acquired all the issued share capital of Subsidiary Ltd (Sub Ltd) giving in exchange 100 000 shares in Parent Ltd, these having a fair value of $5 per share. At the acquisition date, the statements of financial position of Parent Ltd and Sub Ltd, and the fair values of Sub Ltd's assets and liabilities, were as follows: Parent Ltd Sub Ltd Carrying Carrying Fair value amount amount EQUITY AND LIABILITIES Equity Share capital $ 550 000 $300 000 Retained earnings 350 000 140000 Total equity 900 000 440000 Liabilities Provisions 30000 60 000 $ 60000 Payables 27 000 34.000 34000 6000 Tax liabilities 10000 6000 Total liabilities 67 000 100000 Total equity and liabilities $ 967 000 $540000 ASSETS Land $ 120000 $ 150 000 170 000 F12 2 6 & 7 E FB 8 8 F9 ( 9 OB F10 ) 0 F11 PrtSc +11 Inse Time Remaining Show Goog's Chrome it using the webcam 27000 34000 Payables 10000 6000 Tax liabilities 67 000 Total liabilities Total equity and liabilities $967000 ASSETS 170000 $120000 Land 620000 330000 Equipment Accumulated depreciation Shares in Sub Ltd (380000) 500 000 Inventory 92000 80000 Cash 15 000 5000 5000 Total assets 967000 $540000 At the acquisition date, Sub Ltd. has an unrecorded patent with a fair value of $20 000 and a contingent liability with a fair value of $15 000. This contingent liability relates to a loan guarantee made by Sub Ltd which did not recognise a liability in its records because it did not consider it could reliably measure the liability. The tax rate is 30%. Q1(a) Prepare an acquisition analysis. (15 marks) H-E- B I A X. X' 2. >> 66 X E a OR F11 Paudyal, Gi FS F6 F7 F8 D F9 F10 34000 6000 100000 $540000 $150000 480000 (170 000) 75000 F12 PrtSc V FS Unanswered Q1(b) Record the business combination valuation journal entries. (10 marks) H. E. B I ' x x Unanswered. P F6 F7 50 8 LP 00 6 Please note that Present Value Tables are attached at the end of this exam for your reference. Question 1 (25 marks) On 1 July 2019 Parent Ltd acquired all the issued share capital of Subsidiary Ltd (Sub Ltd) giving in exchange 100 000 shares in Parent Ltd, these having a fair value of $5 per share. At the acquisition date, the statements of financial position of Parent Ltd and Sub Ltd, and the fair values of Sub Ltd's assets and liabilities, were as follows: Parent Ltd Sub Ltd Carrying Carrying Fair value amount amount EQUITY AND LIABILITIES Equity Share capital $ 550 000 $300 000 Retained earnings 350 000 140000 Total equity 900 000 440000 Liabilities Provisions 30000 60 000 $ 60000 Payables 27 000 34.000 34000 6000 Tax liabilities 10000 6000 Total liabilities 67 000 100000 Total equity and liabilities $ 967 000 $540000 ASSETS Land $ 120000 $ 150 000 170 000 F12 2 6 & 7 E FB 8 8 F9 ( 9 OB F10 ) 0 F11 PrtSc +11 Inse Time Remaining Show Goog's Chrome it using the webcam 27000 34000 Payables 10000 6000 Tax liabilities 67 000 Total liabilities Total equity and liabilities $967000 ASSETS 170000 $120000 Land 620000 330000 Equipment Accumulated depreciation Shares in Sub Ltd (380000) 500 000 Inventory 92000 80000 Cash 15 000 5000 5000 Total assets 967000 $540000 At the acquisition date, Sub Ltd. has an unrecorded patent with a fair value of $20 000 and a contingent liability with a fair value of $15 000. This contingent liability relates to a loan guarantee made by Sub Ltd which did not recognise a liability in its records because it did not consider it could reliably measure the liability. The tax rate is 30%. Q1(a) Prepare an acquisition analysis. (15 marks) H-E- B I A X. X' 2. >> 66 X E a OR F11 Paudyal, Gi FS F6 F7 F8 D F9 F10 34000 6000 100000 $540000 $150000 480000 (170 000) 75000 F12 PrtSc V FS Unanswered Q1(b) Record the business combination valuation journal entries. (10 marks) H. E. B I ' x x Unanswered. P F6 F7 50 8 LP 00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts