Question: Please answer it as soon as possible Ravsten Company uses a job-order costing system. On January 1, the beginning of the current year, the company's

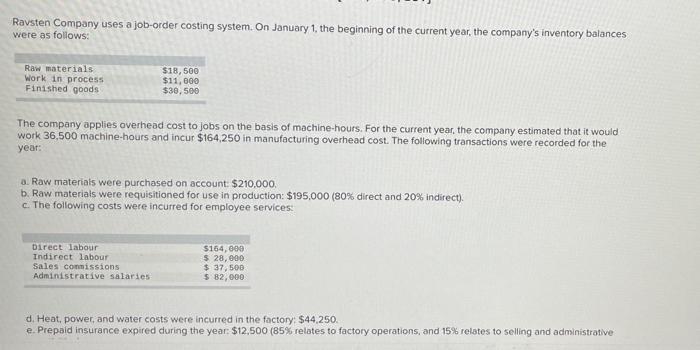

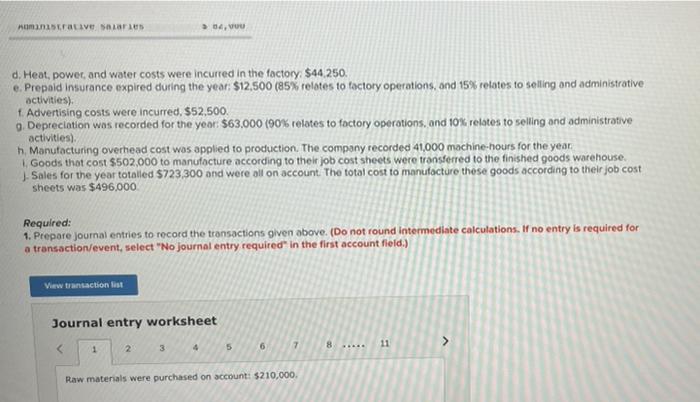

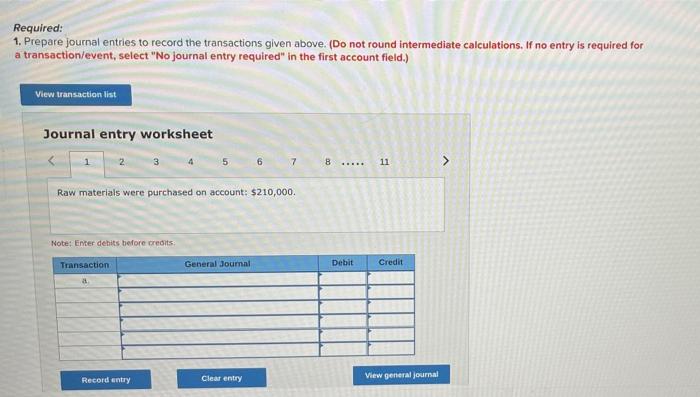

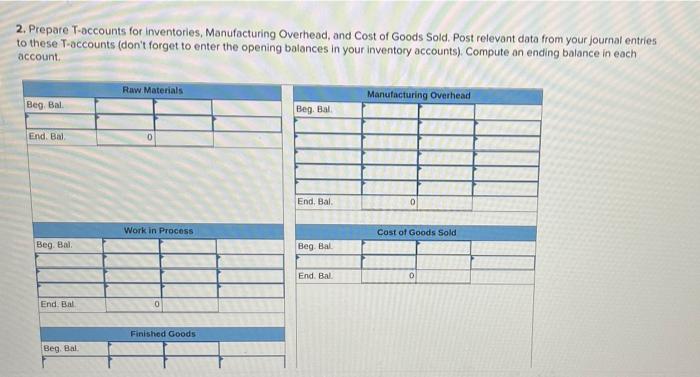

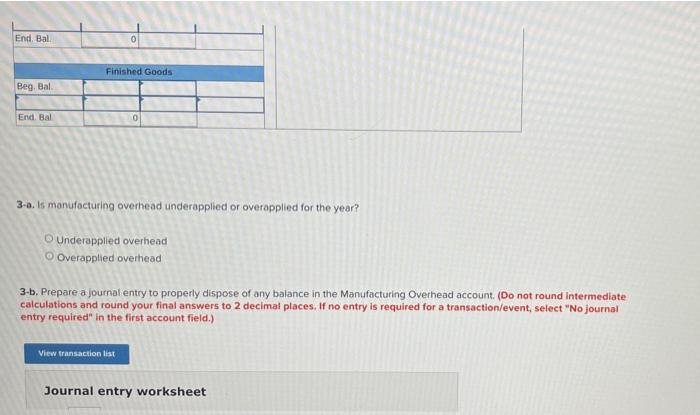

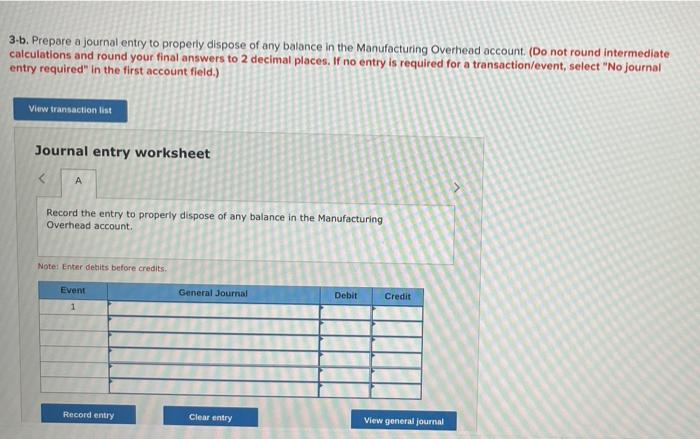

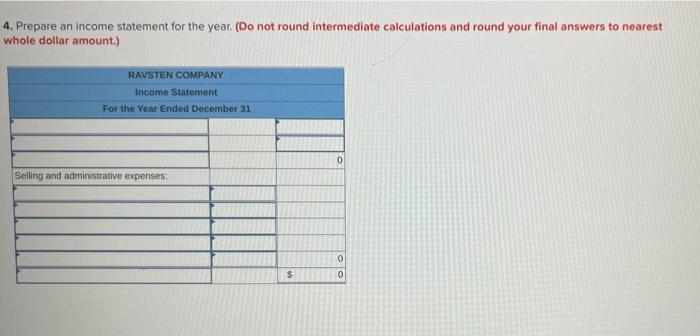

Ravsten Company uses a job-order costing system. On January 1, the beginning of the current year, the company's inventory balances were as follows: Raw materials Work in process Finished goods $18,500 $11,000 $30, 500 The company applies overhead cost to jobs on the basis of machine-hours. For the current year, the company estimated that it would work 36,500 machine-hours and incur $164,250 in manufacturing overhead cost. The following transactions were recorded for the year: a. Raw materials were purchased on account: $210,000. b. Raw materials were requisitioned for use in production: $195,000 (80% direct and 20% indirect). c. The following costs were incurred for employee services: Direct labour Indirect labour $164,000 $ 28,000 Sales commissions $ 37,500 Administrative salaries $ 82,000 d. Heat, power, and water costs were incurred in the factory: $44,250. e. Prepaid insurance expired during the year: $12,500 (85% relates to factory operations, and 15% relates to selling and administrative Auministrative salaries 04, VOU d. Heat, power, and water costs were incurred in the factory: $44,250. e. Prepaid insurance expired during the year: $12.500 (85% relates to factory operations, and 15% relates to selling and administrative activities). f. Advertising costs were incurred, $52,500. g. Depreciation was recorded for the year: $63,000 (90% relates to factory operations, and 10% relates to selling and administrative activities). h. Manufacturing overhead cost was applied to production. The company recorded 41,000 machine-hours for the year. i, Goods that cost $502,000 to manufacture according to their job cost sheets were transferred to the finished goods warehouse. J-Sales for the year totalled $723,300 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $496,000 Required: und intermediate calculations. If no entry is required for 1. Prepare journal entries to record the transactions given above. (Do not a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8.... 11 Raw materials were purchased on account: $210,000. Required: 1. Prepare journal entries to record the transactions given above. (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 6 7 8 ..... 11 Raw materials were purchased on account: $210,000. Note: Enter debits before credits Transaction. General Journal Debit Clear entry Record entry Credit View general journal 2. Prepare T-accounts for inventories, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don't forget to enter the opening balances in your inventory accounts). Compute an ending balance in each account. TATAVA Raw Materials Manufacturing Overhead Beg. Bal. Beg. Bal End. Bal. 0 End. Bal. 0 Work in Process Cost of Goods Sold Beg. Bal End. Bal 0 0 Finished Goods Beg. Bal. End. Bal Beg. Bal. End. Bal. 0 Finished Goods Beg. Bal. End. Bal 0 3-a. Is manufacturing overhead underapplied or overapplied for the year? OUnderapplied overhead O Overapplied overhead 3-b. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account. (Do not round intermediate calculations and round your final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 3-b. Prepare a journal entry to properly dispose of any balance in the Manufacturing Overhead account. (Do not round intermediate calculations and round your final answers to 2 decimal places. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts