Question: Please answer it ASAP the due date after 12 hours from now. I posted the same question 2 days ago and no expert answered it.

Please answer it ASAP the due date after 12 hours from now.

Please answer it ASAP the due date after 12 hours from now.

I posted the same question 2 days ago and no expert answered it.

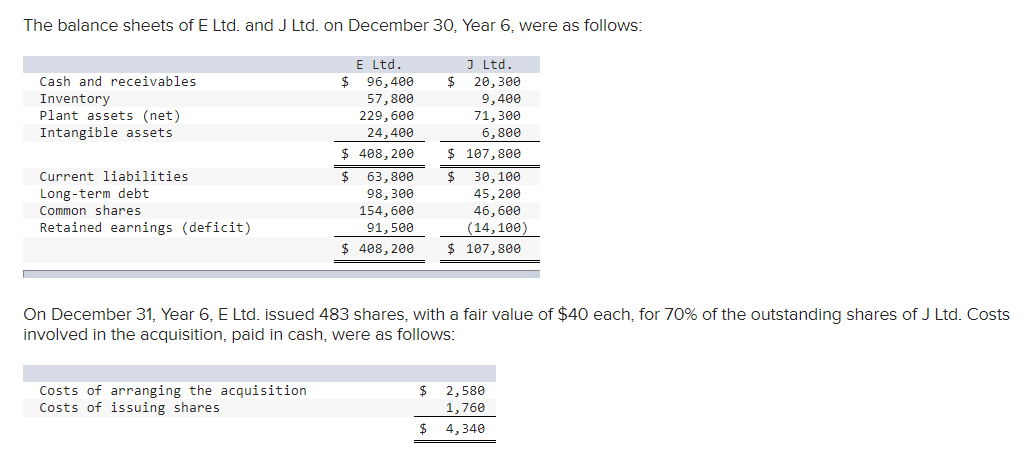

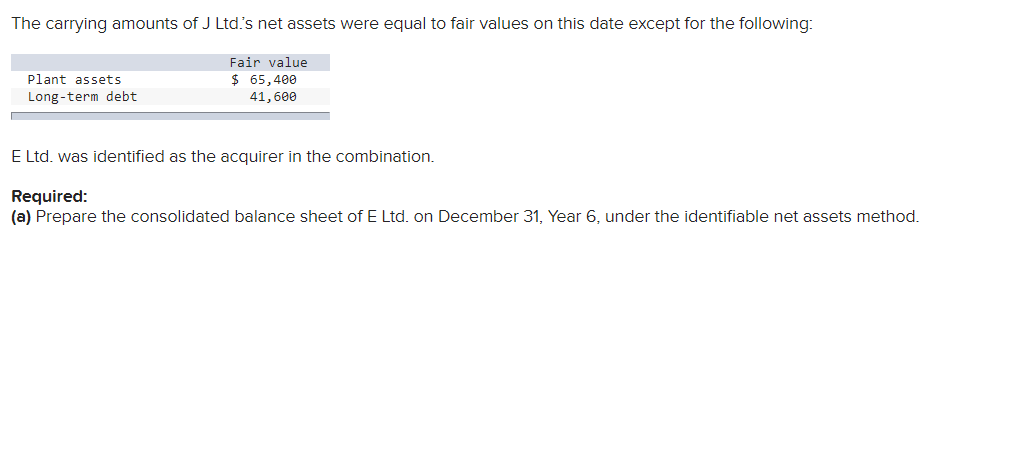

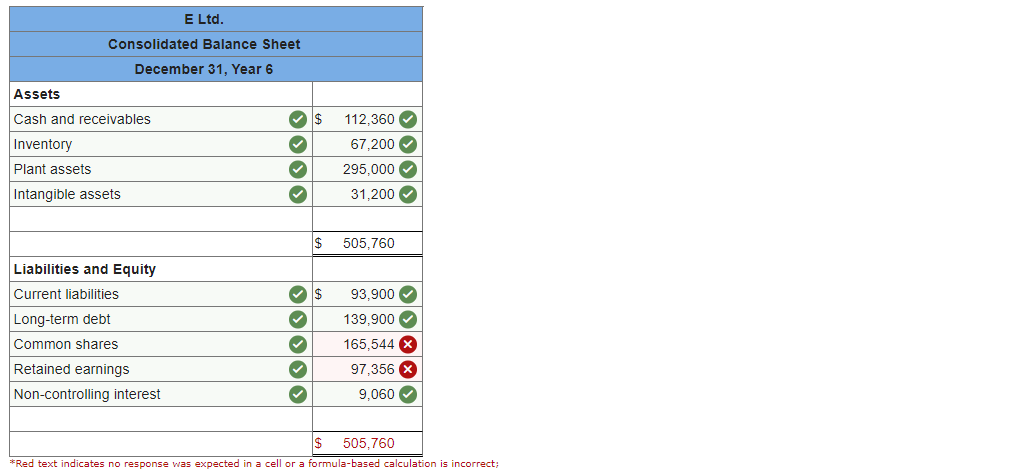

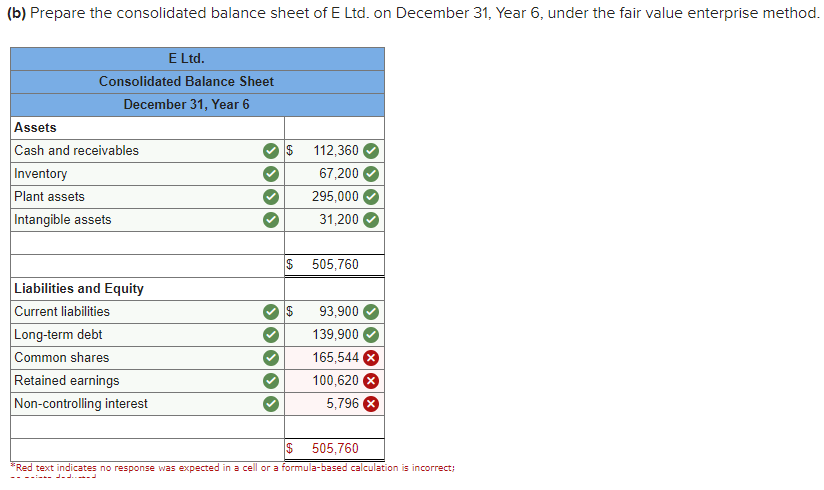

The balance sheets of E Ltd. and J Ltd. on December 30, Year 6, were as follows: Cash and receivables Inventory Plant assets (net) Intangible assets E Ltd. $ 96,400 57,800 229,600 24,400 $ 408,200 63,800 98,300 154,600 91,500 $ 408,200 J Ltd. $ 20,300 9,400 71,300 6,800 $ 107,800 $ 30, 100 45,200 46,600 (14,100 $ 107,800 Current liabilities Long-term debt Common shares Retained earnings (deficit) On December 31, Year 6, E Ltd. issued 483 shares, with a fair value of $40 each, for 70% of the outstanding shares of J Ltd. Costs involved in the acquisition, paid in cash, were as follows: Costs of arranging the acquisition Costs of issuing shares $ 2,580 1,76 $ 4,340 The carrying amounts of J Ltd.'s net assets were equal to fair values on this date except for the following: Plant assets Long-term debt Fair value $ 65,400 41,600 E Ltd. was identified as the acquirer in the combination. Required: (a) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the identifiable net assets method. E Ltd. Consolidated Balance Sheet December 31, Year 6 Assets Cash and receivables Inventory Plant assets Intangible assets OOOO 112,360 67,200 295,000 31.200 $ 505,760 $ Liabilities and Equity Current liabilities Long-term debt Common shares Retained earnings Non-controlling interest OOOOO 93,900 139,900 165,544 X 97,356 9,060 3 $ 505,760 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; (b) Prepare the consolidated balance sheet of E Ltd. on December 31, Year 6, under the fair value enterprise method. E Ltd. Consolidated Balance Sheet December 31, Year 6 Assets Cash and receivables Inventory Plant assets Intangible assets $ 112,360 67,200 295,000 31,200 $ 505,760 $ Liabilities and Equity Current liabilities Long-term debt Common shares Retained earnings Non-controlling interest 93,900 139,900 165,544 100,620 X 5,796 > $ 505,760 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts