Question: Please answer it ASP Thank you ! Suppose that, based on historical data, it has determined that the expected change in the value of the

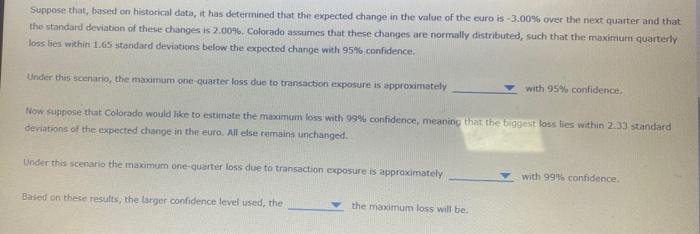

Suppose that, based on historical data, it has determined that the expected change in the value of the curo is -3.00% over the next quarter and that the standard deviation of these changes is 2.00%. Colorado assumes that these changes are normally distributed, such that the maximum quarterly loss lies within 1.65 standard deviations below the expected change with 95% confidence. Under this scenario, the maximum one quarter loss due to transaction exposure is approximately with 95% confidence Now suppose that Colorado would like to estimate the maximum loss with 99% confidence, meaning that the biggest loss lies within 2.33 standard deviations of the expected change in the euro. All else remains unchanged. Under this scenario the maximum one-quarter loss due to transaction exposure is approximately with 99% confidence. Based on these results, the larger confidence level used, the the maximum loss will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts