Question: please answer it clearly for every part Assume that ABC Inc. has a single asset with a historical cost of $100 and accumulated amortization of

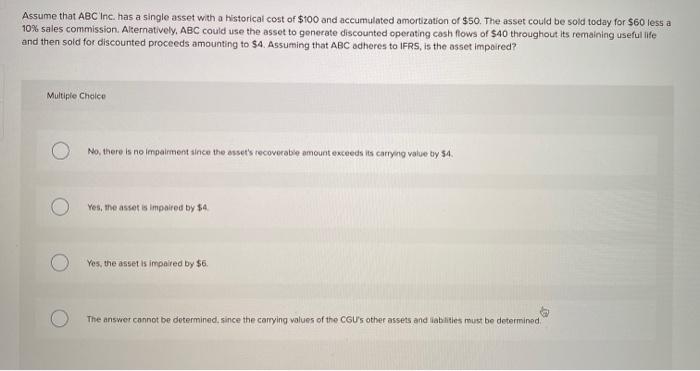

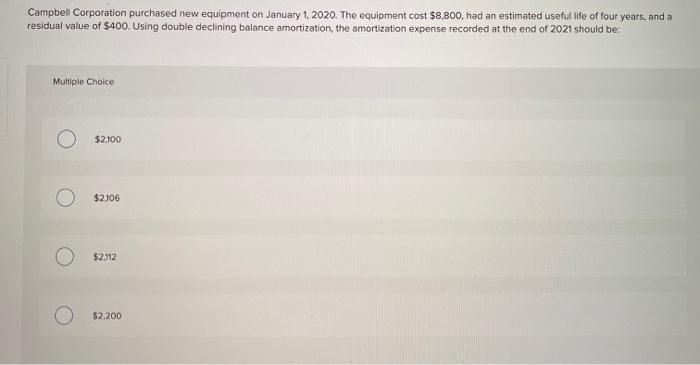

Assume that ABC Inc. has a single asset with a historical cost of $100 and accumulated amortization of $50. The asset could be sold today for $60 less a 10% sales commission. Alternatively, ABC could use the asset to generate discounted operating cash flows of $40 throughout its remaining useful life and then sold for discounted proceeds amounting to $4. Assuming that ABC adheres to IFRS, is the asset impaired? Multiple Choice No, there is no impairment since the esset's recoverable amount exceeds its carrying value by $4. Yes, the asset is impaired by $4 Yes, the asset is impaired by $6. The answer cannot be determined, since the carrying values of the CGU's other assets and liabilities must be determined Campbell Corporation purchased new equipment on January 1, 2020. The equipment cost $8,800, had an estimated useful life of four years, and a residual value of $400. Using double declining balance amortization, the amortization expense recorded at the end of 2021 should be Multiple Choice $2,100 $2106 $2,112 $2,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts