Question: Please answer it correctly An auto manufacturer is considering adding new automation to their assembly line to reduce production costs. The manufacturer is confident that

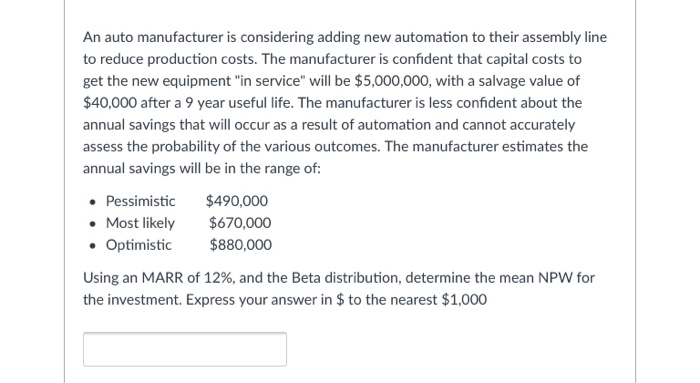

An auto manufacturer is considering adding new automation to their assembly line to reduce production costs. The manufacturer is confident that capital costs to get the new equipment "in service" will be $5,000,000, with a salvage value of $40,000 after a 9 year useful life. The manufacturer is less confident about the annual savings that will occur as a result of automation and cannot accurately assess the probability of the various outcomes. The manufacturer estimates the annual savings will be in the range of Pessimistic $490,000 Most likely $670,000 Optimistic $880,000 Using an MARR of 12%, and the Beta distribution, determine the mean NPW for the investment. Express your answer in $ to the nearest $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts